![]()

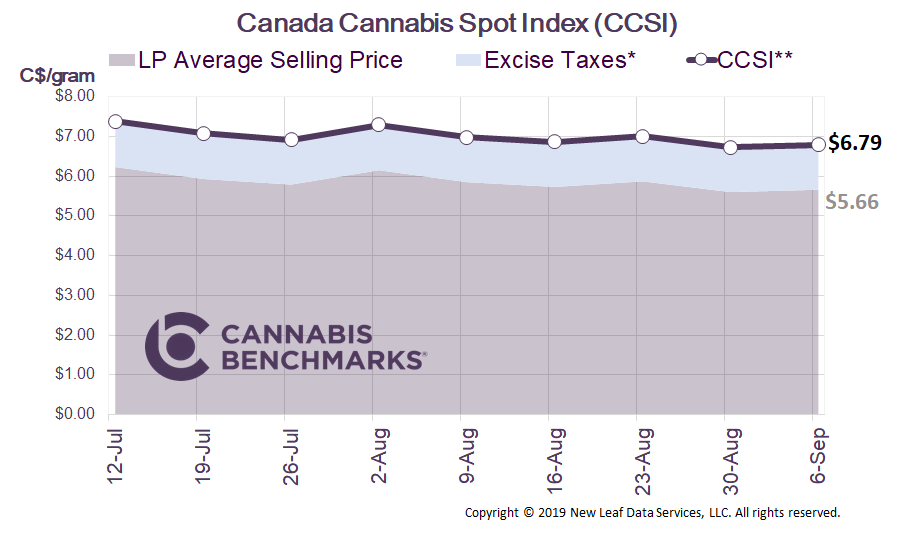

Canada Cannabis Spot Index (CCSI)

Published September 6, 2019

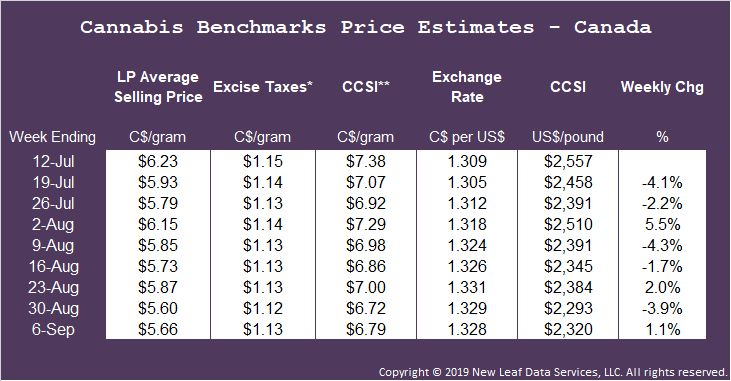

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.79 per gram this week, up 1.1% from last week’s C$6.72 per gram. This week’s price equates to US$2,320 per pound at current exchange rates.

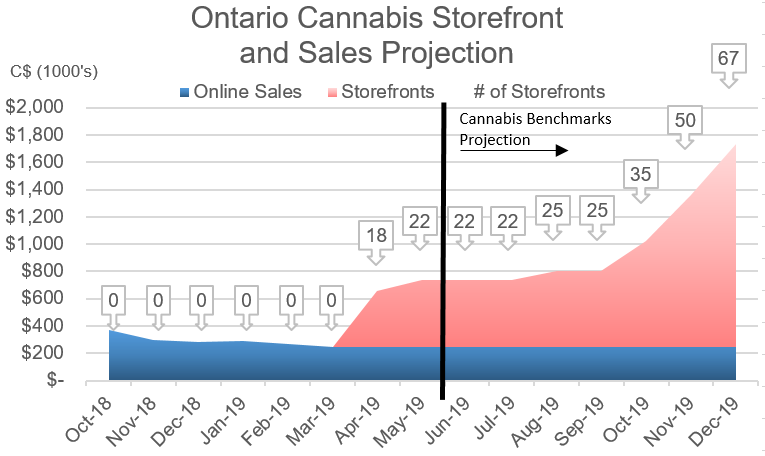

This week we examine June sales figures from Health Canada. The government’s official Cannabis Tracking System data shows sales of both dry cannabis and oils increasing substantially over the past few months, driven mainly by the opening of new storefronts in Ontario.

