Canada Cannabis Spot Index (CCSI)

Published May 22, 2020

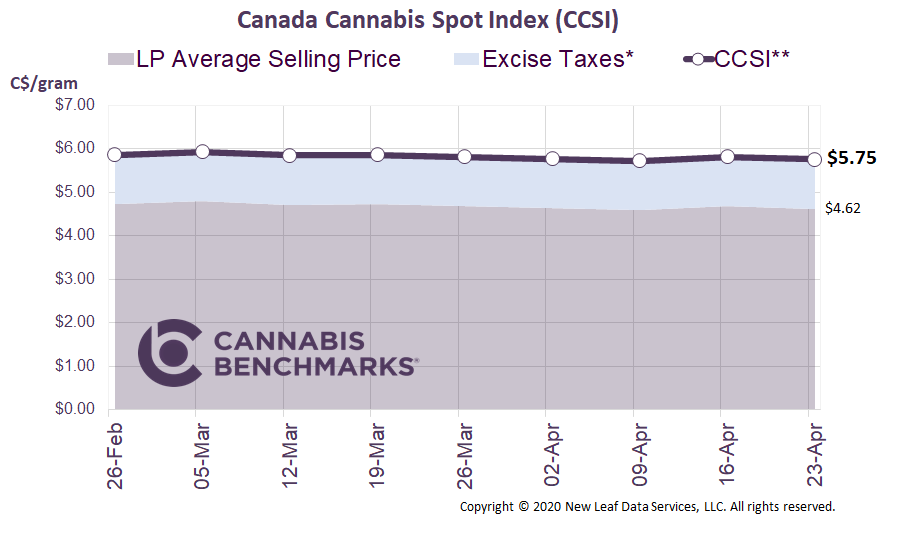

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.48 per gram this week, up 1.1% from last week’s C$6.41 per gram. This week’s price equates to US$2,101 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week, we provide an update on the proliferation of licensed retail storefronts in Canada. As of May, we count 891 retail stores across the country, an increase of 31 from the previous month.

Source: Health Canada, Cannabis Benchmarks

Despite COVID-related lockdowns in effect over the past two months, we are still seeing stores open in Canada’s major provinces. 122 stores have opened since the end of February, with 92% of the new shops located in Alberta, British Columbia, and Ontario.

Alberta still has the highest store count at 461, or 52% of the licensed retailers in Canada. As expected, Alberta, with the largest concentration of stores, has greater sales per capita than the other large provinces.

Month-on-month growth in store counts in Alberta is on a decline. However, the growth trajectory in Ontario, the country’s most populous province, is still going strong. Since the start of the year, the number of legal shops in Ontario has been expanding exponentially. This growth comes despite COVID-19 delaying the licensing process, as well as construction. Our count shows that 31 new stores have opened in Ontario since the end of February, doubling the number of stores in operation.

Source: Cannabis Benchmarks

The industry is keeping a close eye on Ontario, as it is home to an estimated two million cannabis users, or 38% of the total in Canada. The new stores provide more convenient access to those who previously purchased from the illicit market or were pushed to the provincial online stores. We have heard from many cannabis users that the online experience is convenient (especially during COVID), but they prefer walking into a store to see product variety, take in the aromas, and hear from experienced staff.

According to data compiled by Health Canada, Canada is home to approximately 5.1 million cannabis consumers. Alberta is specifically home to 585,000 users. Its current robust cannabis retail presence of 461 stores works out to one store per 1,269 consumers.

Ontario, on the other hand, has a relatively sparse retail presence. Based on the number of cannabis consumers estimated to reside in the province, there is one legal storefront per 31,779 users in Ontario. Clearly, per capita store counts represent a significant difference between Alberta and Ontario.

Source: Statistics Canada, Cannabis Benchmarks

How many stores will Ontario’s cannabis consumer population support? If we take the example of Alberta, there would need to be over 1,500 stores across Ontario in order to reach an equivalent per capita store count, based on the number of self-reported cannabis consumers in each province. An increase of over 1,400 retail outlets in Ontario would certainly result in a robust expansion of sales in the province.

Given Ontario’s total population of over 14.5 million, 1,500 licensed cannabis retailers would result in one store per almost 9,700 total residents. Such a per capita store count could plausibly be supported based on data from some of the more mature cannabis markets in the U.S. The hypothetical per capita Ontario store count just noted is in line with that in Colorado, the most mature legal cannabis market in the U.S., where there is one licensed adult-use retailer per roughly 9,800 residents (587 legal storefronts serving a population of over 5.7 million).

For additional context, Oregon, the U.S.’s most saturated legal cannabis market by store count, has one licensed retailer for about every 6,350 residents (661 legal shops serving a population of over 4.2 million). Store counts in both of those U.S. markets have largely stabilized after several years of growth – Colorado’s market opened in 2014, Oregon’s in late 2016 – but both still expanded a bit in 2019.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.