Canada Cannabis Spot Index (CCSI)

Published February 14, 2020

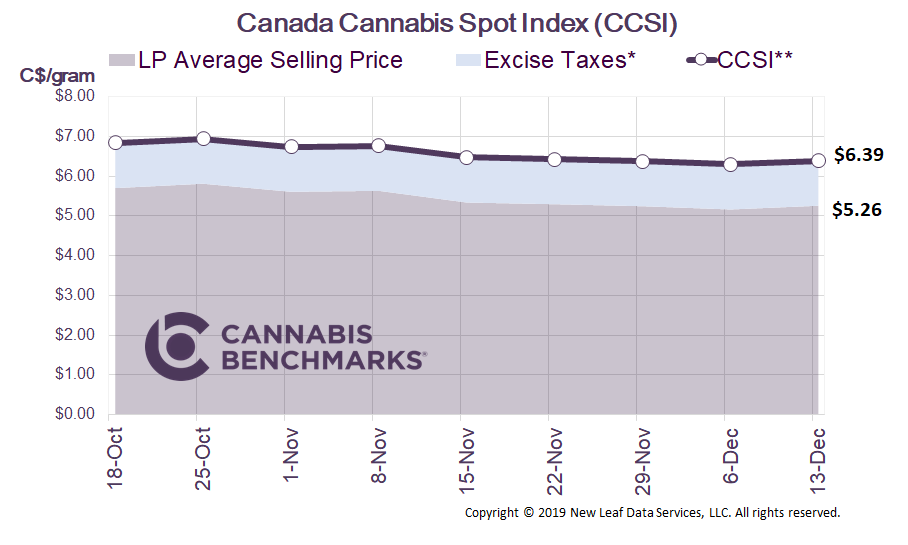

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.31 per gram this week, down 1.3% from last week’s C$6.40 per gram. This week’s price equates to US$2,156 per pound at the current exchange rate.

The era of legal cannabis in Canada has been a bumpy ride for cannabis producers, consumers, and investors. The past year has been volatile and has seen collapsing valuations, high retail price points, dropping wholesale prices, lower-than-anticipated consumption, executive shake-ups, lay-offs, inventory write-downs, and corporate scandals.

This week, the two largest Canadian licensed producers – Aurora and Canopy Growth – reported quarterly earnings for the period ending December 31, 2019. Rather than focusing on the financial results of the two mega-companies, we examine some of the fundamental metrics. In the latest reported quarter, both companies increased their production capacity and total sales. Aurora, which has been focusing on producing high-quality varieties and lowering total harvest costs, grew total quarterly output by 292% to 22,869 kg relative to the same quarter last year.

Sales did not grow at the same pace, and in fact that has been one of the key contributors to the deteriorating financials and the decline in average net selling price. Sales from the same quarter last year have only grown by 36%, leading to excess supply going into inventory each month. Aurora’s cumulative inventory since legalization has ballooned by 68,657 kg. Based on their current sales rate, that is close to 22 months worth of supply.

Canopy Growth followed the same trend in at least the past five reported quarters. Canopy, the largest licensed producer in Canada, harvested 293% more than the same quarter last year, generating 29,900 kg. As with Aurora, sales grew at a significantly slower pace. Sales for the latest quarter reached 13,200 kg, or 31% higher than the same time last year.

The gap between supply and sales has led to a massive inventory issue for Canopy, as well as lower selling prices. Supply in the latest quarter slowed to help ameliorate the inventory overhang, but Canopy’s cumulative product buildup since legalization commenced has grown by 79,600 kg. Based on their current sales rate, that is over 18 months worth of supply.

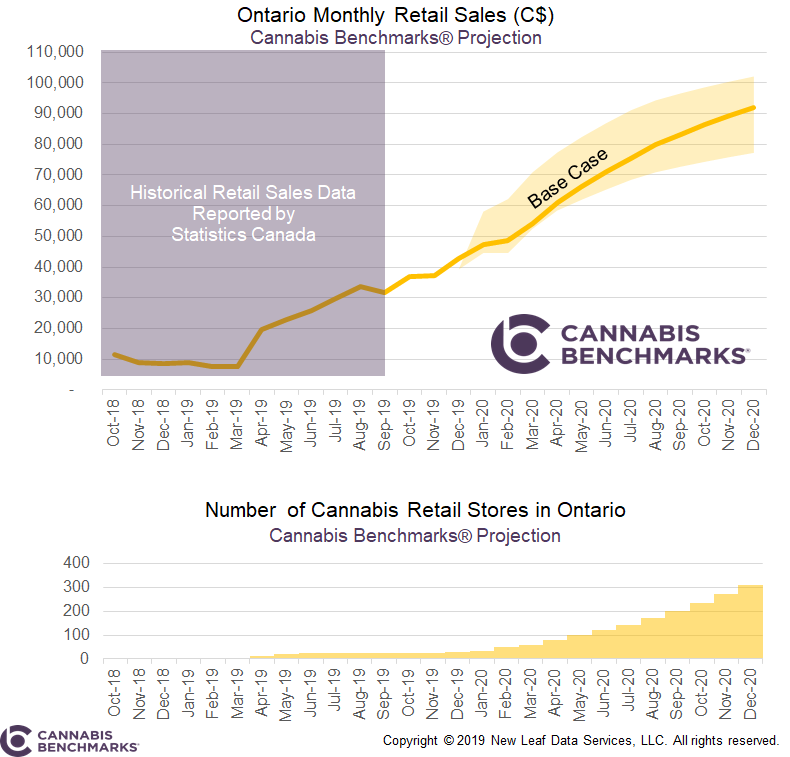

We recognize that 2020 sales will pick up with the opening of new stores, the launch of Cannabis 2.0 products, and increased consumer adoption, but will this be enough to balance the supply-demand fundamentals of this market? We expect to see similar results from many of the Canadian producers over the coming weeks, and potentially some inventory write-downs to help alleviate the rapid expansion in excess supply. As with other novel industries and commodities, cannabis in Canada is going through cycles of shortages and oversupply that should stabilize as the market matures.

Source: Cannabis Benchmarks, Aurora Cannabis and Canopy Growth quarterly earnings

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.