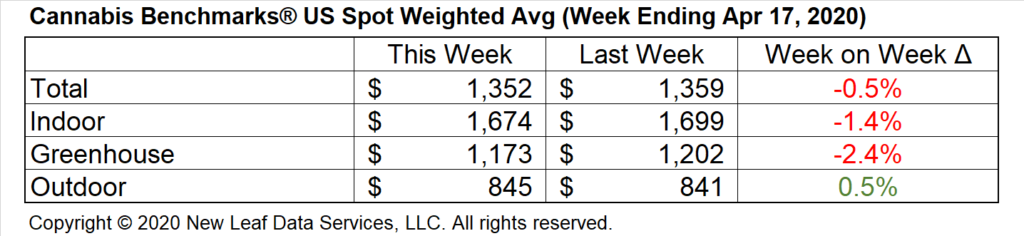

U.S. Cannabis Spot Index down 0.5% to $1,352 per pound.

The simple average (non-volume weighted) price decreased $16 to $1,540 per pound, with 68% of transactions (one standard deviation) in the $832 to $2,249 per pound range. The average reported deal size was nominally unchanged at 2.1 pounds. In grams, the Spot price was $2.98 and the simple average price was $3.40.

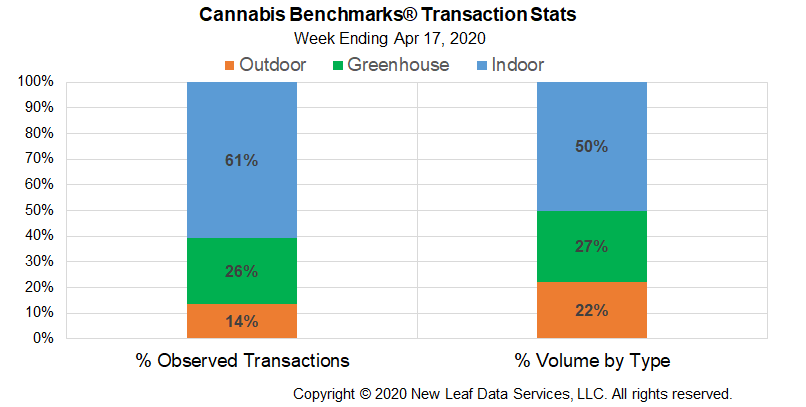

The relative frequency of trades for outdoor flower decreased by almost 3% this week. The relative frequencies of deals for indoor and greenhouse product increased by about 1% and 2%, respectively.

Outdoor flower’s share of the total reported weight moved contracted by over 2% this week. The relative volume of greenhouse product expanded by the same proportion, while that for warehouse flower was unchanged.

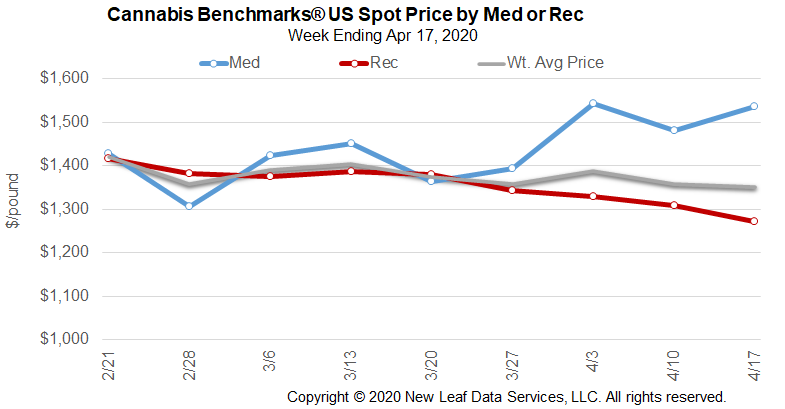

The U.S. Spot Index declined by 0.5% this week to settle at $1,352 per pound. It may be tempting to interpret the recent downward trend in the national composite price in light of reports of reduced sales due to the COVID-19 pandemic and accompanying stay-at-home orders in all of the country’s five largest legal cannabis markets, and others. This is especially true at this time of year, with 4/20 approaching, which usually results in a spike in retail sales.

