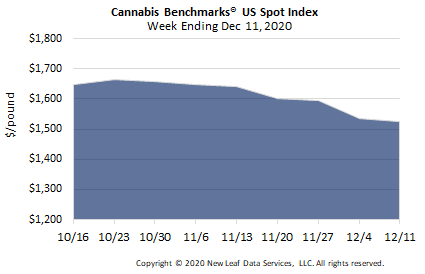

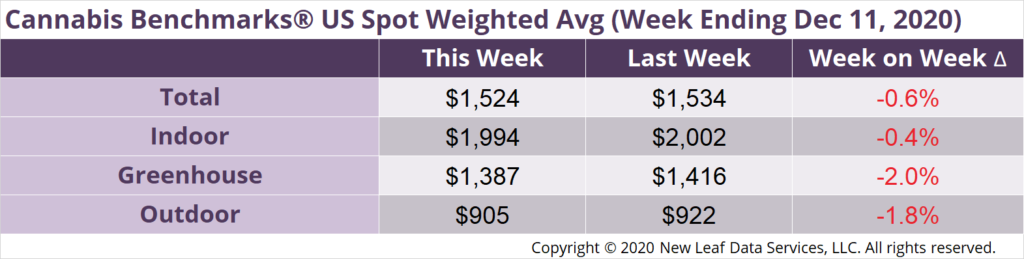

U.S. Cannabis Spot Index down 0.6% to $1,524 per pound.

The simple average (non-volume weighted) price decreased $21 to $1,813 per pound, with 68% of transactions (one standard deviation) in the $1,091 to $2,536 per pound range. The average reported deal size decreased from 2.5 pounds to 2.4 pounds. In grams, the Spot price was $3.36 and the simple average price was $4.00.

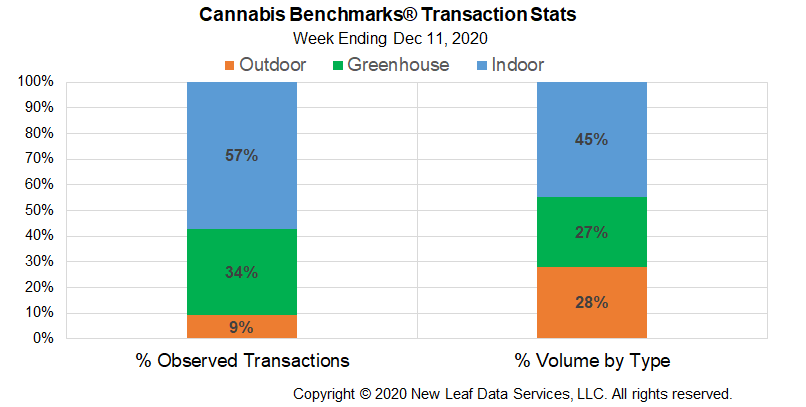

The relative frequency of trades for indoor flower decreased by over 2%. The relative frequency of deals for greenhouse product increased by the same proportion, while that for transactions for outdoor flower was unchanged.

The relative volume of greenhouse flower expanded by 3% this week. The relative volumes of warehouse and outdoor product contracted by 1% and 2%, respectively.

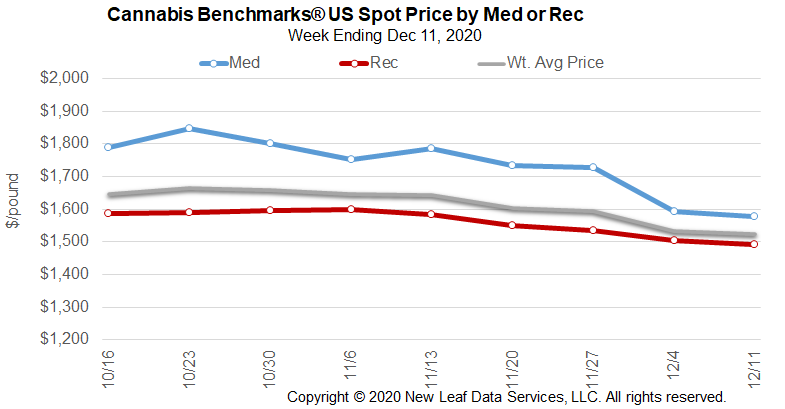

New sales data out of several states confirms our previous analysis that demand has subsided since late summer. In Colorado, total sales declined for the third straight month in October, but were still up by over 30% compared to 2019. September saw retail revenues in Nevada decrease, even despite a rise in the number of tourists visiting Las Vegas.

Additionally, in states with newer adult-use markets – namely Massachusetts and Illinois – November sales saw a downturn after steady growth in both states earlier this year. However, the declines were relatively small. In the case of Illinois’ adult-use sector, average daily sales in November were up compared to October, but growth has slowed.

While it appears that the COVID-related wave of increasing cannabis demand crested around July or August in most states, monthly retail revenue figures remain elevated. In other words, recent decreases in demand do not mean that sales have fallen to pre-coronavirus levels. Wholesale flower prices reflect continued strong demand. National prices for product of each grow type have remained relatively stable during the autumn, although a slight downward trend has developed for outdoor flower in particular. The recent downturn of the U.S. Spot, meanwhile, is due to expanded volumes of lower-priced outdoor product being traded in the West Coast states and Colorado.

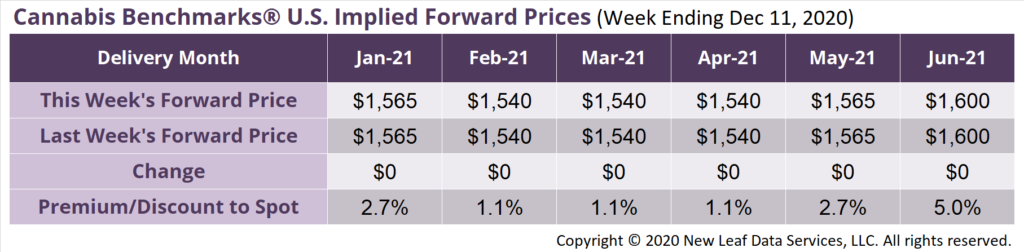

January 2021 Implied Forward unchanged at $1,565 per pound.

The average reported forward deal size was 35 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 34%, and 22% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 50 pounds, 21 pounds, and 28 pounds, respectively.

At $1,565 per pound, the January Implied Forward represents a premium of 2.7% relative to the current U.S. Spot Price of $1,524 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

Total Sales Decline for Third Straight Month in October to Just Under $200M, Still Up 33% YoY

Nevada

September Retail Revenue Down 3.5% MoM to $76.7M, Despite Increase in Tourism that Month

Massachusetts

November Adult-Use Sales Slip 8.5% from Prior Month to $76.2M, First Significant Decrease After Steady Growth in 2020

Illinois

Adult-Use Demand Growth Slowed, Medical Sales Down in November; Total Sales Reached $106M, Off 2% from October