Canada Cannabis Spot Index (CCSI)

Week Ending May 28, 2021

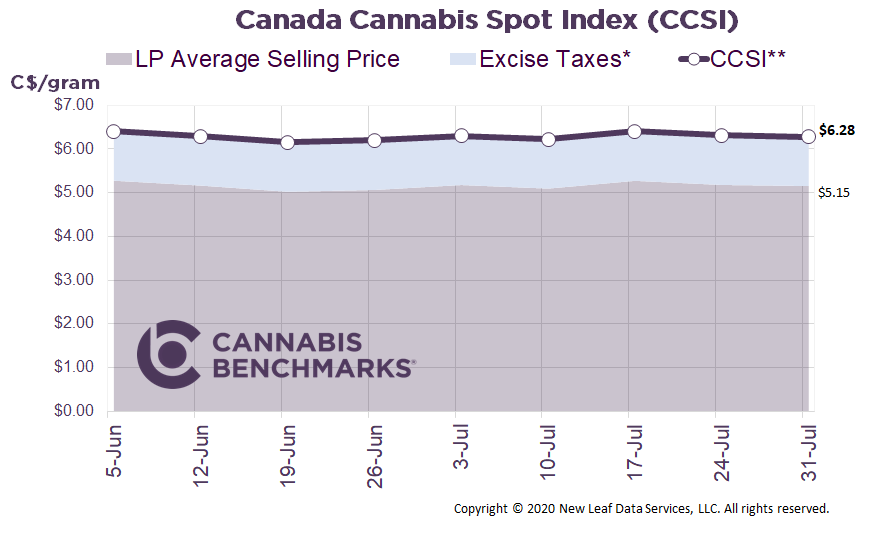

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.55 per gram this week, down 0.6% from last week’s C$5.58 per gram. This week’s price equates to US$2,085 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

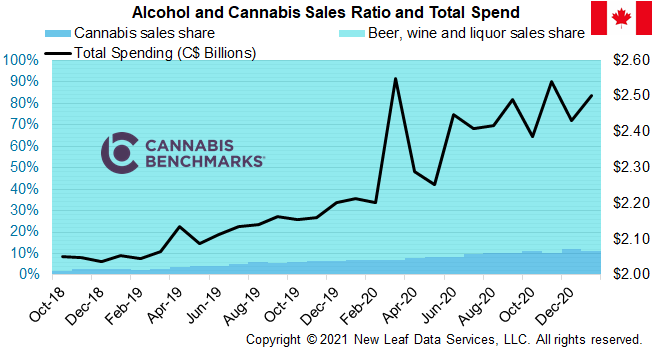

Last week, Statistics Canada released retail sales data for March 2021 with nationwide legal cannabis sales reaching a new monthly high of C$298.1M.

Prior to March, we saw a decline in sales after December, which can be attributed to three main issues:

1) A decrease in spending after the holiday season;

2) fewer days in February;

3) newly enforced COVID-related restrictions in Canada after the holiday season.

To correct for the different number of days in each month, we look at average daily sales in the chart below, which shows March 2021 edging out December 2020 by a small margin. March sales reached C$9.62M per day.

Source: Cannabis Benchmarks, Statscan

Looking at the month-on-month change in each province, sales have started to plateau in most provinces, with Ontario being the exception. Ontario’s cannabis industry continues its growth trajectory, as it plays a bit of catch-up in terms of the number of operational retailers in the province.

Source: Cannabis Benchmarks, Statscan

While Ontario now has the largest overall retail store footprint, it still does not compare to the number of stores in Alberta per capita. Ontario has announced plans to continue to roll out stores, with an expectation of 1,000 stores by September. As seen in the chart above, sales growth in Canada this year is tied primarily to better accessibility in Ontario. Longer term, we are expecting a boost in sales across all provinces, as Canada’s legal market becomes more accessible, product variety and quality increases, and prices become increasingly competitive with or lower than those offered by illegal sources.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.