However, the U.S. Spot’s decline in recent weeks is not uncharacteristic for the period ahead of 4/20, although this year’s is of a slightly larger magnitude than last year’s. For 2020, the national composite price’s current peak is $1,459 per pound, which occurred on February 14. Since then, the U.S. Spot has declined by 7.3%. In 2019, the national average rate was largely steady from the outset of the year until February 15, after which it declined by 6.3% from that point to the week ending April 19, 2019, movement very similar to this year. In 2018, the U.S. Spot rose in March, but then fell by 4.4% from the final week of that month to the week ending on April 20, 2018.

While the movement of the U.S. Spot leading up to 4/20 this year has not departed significantly from prior trends, the reasons behind the movement may have changed. Declining prices in the weeks ahead of 4/20 in prior years have been attributed to better supply-chain management (retailers not waiting until the week or two just before the holiday to stock up), generally looser supply (compared to 2015 or 2016, for example), and retailers increasingly choosing lower-priced outdoor product to sell in larger-volume increments at discounted prices.

Although the national average deal size for outdoor flower grew this week, the relative volume of such product contracted in California and Oregon, but expanded in Colorado and Washington, significantly in the latter. Overall wholesale prices have not seen dramatic swings in recent weeks in any of the four largest legal cannabis markets mentioned above, even as significant alterations to sales have occurred due to COVID-19. Meanwhile, the downward trend in Michigan’s Spot is likely attributable to both loosening supply as licensed growers continue to ramp up, along with lower sales while the state is under a stay-at-home order.

As we have pointed out in the past, Nevada’s market is likely to be the one of the hardest hit by COVID-19, as Las Vegas tourism has virtually disappeared. Sales in the Las Vegas metropolitan area make up a vast majority of those that take place statewide, but the region’s resident population of about 2.2 million is usually supplemented with between roughly 3.2 and 3.7 million tourists monthly. Overall, the downturn in Nevada’s Spot is almost certainly attributable largely to the dramatic reduction in demand taking place in the Las Vegas area.

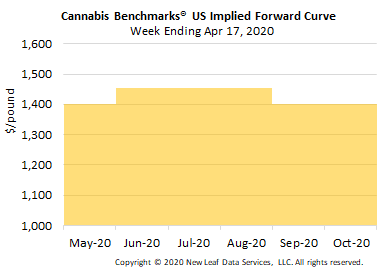

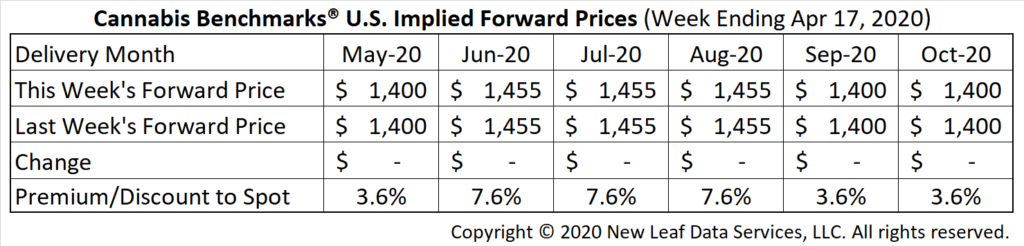

May Forward unchanged at $1,400 per pound.

The average reported forward deal size was 37 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 46%, 37%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 43 pounds, 29 pounds, and 36 pounds, respectively.

At $1,400 per pound, the May Forward represents a premium of 3.6% relative to the current U.S. Spot Price of $1,352 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

Colorado

February Adult-Use and Medical Cannabis Sales Total Almost $140 Million, Essentially Flat from January and Up 17% YoY

Massachusetts

Judge Upholds Governor’s Closure of Adult-Use Cannabis Retailers in Response to COVID-19

Illinois

March Medical Cannabis Sales Set New Record for State’s Program at Nearly $30 Million; Average Retail Price for Flower in Medical Market Declined for the First Time in Six Months

New Mexico

Supply Outpaced Growing Demand in State’s Medical Market in Q4 2019, Leading to Expanding Unsold Inventory and Falling Wholesale Flower Prices

Maine

Beginning of Adult-Use Sales Delayed Indefinitely Due to COVID-19