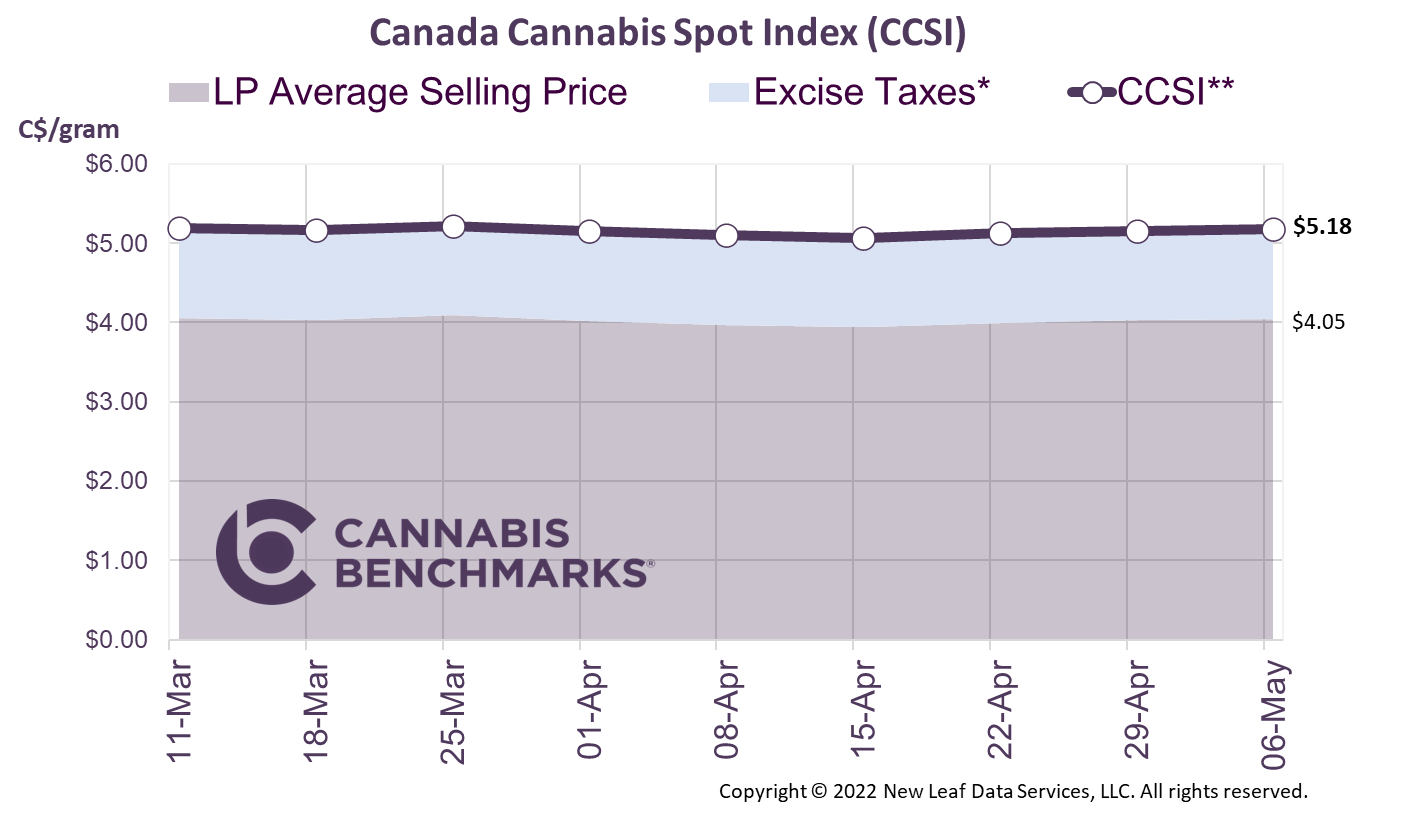

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.18 per gram this week, up 0.4% from last week’s C$5.16 per gram. This week’s price equates to US$1,831 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

