Canada Cannabis Spot Index (CCSI)

Published February 7, 2020

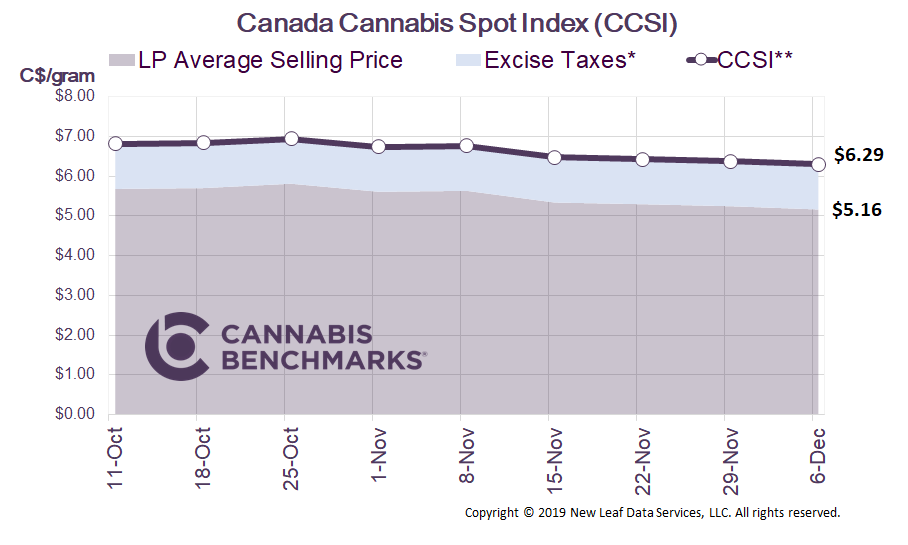

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.40 per gram this week, up 0.2% from last week’s C$6.38 per gram. This week’s price equates to US$2,187 per pound at the current exchange rate.

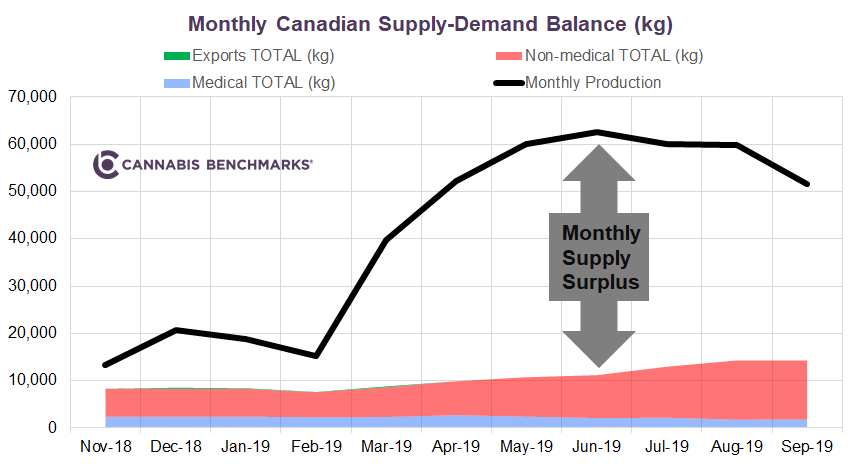

This week we examine new data released by Statistics Canada. On January 31, officials published information on total cannabis cultivation area licensed in October 2019. Up until this report, only a single aggregate figure encompassing all grow types was reported. The previous reports showed that total production capacity climbed steadily through summer 2019.

In the most recent report, for the first time, indoor and outdoor areas licensed for cannabis cultivation are reported separately. The data shows regulators have licensed roughly 13 million square feet of indoor and greenhouse production capacity, along with 19.4 million square feet for outdoor growing.

The new data shows definitively for the first time that outdoor cultivation area is outpacing indoor grows. However, this does not necessarily translate into outdoor cannabis production generating a larger volume of flower and other plant material. Licensed cultivation areas, whether indoor or outdoor, might not be fully utilized at any given time. Also, indoor facilities can in some cases have a higher annual yield due to more dense plant spacing and the ability to achieve multiple harvests per year.

Regardless, outdoor operations should help Canada’s legal industry in its fight against the illicit markets that still provide an estimated 80% of the total amount of supply consumed nationally. Price has been one of the largest roadblocks to getting experienced consumers to switch to the legal markets. As we have seen in the Western U.S., outdoor-grown cannabis costs much less to produce; hence, it sells at a lower wholesale price point. Many Canadian licensed producers (LPs) at first lobbied against permitting outdoor operations, but have since jumped on the bandwagon of this growing method in the hopes of producing larger volumes at a very low cost. In addition to helping LPs become more price-competitive with illicit dealers, robust outdoor harvests can provide ample plant material that can be processed into extracts and infused products to service the growing Cannabis 2.0 industry.

Although outdoor operations make complete sense based on the factors described above, it can be quite the gamble in Canada. As small and large LPs shift to increased outdoor production, we do expect downward pressure on wholesale prices, but also more volatility from seasonal supply fluctuations, as well as the general uncertainty regarding yield and product quality that naturally comes with growing outdoors.

Source: Cannabis Benchmarks

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.