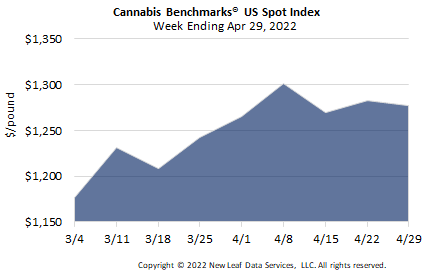

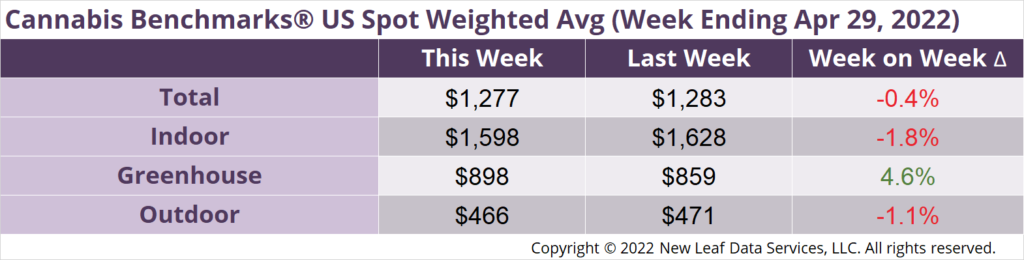

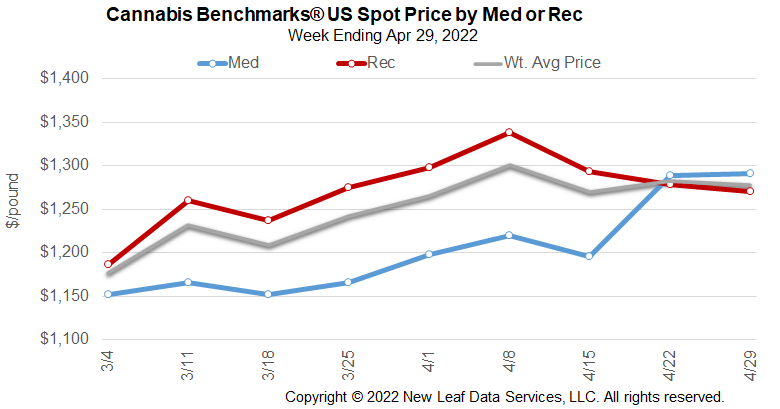

The U.S. Cannabis Spot Index decreased 0.4% to $1,277 per pound.

The simple average (non-volume weighted) price increased $9 to $1,515 per pound, with 68% of transactions (one standard deviation) in the $677 to $2,353 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $2.82 and the simple average price was $3.34.

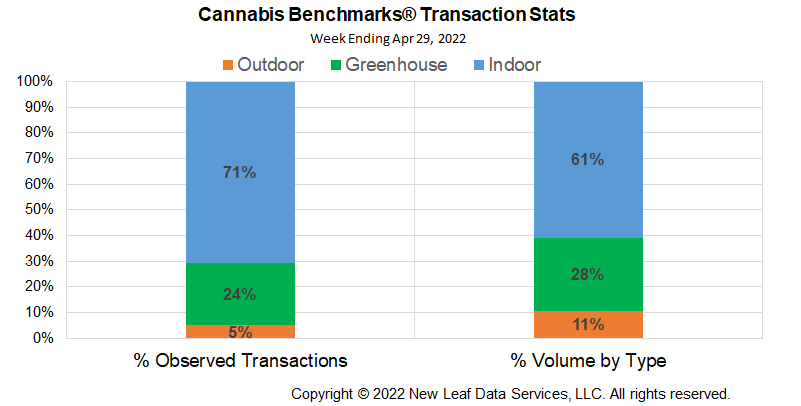

The relative frequency of transactions for indoor flower fell by 1%. The relative frequency of trades for greenhouse flower rose 2% while that for deals for outdoor product fell 1%.

The relative volume of indoor flower was unchanged, as were those of greenhouse and outdoor flower.

