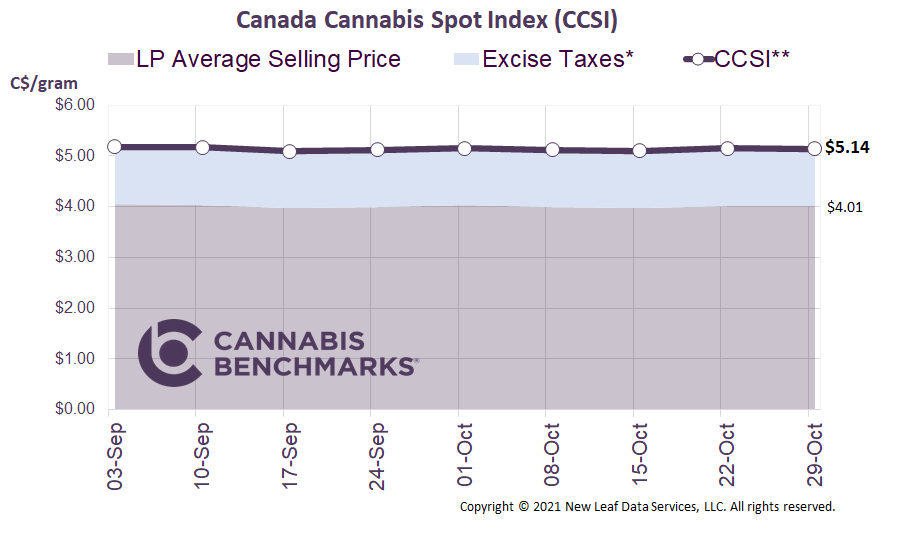

Canada Cannabis Spot Index (CCSI)

Week Ending October 29, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.14 per gram this week, down 0.2% from last week’s C$5.15 per gram. This week’s price equates to US$1,885 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

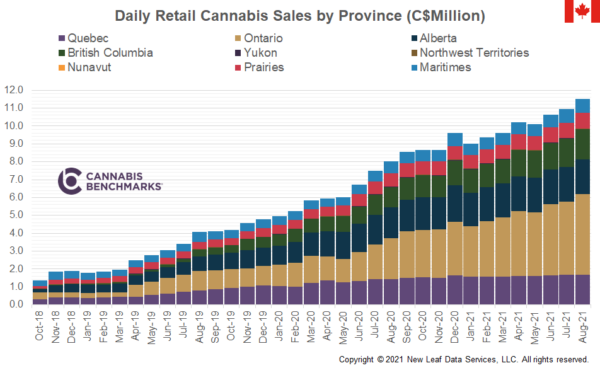

Last week, Statistics Canada released retail sales data for August 2021, with nationwide legal cannabis sales reaching a new monthly high of C$356.9M. This is the first month where sales have exceeded the C$350M threshold, which puts the current annual run rate at C$4.3B. At this rate, we estimate the illicit market still controls nearly half of the total retail cannabis market.

To correct for the different number of days in each month, we look at average daily sales. As seen in the chart below, August 2021 sales reached C$11.5M per day. This is a significant increase from the previous month, which was at C$10.9M per day. We have observed seasonality in consumption, with August typically being a strong sales month; hence we believe September sales might ease from these levels. The strong August sales are easily explainable, with good weather and summer holidays leading to more opportunities to consume cannabis.

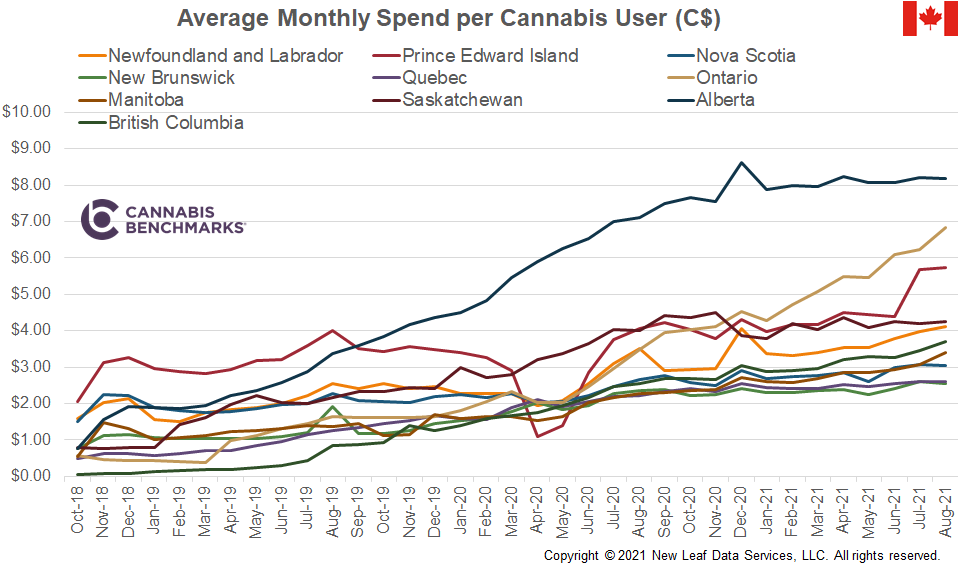

This week, as we did this past July, we sliced up the above data to calculate the average monthly sales per cannabis user. Each province has a different usage rate that is estimated by Statistics Canada through a quarterly survey. With the last quarterly survey being conducted in Q4 2020, we made some adjustments to this baseline to account for new cannabis users, as well as better accessibility to cannabis; a factor that allows customers to transfer their purchasing habits from the illicit market to the legal markets. Overall, we estimate 17% of the Canadian population consumes cannabis.

This is a flow diagram of the calculation we performed for each province.

The result of these calculations is shown by month in the chart below.

Alberta continues to lead the way with its spending habits. We estimate a typical Alberta cannabis user who purchases cannabis from the legal market spends C$8.20 each month. This is approximately C$1.10 or 15% more than they spent last year. The strong Alberta spending rate makes sense, as the province boasts the largest retail footprint per capita in Canada. With Ontario picking up the pace on opening retail stores, we see that Ontario cannabis users are also spending more in licensed stores as they move their buying habits away from the illicit market. We estimate that the average Ontario cannabis user now spends C$6.80 each month in licensed stores.