Canada Cannabis Spot Index (CCSI)

Published May 29, 2020

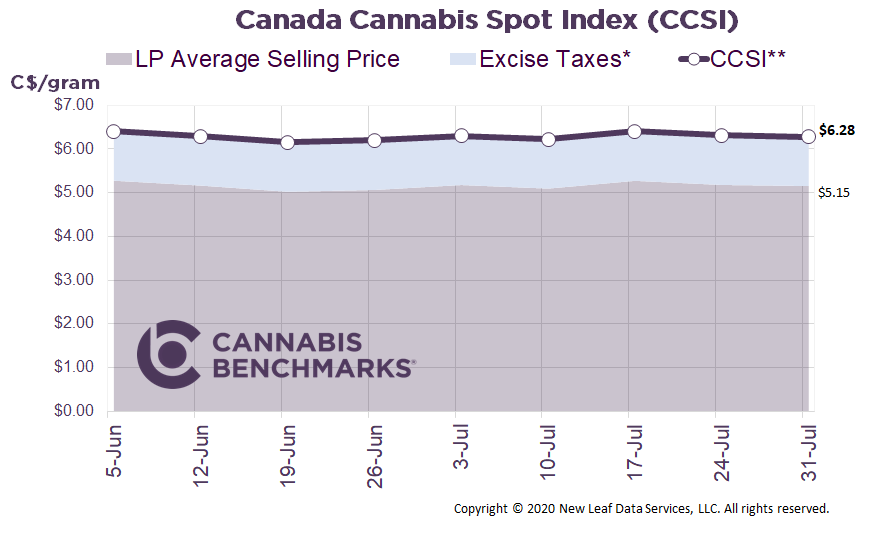

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.41 per gram this week, down 1.0% from last week’s C$6.48 per gram. This week’s price equates to US$2,096 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

Last week, Statistics Canada released retail sales data for March 2020. Sales have been steadily growing across Canada, and the impacts of COVID-19 led to sales skyrocketing as cannabis users stockpiled cannabis along with toilet paper. In the back half of March, as work-from-home and social distancing became a reality, provincial online sales and retail sales grew rapidly across the country.

March sales settled at C$181M over the month, which was C$29M higher than February’s revenues, as well as up C$120M year-on-year.

Source: Health Canada, Cannabis Benchmarks

We have heard that online sales picked up, but the vast majority of sales still occur at physical retail locations. In past reports, we discussed the proportion of online sales to total recreational sales. The last data point on this topic released by Statistics Canada is for September 2019, which shows online sales dropped to 5.9% of total sales at that point. In our April 17 report, we modelled online sales continuing to drop to 5% over the next few months, until March 2020 when COVID-19 lockdowns were initiated. We estimate online sales in March rose to account for 6.5% of total sales.

With that estimate, we can better understand the average daily sales per store at the provincial level. We first stripped out the online sales to get to sales at physical retail stores. Next, we divided those figures by our monthly store count, then divided by the number of days in each month, to get the average daily sales per retail store.

Source: Cannabis Benchmarks

The two most populous provinces, Ontario and Quebec, have a relatively low number of stores per capita. Therefore, the licensed retailers in those provinces each serve a disproportionately large number of cannabis users and benefit by seeing voluminous amounts of daily transactions. However, average daily sales per individual retail shop in Quebec have been dropping since mid-2019, as sales have not grown at the same rate as new stores. Ontario looks to be experiencing a similar decline in recent months as new stores have been opening quickly.

Alberta and British Columbia have sales levels that are well below the average. While this could potentially point to an oversaturation of physical outlets relative to each province’s consumer base, the average is also skewed upward by the data out of Ontario and Quebec, where retail storefronts have been slower to proliferate.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.