The U.S. Spot Index slipped just over $5 this week even as legacy states mostly saw prices decline by greater amounts. Oregon fell over $23 per pound basis spot, but the 10-week average of weekly losses has narrowed to -$4.45 per pound. The California Spot index fell nearly $21 per pound on a narrowing 10-week average loss of just -$6.89 per pound. Colorado Spot fell $11.82 per pound, but the 10-week average weekly losses remain low at $6.24 per pound. Narrowing average losses typically presage a steady, if not rallying market. Washington state tacked on $29 per pound on a 10-week average gain of $3.03 per pound.

Large population states newer to the adult use market have undergone significant price erosion even amid unflagging demand as growers jockey for market position, including Illinois where the spot price fell more than $91 this week. New cannabis business licenses in Illinois remain mostly mired in lawsuits, while craft cultivators granted licenses earlier this year are not yet up and running, making the rapid spot market price deterioration more likely a function of competition among multi-state operators for market share. Illinois Spot is down 19.6% since October 2021 and down 13% in 2022.

Massachusetts Spot fell nearly $73 per pound this week, but the 10-week average loss is just under $40 per pound. In 2021, Massachusetts saw spot cannabis prices hew closely to the $3,500 level, but price has fallen 32.6% this year amid a well-supplied market and strong demand, again suggesting competition among growers is likely responsible for lower prices.

Michigan Spot rose over $12 per pound this week, amid a shrinking 10-week average loss per pound of $36. Michigan Spot is down 54% from the end of November 2021, some of which has been attributed to outdoor-grown crops entering the market and some of which is likely due to the state’s uncapped licensing scheme. That said, Michigan Spot has steadied over the past several weeks, trading in within a $27 range.

New Jersey opened their adult use market last week and other states in the Northeast are likely to begin sales near year-end or just after the new year. Demand will likely push prices higher in the first months of legalization, but the rapid deterioration of spot prices in new states is signaling a much faster uptake of price trends. With cannabis available literally across the nation, the price increases seen in early adopter states may be fleeting in the Northeast.

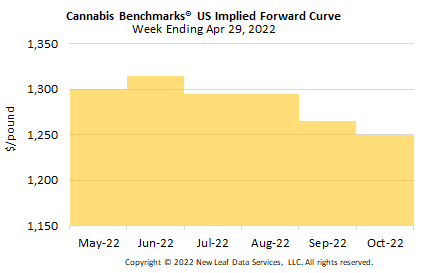

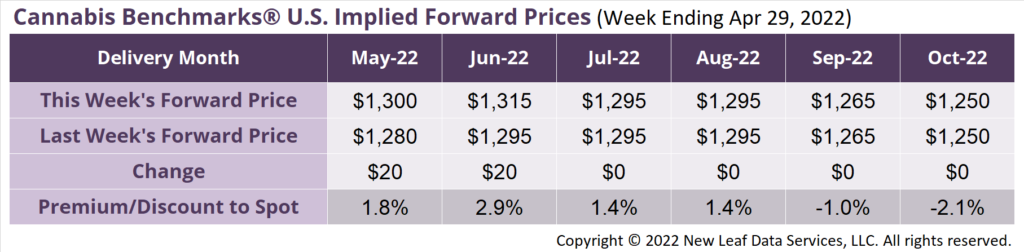

May 2022 Implied Forward assessed up $20 to $1,300 per pound.

The average reported forward deal size increased to 78 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 41%, 45%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 86 pounds, 77 pounds, and 58 pounds, respectively.

At $1,300 per pound, the May 2022 Implied Forward represents a premium of 1.8% relative to the current U.S. Spot Price of $1,277 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Business License Moratorium in Effect, But Current Market Conditions Likely to Persist

Michigan

4/20 Saw 3X Revenue, 6X Flower Sales Volume of Typical Day

New Jersey

$1.9 Million in Revenue Generated on First Day of Adult Use Sales

New York

Report: Regulators Expect Some Adult Use Sales to Begin by Fall 2022