Canada Cannabis Spot Index (CCSI)

Published January 10, 2020

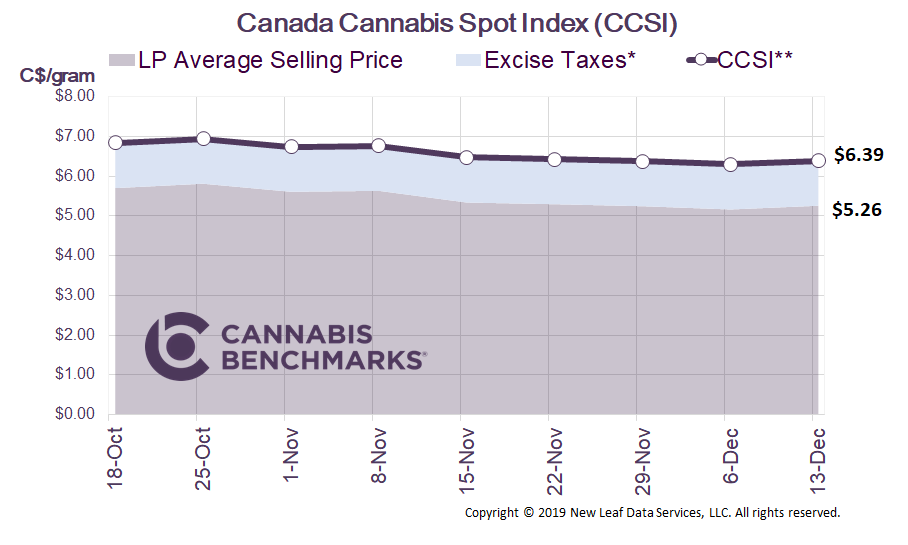

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.51 per gram this week, down 1.8% from last week’s C$6.61 per gram. This week’s price equates to US$2,260 per pound at the current exchange rate.

Let’s start by clarifying the definition of Cannabis 1.0 and Cannabis 2.0.

Cannabis 1.0 refers to the first phase of THC product legalization in Canada, which included the sale of dry flower (combustible products), cannabis oils, and cannabis plants and seeds. These products first became available for recreational use on October 17, 2018. At the outset, this new industry faced some turbulence in the form of supply shortages that quickly turned into oversupply. Today, with over 100 different licensed producers (LPs), the market is flooded with dry flower of different qualities and strengths. Consumption has not tracked with the growth in supply; most cannabis consumed in Canada is still bought from illicit sources due to the legal market’s inadequate accessibility and high prices.

Cannabis 2.0 refers to the legalization of edibles, extracts, and topicals. While these expanded product lines were formally permitted on the one-year anniversary of legalization in October 2019, a full product offering is not yet available in most provinces due to regulatory timelines and approval processes put in place by Health Canada. Cannabis cultivators are required to apply for an amended license, submit products for a 60-day review period, and pass strict quality assurance standards. When products meet these criteria, they may be introduced to the market; hence the earliest these products could be available would have been Dec 17, 2019.

As of this week, while most provinces are authorized to sell these products, retailers have very limited, if any, product selection.

Major Provinces Cannabis 2.0 roll out details:

Saskwetchwan & Manitoba: Limited product available as of late December, with more selection available at retail shops expected in late January.

Quebec: Limited products available as of January 1.

Ontario: Limited selection available in stores starting January 6. Stores have been given a head start in selling new products ahead of the provincial online store due to limited availability initially. The online store is scheduled to start sales on January 16.

British Columbia: The BC online store had its first batch of four products available on December 20. Products were to arrive in stores by late December

Alberta: Products are expected to be available in mid-January.

Per-item prices for edibles are expected to range from $7 to $14, beverages are set to cost between $4 and $10 each, and vapes will be priced anywhere from $25 to $125 per unit.

Cannabis 2.0 is expected to kick start additional demand in the legal market. Despite many stores not being stocked with the new product offerings currently, LPs are more prepared this time around relative to the start of Cannabis 1.0. The initial supply shortages are not expected to persist for as long as the shortages for dried flower and oils that occurred in late 2018 and early 2019. These products will fetch a hefty premium over dry cannabis, as this category does not compete directly with most cannabis products coming from the illicit market.

The variety of products should expand the current cannabis user base by bringing in novelty buyers, as well as attracting consumers away from the illicit market. We anticipate additional spending for Cannabis 2.0 products and forecast the boost in sales to reach 25% of the total spend in this market by Q4 2020.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.