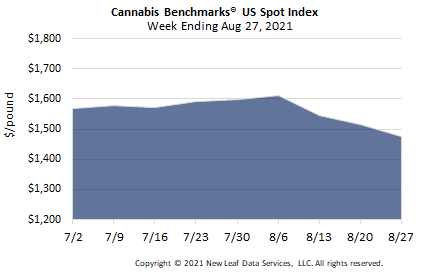

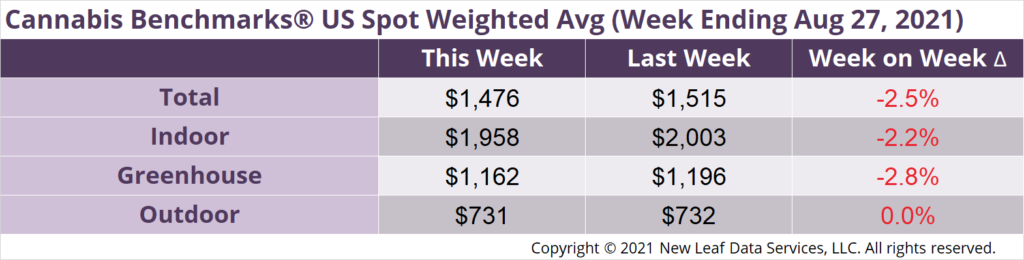

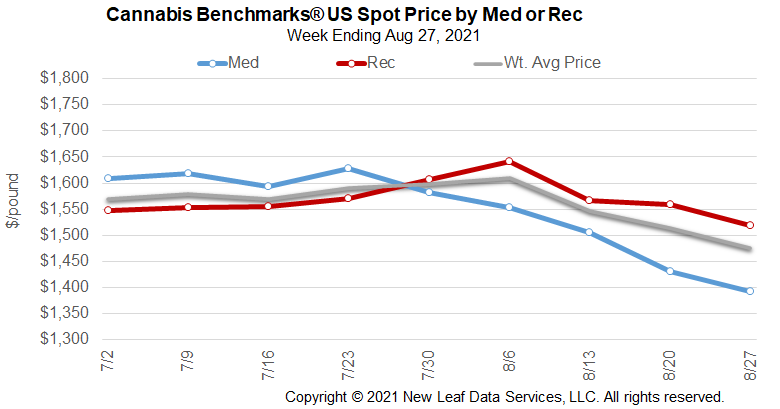

U.S. Cannabis Spot Index decreased 2.5% to $1,476 per pound.

The simple average (non-volume weighted) price decreased $50 to $1,793 per pound, with 68% of transactions (one standard deviation) in the $975 to $2,612 per pound range. The average reported deal size was nominally unchanged at 2.6 pounds. In grams, the Spot price was $3.25 and the simple average price was $3.95.

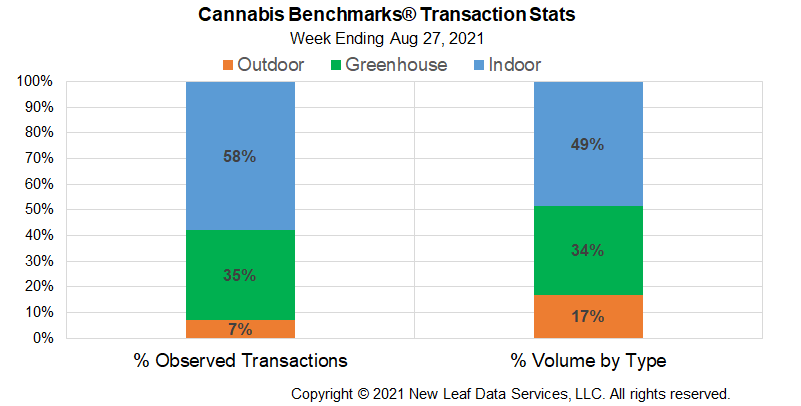

The relative frequency of transactions for indoor flower increased by 1% this week. The relative frequency of trades for greenhouse product decreased by the same proportion, while that for deals for outdoor flower was stable.

The relative volume of outdoor product expanded by 1%. The relative volume of greenhouse flower contracted by the same proportion, while that for warehouse product was unchanged.

The U.S. Spot Index fell below the $1,500 per pound threshold for the first time since January of this year. In fact, this week’s assessed national composite price is $1 below that observed in the week ending January 15, 2021, which ended up being the lowest observed U.S. Spot price in the wake of 2020’s autumn harvest.

That prices are already dipping below those documented after last year’s crop was brought in, with this year’s full-term plants yet to be cut down, suggests that wholesale flower rates could slide significantly lower. As we have noted in recent weeks, the drop in the overall national price is being driven largely by a reported glut of available supply in California and Oregon, consisting of both inventory harvested in 2020 and introduced in commerce recently and fresher product from this summer’s light-deprivation crops.

The current situation appears somewhat reminiscent of that documented by Cannabis Benchmarks beginning in the summer of 2016. At that time, cultivation capacity that had begun to be set up in the wake of legalization in Colorado and Washington hit its stride, while California and Oregon growers were being typically prolific. The overbuilding of production capacity was compounded by large summer and fall harvests in 2017 and the U.S. Spot experienced a prolonged and dramatic erosion from mid-2016 through nearly all of 2018.

Whether the current situation will play out in a similar manner remains to be seen. While California’s situation recalls that observed previously in Colorado and Washington in some ways – in terms of planned cultivation capacity coming online and producing at scale in the years after the licensed market opened – the Golden State’s retail side has significantly more room to grow and absorb additional supply. Recently-released sales and tax data from California shows taxable sales increasing by 11% from Q1 to Q2 of this year; Q2 2021’s sales figures are also up almost 25% from the same period last year.

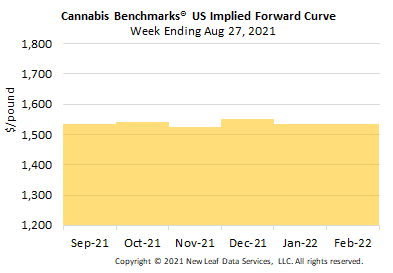

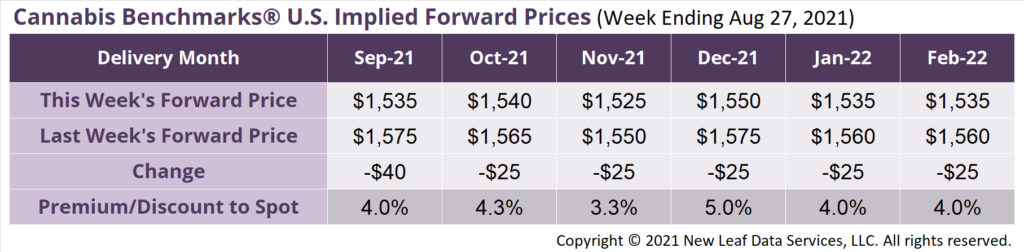

September 2021 Implied Forward closes down $40 to $1,535 per pound.

The average reported forward deal size was 71 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 38%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 92 pounds, 63 pounds, and 30 pounds, respectively.

California

Volume of Flower and Other Product Sold into Wholesale Market in Q2 2021 Up Significantly YoY, But Down Slightly from Q4 2020

Arizona

Sales Data from January – June Shows Share of Total Made up by Adult-Use Market Increasing as Sales Plateaued Overall in Latter Months

New Jersey

Rules for Adult-Use Market Adopted, Setting Up First Sales to Commence in February 2022

New Mexico

State Adopts Rules for Adult-Use Producers, Including Production Capacity Limits