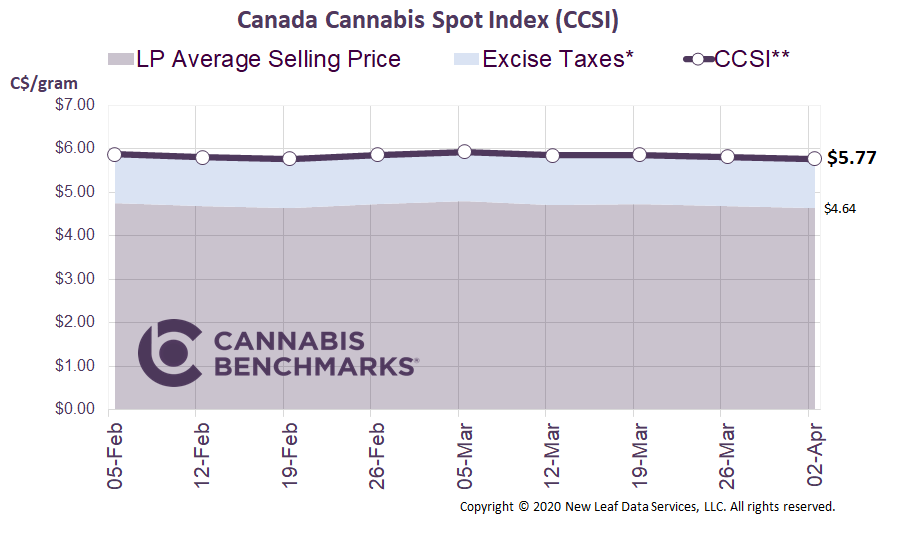

Canada Cannabis Spot Index (CCSI)

Week Ending February 5, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.88 per gram this week, down 0.3% from last week’s C$5.89 per gram. This week’s price equates to US$2,082 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we examine the growing number of cultivators in Canada’s market. There are two types of cultivation licenses issued by Health Canada: a standard cultivation license and a micro-cultivation license. The standard license has no size limit on the growing area for the facility, while a micro-cultivator is limited to 200 square meters (about 2,150 square feet) of growing area.

Micro-cultivators are likely to focus on quality over quantity – much as craft brewers do in the beer industry. These smaller growers often focus on unique strains to differentiate their product and receive a premium price.

Source: Cannabis Benchmarks

Regardless of type, Health Canada takes the same approach in reviewing cultivation applications. The completed form requires municipal permits, property details and layouts, executive team security clearances, approvals from local fire and police associations, and much more. The average time to receive a license takes anywhere from three to nine months depending on the completeness of the application.

Health Canada has been working through the backlog of cultivation licenses and there are currently 513 active cultivation licenses split amongst standard and micro-cultivation grow operations. Approximately two-thirds of the licenses are standard licenses.

Source: Cannabis Benchmarks, Health Canada

As seen in the chart below, the micro-cultivation license is a relatively new phenomenon. The issuance of standard licenses accelerated quickly ahead of the legalization of cannabis on October 17, 2018, but the same phenomenon for micro-cultivation was not seen until the following year.

Source: Cannabis Benchmarks, Health Canada

Lastly, we break down in which provinces the licenses are issued. Ontario with its sizable population and British Columbia with its favorable climate have seen the largest numbers of licensed cultivators in their jurisdictions.

Source: Cannabis Benchmarks, Health Canada

We should note that at the moment not all licensees are operational. However, if each license holder builds their cultivation facility and begins producing, we can expect Canada’s production capacity will continue to outstrip domestic demand. Furthermore, if options to export significant amounts of product remain limited, as they are currently, the growing surplus inventory would likely need to be destroyed as the cost of carry outweighs the economic value of the product.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.