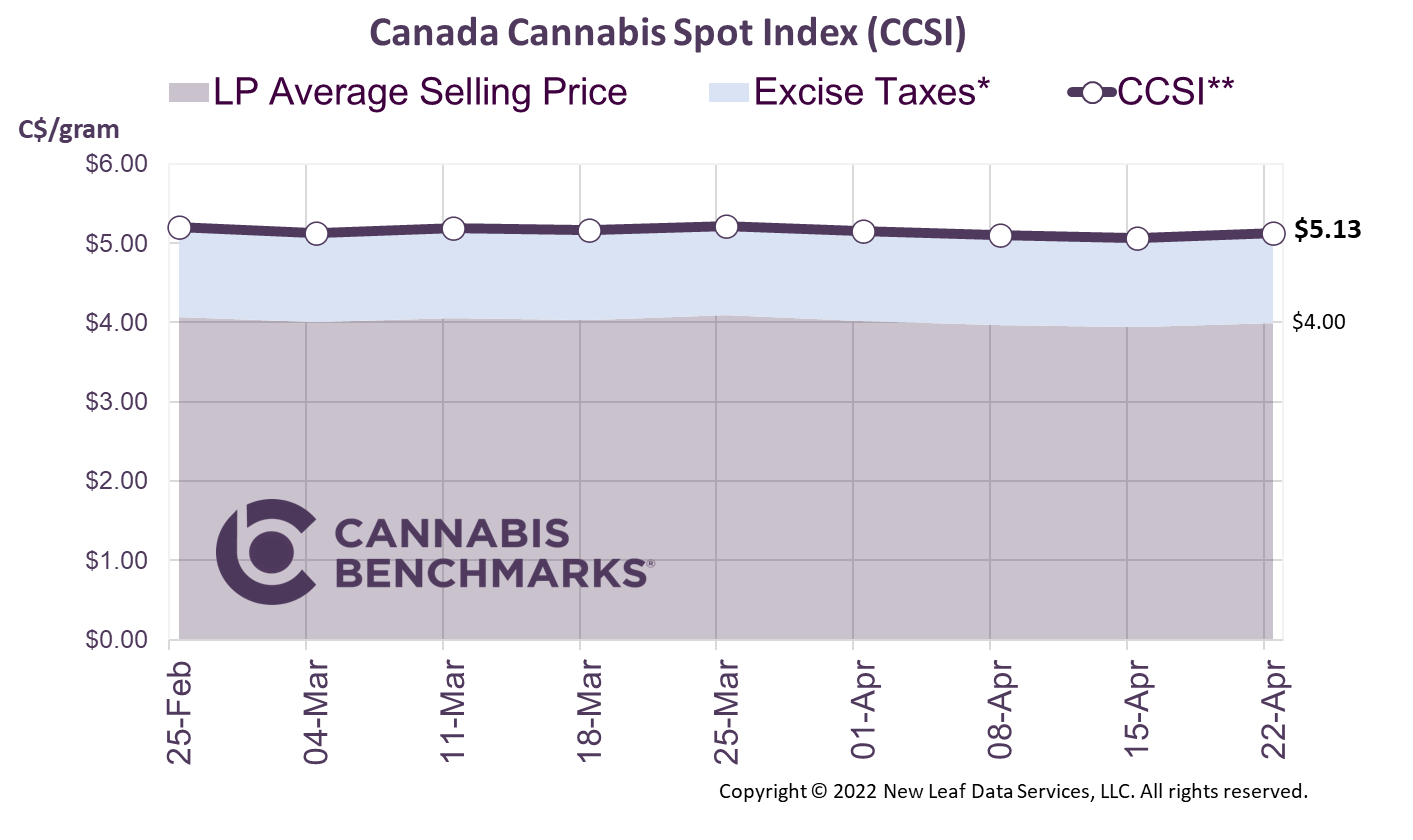

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.12 per gram this week, up 1.1% from last week’s C$5.07 per gram. This week’s price equates to US$1,846 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

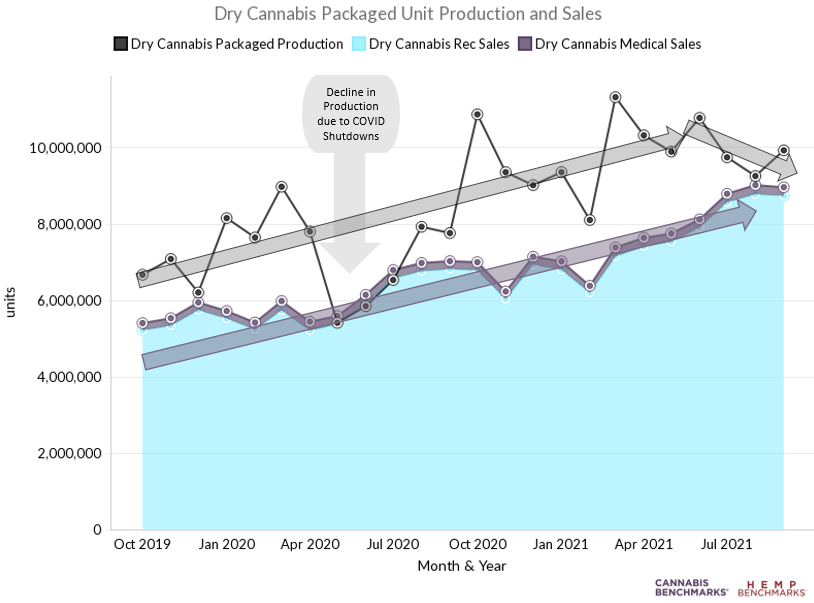

In this week’s report we review data released by Statistics Canada, which expands our understanding of the state of cannabis market fundamentals. The data set we focus on this week shows monthly dry cannabis unit production and sales data through September 2021. We discover the dynamics are changing rapidly with this latest installment of data, which spans from April 2021 to September 2021.

The chart below shows monthly dry cannabis packaged production alongside total cannabis sales. Both monthly data sets are reported on a packaged unit basis rather than volume.

As the chart illustrates, both production and sales were increasing at a steady rate in the first few years of legalization. However, with the exception of the COVID shutdown periods during Q2 2020, production consistently outpaced sales, with the excess production each month either being destroyed or pushed into storage facilities. As with most commodity markets, a steady increase in inventory leads to weakening wholesale prices. While declining prices typically result in an increase in sales in the short term, over the longer term producers need to cut production to correct the imbalance. As of last September, the data indicates that production cuts are finally being made to move supply closer in line with demand, with a number of cultivators closing production facilities. A better supply/demand balance should be good news for the cannabis markets as a whole, and should be seen as another sign of a maturing market.