Canada Cannabis Spot Index (CCSI)

Published November 20, 2020

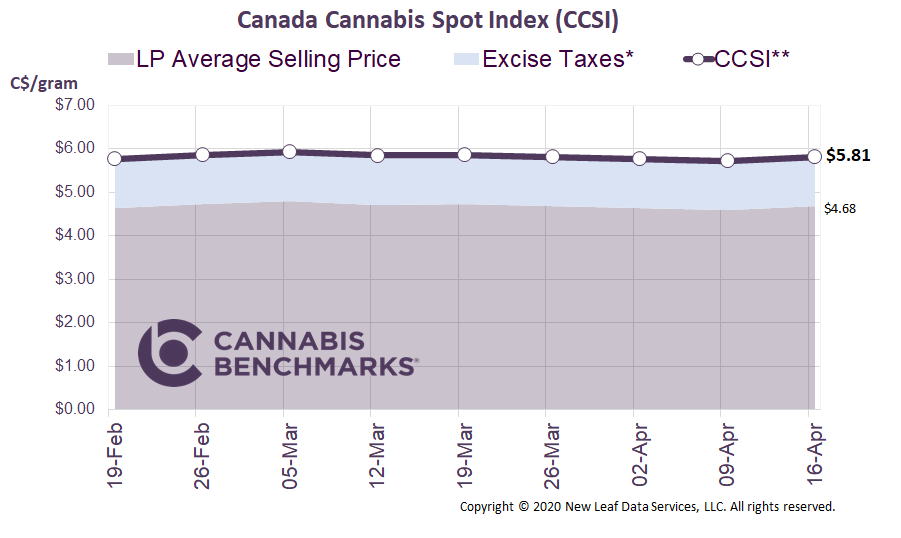

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.86 per gram this week, down 1.2% from last week’s C$5.93 per gram. This week’s price equates to US$2,030 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we review the number of federal licenses issued for cultivation and processing. The licenses are issued under the Cannabis Act by Health Canada, which maintains a massive list of every license that has been issued to date. We examined each record and cleaned it up to produce some interesting statistics. We share this full license database – along with other data – with our Price Contributor Network. Click here to join our Price Contributor Network for free.

Before we jump into the data, the following are the activities permitted by the standard types of licenses under discussion.

A cultivation license is required for:

- cultivating indoors or outdoors,

- selling to provincial authorities,

- reselling to another licensed authorized seller, and/or

- conducting later stage services such as drying, trimming, and milling.

A processing license is required for:

- any extraction processes,

- providing lab testing services,

- manufacturing cannabis 2.0 products, and

- selling finished products to provincial authorities.

Since the lead up to the opening of the country’s legal medical cannabis market, Health Canada has been very busy processing applications for cannabis market participants. The charts below show cultivation and processing licenses issued from October 2013 through October 2020, encompassing Canada’s initial medical cannabis legalization, followed by its approval of adult-use cannabis in 2018. The charts illustrate the uptick in the issuance of licenses ahead of adult-use legalization. Focusing on more recent events, it is notable that there was no real slow down in application approvals during the COVID lockdowns.

There have been a total of 308 cultivation licenses issued to date, with some companies having multiple locations across multiple provinces. Ontario has the largest share of cultivation licenses with 119, or 39% of the total. British Columbia has the next highest number of cultivation licenses with 76, or 25% of all licenses.

In 2020 so far, there have been 95 licenses issued for cultivation. On the list are many numbered companies and unfamiliar names; our thinking is the larger licensed producers (LPs) have multiple licenses under different corporate entities. The firm with the most licenses is Aurora, with nine cultivation sites across four provinces.

Source: Cannabis Benchmarks

On the processing side, there have been a total of 277 unique licenses issued to companies across Canada. Just as with cultivation licenses, Ontario disproportionately has the highest number of processing licenses with 122, or 44% of the total.

Source: Cannabis Benchmarks

Likely, most of these licenses are not being utilized. That is probably a good thing in light of the large overhang of finished and unfinished products currently sitting in inventory at LP sites, provincial distributors’ storage facilities, and with retailers. The latest data from Statistics Canada shows 100,240 kg of finished products and 782,698 kg of unfinished products in inventory. Based on our assessment of current demand, this constitutes 39 months’ worth of supply.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.