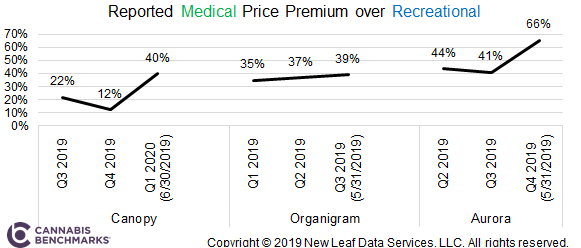

Total sales of non-medical dried cannabis in June increased by 8% from May, to a total of 8,441 kg sold (or 281 kg/d on average). The growth comes as new retail outlets provide increased availability and Canadians become more familiar with the product. As the non-medical market expands, total sales of medical dried cannabis dropped for the second straight month. In June, total sales of medical dried cannabis decreased by 10% to 1,535 kg (or 51 kg/d on average), the lowest sales volume figure for medical cannabis since adult-use legalization in October 2018.

Source: Cannabis Benchmarks, Health Canada

Non-medical cannabis sales volume now exceeds that in the medical sector by a factor of five-and-a-half. This is an increase from January, when non-medical sales volume outpaced medical by a factor of about three.

As has been observed in state-legal cannabis markets in the U.S., medical cannabis patients in Canada seem to be turning to recreational outlets for their supply, rather than ordering online from government sources. It is likely the trend in this ratio will continue even if medical sales remain steady; more Canadians will likely give the licensed recreational markets a chance in the future, either as a first time user or one making the switch from purchasing from the illicit markets.

Source: Cannabis Benchmarks, Health Canada

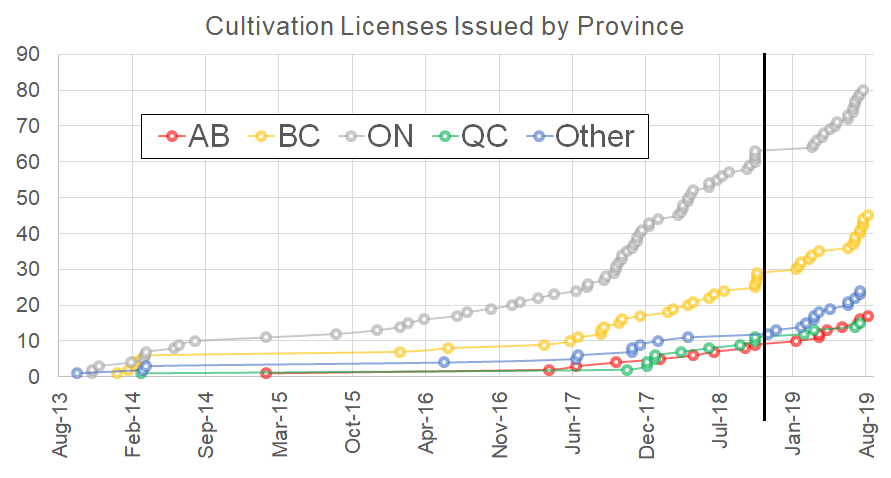

The Cannabis Tracking System also reports total finished and unfinished inventory for the end of each month. We have observed inventory climbing steadily as Canadian licensed producers (LPs) bring on more cultivation capacity. New figures from the recent report report show finished inventory ballooning to almost 49,000 kg, with 62% of that inventory held by distributors and retailers. Our calculations based on the three-month average demand from all consumers indicates this finished inventory represents over five months of supply.

Source: Cannabis Benchmarks, Health Canada

The amount of unfinished inventory is even more staggering at 263,333 kg ready to be processed, packaged, and distributed. Our calculations based on the three-month average demand indicates that the unfinished inventory held by LPs represents 28 months of supply.

Source: Cannabis Benchmarks, Health Canada

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..