Canada Cannabis Spot Index (CCSI)

Published May 1, 2020

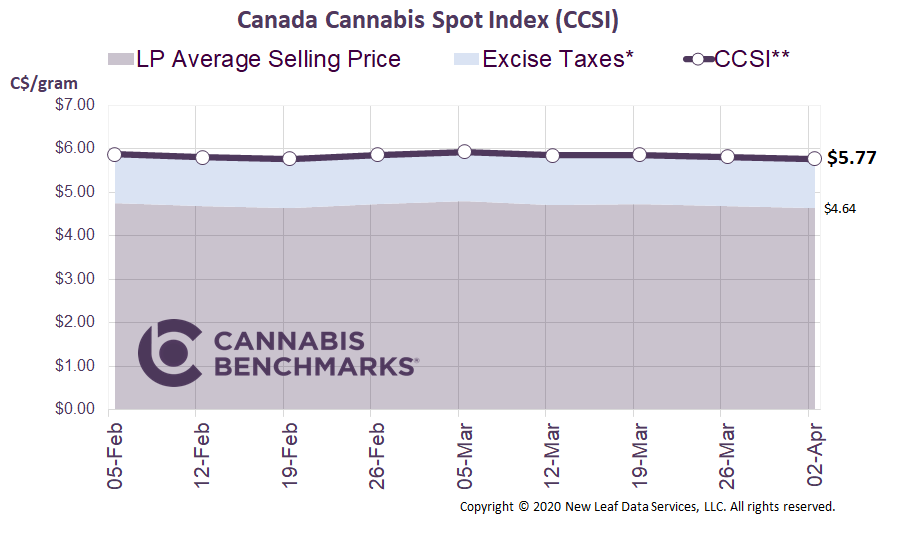

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.41 per gram this week, up 3.8% from last week’s C$6.18 per gram. This week’s price equates to US$2,076 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor NetworkIf you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we focus on the growth in legal cannabis purchasing. Statistics Canada does a very detailed job of estimating total expenditures each quarter. The break-out into various categories is informative, as they map out where spending occurs each month. We zoomed into this dataset this week to see how much Canadians spent on non-medical cannabis in 2019 in both the legal and the illegal markets.

To our surprise, overall cannabis sales stayed relatively flat throughout 2019. Canadians consistently spent roughly C$1.3 billion each quarter on non-medical cannabis, with no increase since late 2018, despite legal sales commencing in October of that year. We do believe more volume was purchased, but at a lower price point, making the sales flat in revenue terms.

The data illustrates how spending for non-medical cannabis is moving from the illicit market into the legal market. In Q4 2018, 87% of cannabis sales were made through illegal channels. That has been shifting over time; in Q4 2019, 65% of cannabis sales were attributed to illicit sources.

Source: Statistics Canada, Cannabis Benchmarks

The shift has not occurred as fast as the industry would have liked. Legal cannabis producers pay excise tax, just like alcohol and tobacco manufacturers, and in most provinces consumers pay sales tax on legal cannabis. These taxes push the price of legal products higher than analogous items from illicit sources. Adding to the pain of higher prices is the lack of widespread, convenient retail access. The combination of higher prices and poor accessibility makes it very difficult for the legal market to compete with the illegal market. Cannabis Benchmarks estimates 80% of cannabis was bought from illicit markets in 2019, which is higher than that suggested by the StatsCan data above.

The data above indicates that the real opportunity for this new industry is not generating a new customer base, but capturing the one already buying from illegal producers and sellers. We believe the previous trend of growing legal cannabis purchasing will change drastically in 2020, to the benefit of the licensed market.

We are modelling a structural shift due to COVID-19 and its impacts on the Canadian economy, which will alter purchasing habits across the board. For example, it has been shown that when the economy tumbles, alcohol sales traditionally spike as consumption increases. On the other hand, with items such as toilet paper, panic-buying might empty shelves, but people do not use more of it; they just buy less later.

We believe cannabis usage and purchasing habits will track more closely with alcohol, with the crisis resulting in increased consumption generally. We also expect online access to legal cannabis will encourage consumers to favor legal channels, rather than having to go out and meet up with illegal dealers. In our April 17 CCSI report, we detailed our projections for legal cannabis sales in March, which included an increasing share of online sales for the first time in over six months.

Below is our projection of the total volume of cannabis sold to non-medical consumers in the legal market. Our latest estimate for April is 15,267 kg of dry cannabis sold. A late-March spike in sales ahead of stay-at-home orders going into effect saw users stockpile personal supplies, leading to a dampening of April sales. Similar scenarios have been observed in state markets in the U.S.; sales revenue and volume typically slumps after events or holidays, such as 4/20, that spur a momentary, outsized increase in purchasing.

Source: Cannabis Benchmarks

Getting cannabis users to the store or ordering online is one of the biggest hurdles that the industry has been facing. Allowing legal cannabis businesses to continue operating amid the COVID-19 shutdown has created a unique opportunity for this industry. With Canadians under lock down, we have altered the way we live, including how we communicate with friends and buy groceries. Cannabis purchasing is no exception. We believe cannabis consumers will now have an opportunity to experience the variety, packaging, and reliability of legal cannabis, and will respond favorably overall. We expect the altered habits to be long-lasting and lead to increased legal sales even after the pandemic subsides and daily life returns to normal.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.