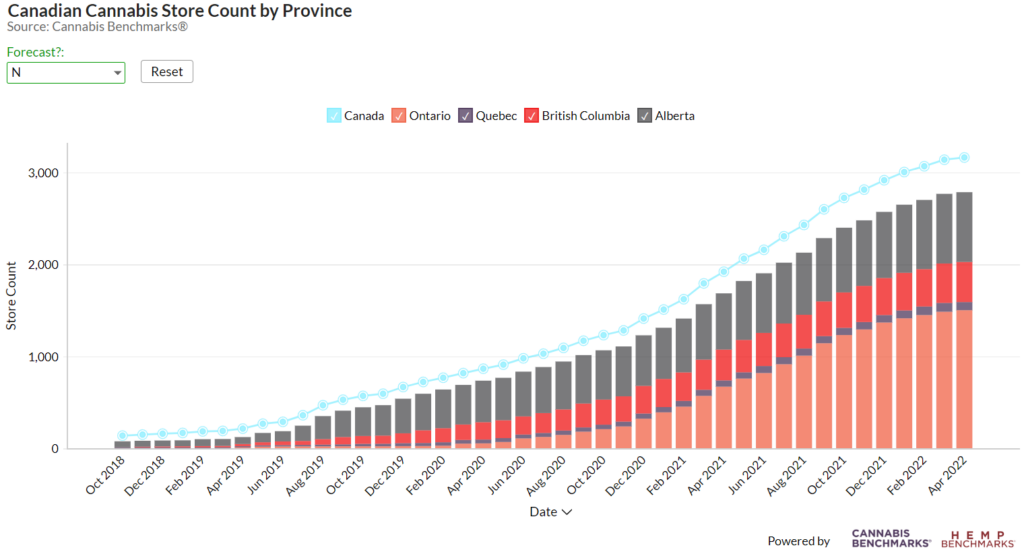

This week we provide additional analysis on the optimal number of recreational cannabis stores in Canada. The Canadian cannabis industry continues to open new retail outlets across the country at a steady pace. As of the end of April, we counted 3,162 licensed retailers. The pace of store openings has slowed considerably in 2022 so far relative to 2021. In 2021, we counted 125 new stores opened each month, on average, with 70% of new store openings occurring in Ontario. So far in 2022, new store openings have declined to an average of 62 each month.

Alberta remains an outlier, with stores continuing to open despite it having the smallest population of the four major provinces. We expect the number of stores in Alberta to decline over the next 24 months, as competition intensifies and store economics become less favorable. British Columbia’s store count, meanwhile, is growing at a steady rate, while Ontario’s exponential growth in 2021 allowed it to catch up to a more respectable level. Quebec remains the biggest laggard this year, with the slowest rollout due to the provincial government owning and operating all cannabis retail operations.

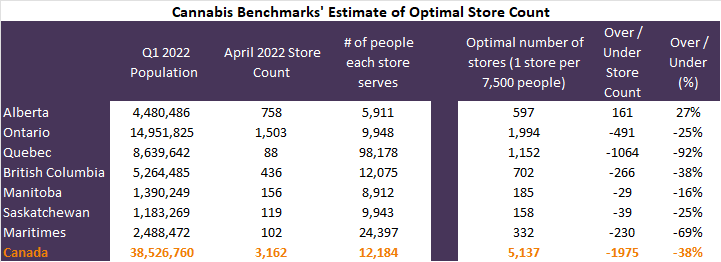

The table below shows the average number of people each store serves in all the major provinces. To better understand the number of stores required, we looked to Colorado and Oregon, two of the most mature legal cannabis markets in the U.S. that do not place an artificial cap on the number of stores permitted to open. In Colorado, there is one recreational retailer for about every 9,600 residents while in Oregon there is one legal store for about every 6,150 people.

Using that example, we assume one store should ideally serve around 7,500 people. Based on this analysis, Canada as a whole would require a total of 5,137 stores, or 1.6 times the current number of retailers.

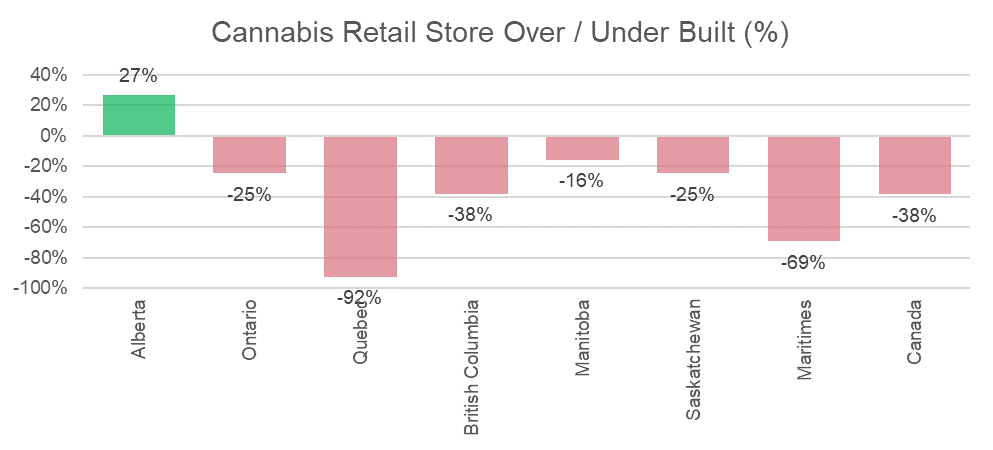

In the chart below, we show how each province is performing relative to the optimal store count. Other than Alberta, every province is still behind its optimal level. That being said, we saw meaningful progress made in comparison to 2021 and continue to see this trend moving in the right direction.