Canada Cannabis Spot Index (CCSI)

Week Ending May 14, 2021

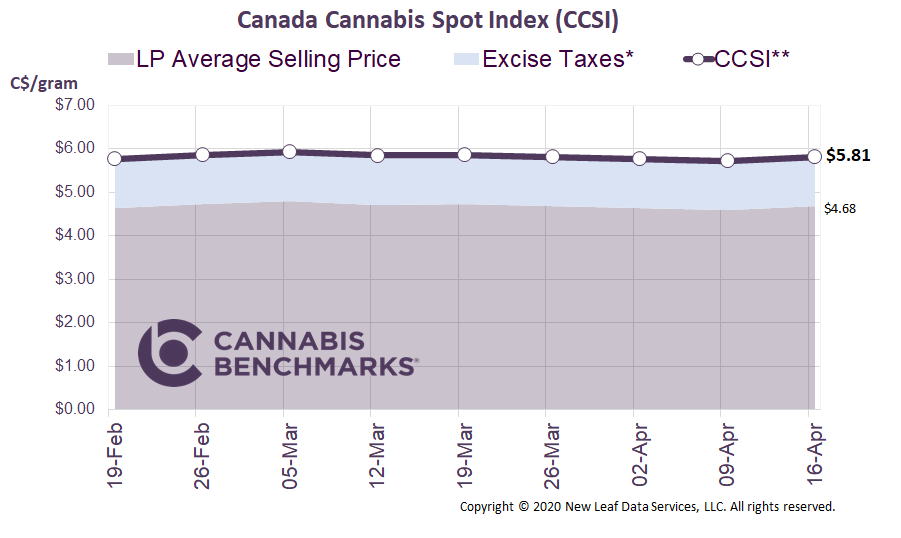

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.63 per gram this week, down 1.7% from last week’s C$5.72 per gram. This week’s price equates to US$2,103 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week, we provide an overview of Canadian hemp production in recent years. Commercial production became legal in Canada in 1998, with grower licenses and other regulatory provisions covering farming, processing, transportation, delivery, and sale provided by Health Canada. Prior to 2018, regulations limited commercial hemp production to fiber and grain products; hemp rules were then overhauled to allow CBD varieties as part of the Cannabis Act, which legalized cannabis for adult-use in the country. As a result, Canada has historically produced hemp for the food and nutrition market, with roughly 70% of the country’s production exported to the United States.

Health Canada sets out a list of hemp cultivars approved for commercial cultivation each year. All seeds planted need to be certified, with inspectors enforcing compliance. Due to previous rules, seeds approved for hemp production in Canada have until recently been exclusively grain and fiber varieties, but this year the federal government has approved new CBD dominant genetics originating from within the country, as well as those from the U.S.

Choosing the right cultivar is very important to farmers, as it determines the resulting production target (seeds, grain, fiber, and / or flower), yield, and other factors. Additionally, logged data gives farmers information on which cultivars grow best in the various regional climate and soil conditions across Canada. For example, certain cultivars grow best in drier soil conditions, such as those found in the western part of the country.

Based on data from Health Canada, we examined the top five cultivars planted in the past three years, which make up roughly 80% of total hemp acres planted in the country. Four of the five cultivars have been the same in each of the past three years, which goes to show that experienced farmers looked to plant cultivars that are well suited for their climate and that generate strong, high-quality yields of the production targets desired by buyers.

Source: Hemp Benchmarks®, StatsCan

Finola has been the dominant cultivar and made up almost 48% of the total hemp acreage planted last year. The Finola hemp variety has proved to be an excellent source of grain and fiber, but it also produces CBD-rich flowers only 120 days after germination. The table above shows a big increase in acres planted with Finola in 2020 relative to other cultivars. This occurred even as prices for CBD-rich hemp plant material plummeted after 2019’s harvest – market dynamics that are tracked by our Hemp Benchmarks division – which is reflected in the proportionally smaller amount of hemp harvested for flower and leaves in 2020, shown in the charts below.

The versatile nature of hemp is what makes it so potentially beneficial for farmers. Not only does it promote soil regeneration and absorb carbon, but each acre of planted hemp can yield various production targets. In other words, each acre of hemp harvested can be equivalent to more since various product forms can come from it. According to Health Canada, the 92,503 acres planted in 2019 was equivalent to 177,981 acres, or almost double the actual acreage planted. The 54,906 acres planted in 2020 was equivalent to 88,832 acres, or 1.62 times the actual acreage farmed.

Source: Hemp Benchmarks®, StatsCan

This data is important for U.S. farmers, who are still in the early stages of establishing and diversifying their hemp industry. In the U.S., all forms of hemp – including grain and fiber varieties – were only legalized for commercial production in 2018. As put by the U.S. Department of Agriculture, “Canada is perhaps the most relevant analog for the U.S. hemp industry. Canada’s modern hemp industry developed following a similar legislative and policy path as the U.S. industry, but it began 20 years earlier.” While the U.S. market has in its early stages been focused primarily on CBD and other cannabinoid production, a small amount of grain acreage has found a foothold in some states and interest in fiber is growing.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.