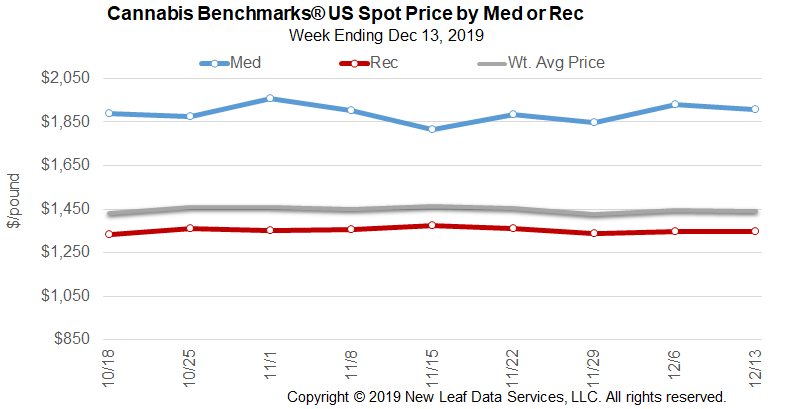

U.S. Cannabis Spot Index down 0.3% to $1,442 per pound.

The simple average (non-volume weighted) price decreased $12 to $1,659 per pound, with 68% of transactions (one standard deviation) in the $988 to $2,329 per pound range. The average reported deal size was nominally unchanged at 2.1 pounds. In grams, the Spot price was $3.18 and the simple average price was $3.66.

The relative frequency of trades for indoor flower decreased by almost 3% this week. The relative frequencies of deals for greenhouse and outdoor product increased by about 1% and 2%, respectively.

Warehouse flower’s share of the total reported weight moved nationally contracted by 3% this week. The relative volumes of greenhouse and outdoor product expanded by 1% and 2%, respectively.

The U.S. Spot Index declined by 0.3% this week to settle at $1,442 per pound. The national price for outdoor flower continued its Q4 climb, with this week’s rate up by 39.2% from the price of $842 per pound, documented in the opening week of the quarter.

National rates for the other grow types have also been on the rise in Q4, but not nearly to the same degree. From the beginning of the current period through this week, the U.S. volume-weighted prices for indoor and greenhouse product have climbed by 4.8% and 6.4%, respectively. The U.S. Spot Index has been more stable, with this week’s up by only 1.3% from the first week of Q4.

While the fall harvest has not resulted in the Q4 downturn to which cannabis market observers have become accustomed, the chart above shows that previously persistent positive price trends in California, Colorado, and Washington have flattened in recent weeks, while Oregon’s Trailing 4-Week Average slid downward from late October to late November, then leveled off.

As we expand upon below, new data from Colorado and Nevada shows slumping demand in October and September, respectively. Meanwhile, reports of strong early adult-use sales in Michigan must be couched in the context that they are taking place at only a small number of stores. In general, demand will likely pick up in most markets in the coming weeks, around the end-of-year holidays.

The national volume-weighted price for flower to be sold to general consumers was flat this week. Small downturns in California’s and Colorado’s adult-use sectors were counterbalanced by upticks in Oregon and Washington State.

The national price for medical flower declined this week on decreases in that section of the market in Colorado, Massachusetts, and Michigan, in addition to falling rates in the medical-only systems of Arizona, Connecticut, Washington, D.C., Illinois, Maine, New Mexico, and Vermont.

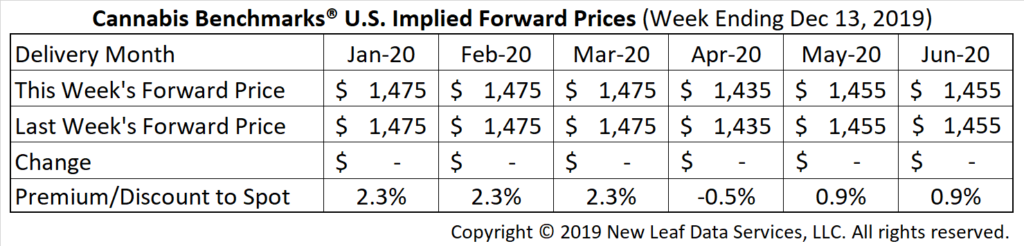

January 2020 Forward unchanged at $1,475 per pound.

The average reported forward deal size was 49 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 47%, 36%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 50 pounds, 43 pounds, and 52 pounds, respectively.

At $1,475 per pound, the January 2020 Forward represents a premium of 2.3% relative to the current U.S. Spot Price of $1,442 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

California

Q3 Tax Collections Show Expanding Retail Demand; Cultivation Tax Receipts Shrink on Significantly Lower Volumes of Trim Moved by Growers

Colorado

October Sales Data Shows Demand Shrank for Second Straight Month, But YTD Retail Revenue Up Almost 14%

Oregon

Outdoor Flower’s Share of Observed Volume Traded Shrank to Lowest Levels of the Year in October and November, But Has Increased in Recent Weeks

Washington

State Spot Index Rises to New YTD Peak

Nevada

Total Retail Sales in September Down 7% From August’s Record Revenues