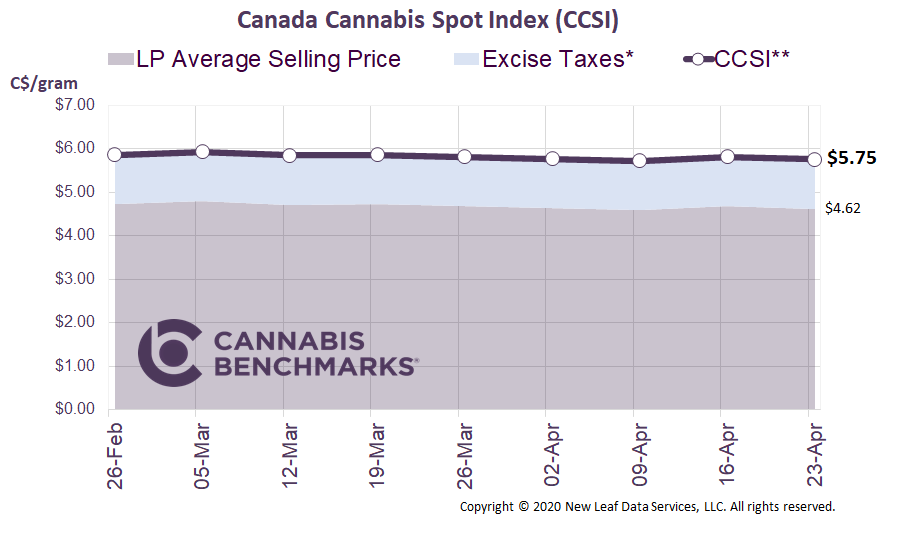

Canada Cannabis Spot Index (CCSI)

Week Ending January 29, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.89 per gram this week, down 1.0% from last week’s C$5.95 per gram. This week’s price equates to US$2,097 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

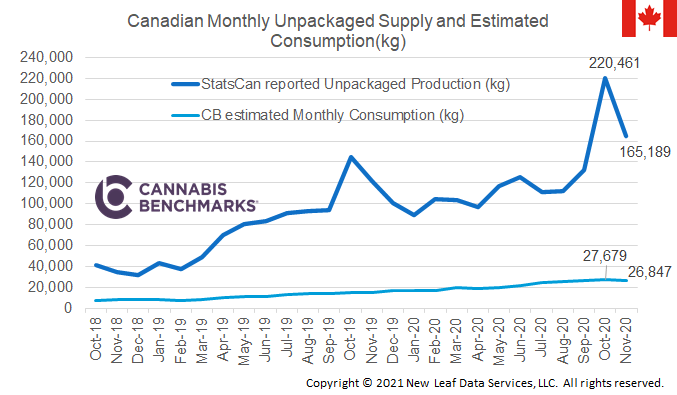

Last week, Statistics Canada released retail sales data for November 2020. November’s sales reached C$261.4M, down by C$8.5M from October. On a monthly basis, sales have been increasing steadily across Canada up until the most recently released data. The monthly figures are a bit misleading in this case, however, due to October having 31 days to November’s 30. When looking at the same data on a daily basis, as shown in the bar chart below, we see that sales began to plateau after September. After strong growth through the first 8 months of the year, we see daily sales holding at C$8.7M per day across the country.

Source: Cannabis Benchmarks, Statistics Canada

When drilling into each province individually, the data reveals divergent trends. In most cases, consumers gaining better accessibility to the regulated market due to an expanding retail footprint did not equate to sales growth. From September to November, we counted 198 additional stores open across Canada, an increase of 18%, yet there was no increase in average daily sales on the national level or for most provinces. The exception was Ontario, which saw daily sales increase by 6% from September to November. The rest of the provinces saw either flat sales or a decline, with daily sales dropping 6% in the Maritime provinces.

Source: Cannabis Benchmarks, Statistics Canada

November’s data suggests that Canada’s legal cannabis market may have reached a momentary baseline in much of the country, although Ontario’s slower-to-develop provincial market is still seeing expansion. On the national level, though, instead of the relatively steady, consistent growth in monthly revenues that has been recorded through the first two years of legal sales, we may begin to see more monthly and seasonal fluctuations in consumer demand. Similar trends have been observed in the numerous state markets in the U.S. as they have developed.

However, this does not mean that overall growth has ceased, nor does it mean that annual growth rates will necessarily subside in the future. In Colorado, for example, the most mature legal cannabis market in the U.S., annual sales growth slowed in 2018. After four years of significant year-over-year increases in retail revenues from 2014 through 2017, 2018 saw a less than 3% uptick in annual sales. Total retail revenues then rose by 13% in 2019. Full sales data for 2020 is not yet complete, but should represent a roughly 20% jump from 2019 once December’s figures are tallied.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.