Canada Cannabis Spot Index (CCSI)

Published February 21, 2020

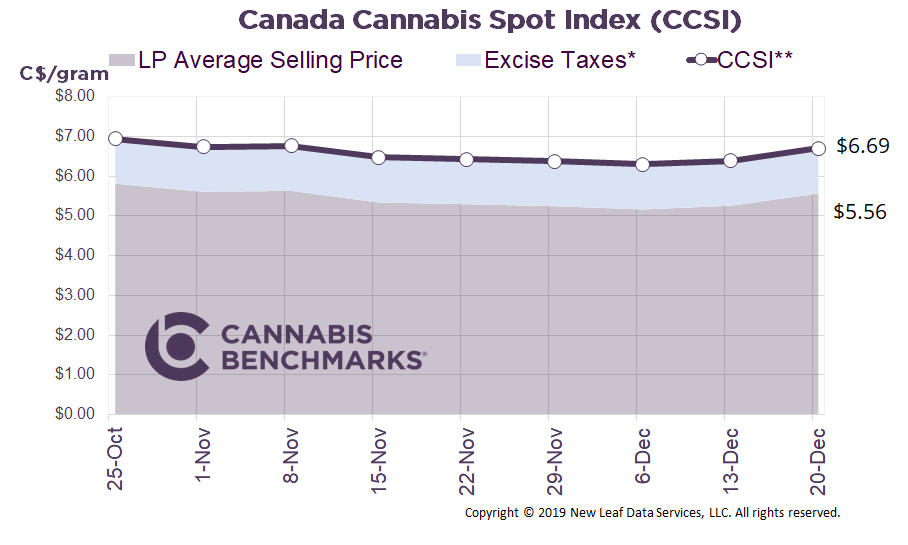

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.28 per gram this week, down 0.5% from last week’s C$6.31 per gram. This week’s price equates to US$2,151 per pound at the current exchange rate.

Company Announcement:

We are pleased to share that Cannabis Benchmarks® has begun disseminating its Canada cannabis index data through Nasdaq’s GIDS service. These unbiased indexes provide a variety of benefits for this emerging commodity, including:

– making it easier to reference the market value of product in buy/sell negotiations,

– writing spot and forward contracts on a published index,

– third-party validation for asset valuation (e.g., biological assets), and

– paving the way for more sophisticated financial instruments for hedging, trading, and risk management (e.g., swaps, futures, and other derivative contracts).

Click to read the full press release: Cannabis Benchmarks® Distributes its Canada Cannabis Pricing Indexes on Nasdaq Global Index Data Service

Join our Price Contributor NetworkIf you have not already done so, we encourage you to join our Price Contributor Network where market participants anonymously submit weekly wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

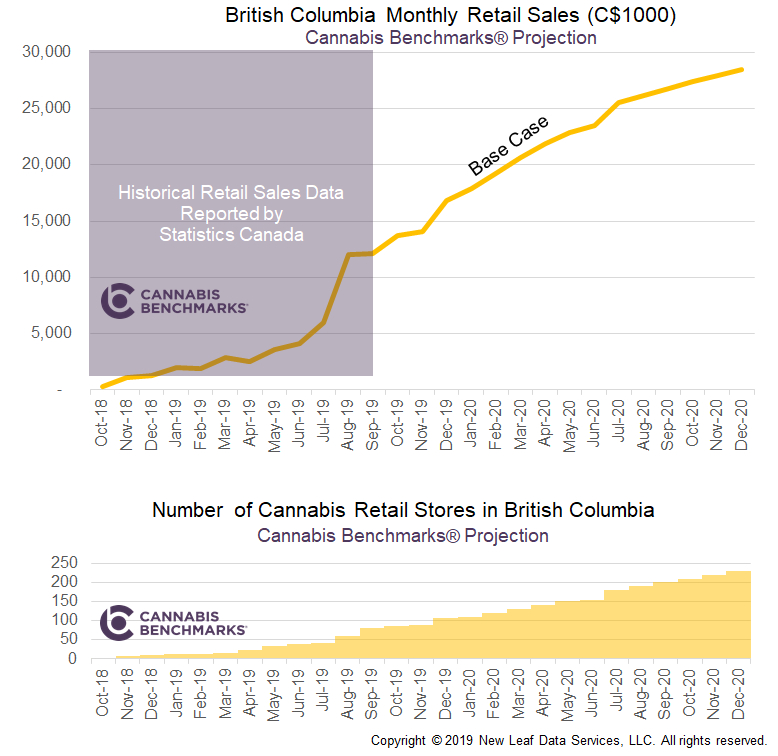

This week we look at how growth in the number of physical brick and mortar stores has been the key driver behind rising national cannabis sales. We now count 770 retail stores across Canada as of February, an increase of 47 stores from the previous month for a 6.5% growth rate.

Source: Cannabis Benchmarks, Statistics Canada

Alberta still has the highest store count with 420 stores, or 55% of the cannabis stores across Canada. As expected, Alberta, with the largest concentration of stores, has greater sales per capita than the other large provinces. While all other major provinces saw new store openings, this month was particularly important for Ontario. Stores from Ontario’s second lottery that was conducted in August 2019 opened this month. Six new stores of the 42 licenses issued opened in Canada’s largest province, which takes Ontario’s total to 31 retail outlets.

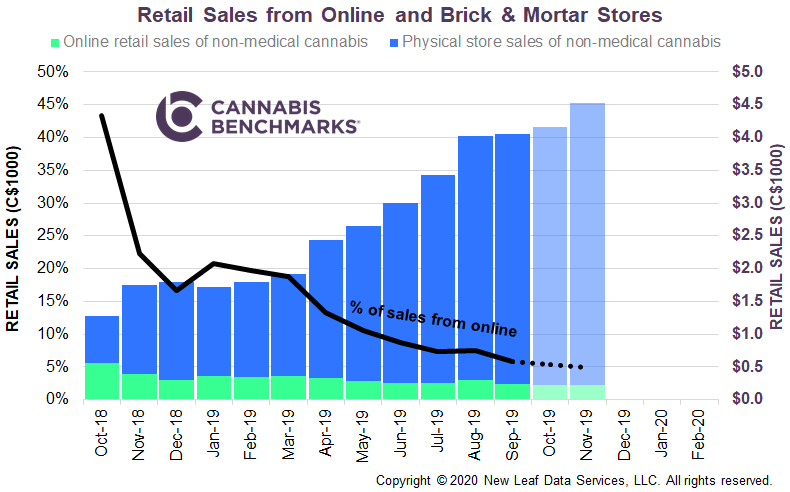

As new stores have opened across the country, they have provided more convenient access to cannabis users who previously purchased from the illicit market or were pushed to the provincial online stores. This has been positive for the industry as the customer base continues to grow. We have heard from many cannabis users that the online experience is convenient, but they prefer walking into a store to see product variety, take in the aromas, and hear from experienced staff.

As seen in newly released data from Statistics Canada, the opening of new stores has coincided with a large drop in online sales as a proportion of overall revenue. At the onset of legalization, the lack of retail stores resulted in 44% of total sales coming from online provincial marketplaces. The latest data for September shows only 6% of sales coming from online stores.

Source: Cannabis Benchmarks, Statistics Canada

We project this downward trend in online buying to continue, and forecast monthly sales of $6.6M, or daily sales of $220,000, for all Canadian online stores for the month of November. We expect the growth in store counts, lower priced products, shrinking retail margins, and new cash and carry models will put immense pressure on provincial government run stores that continue to operate in the red. In our opinion, this could eventually lead to the privatization of online sales

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.