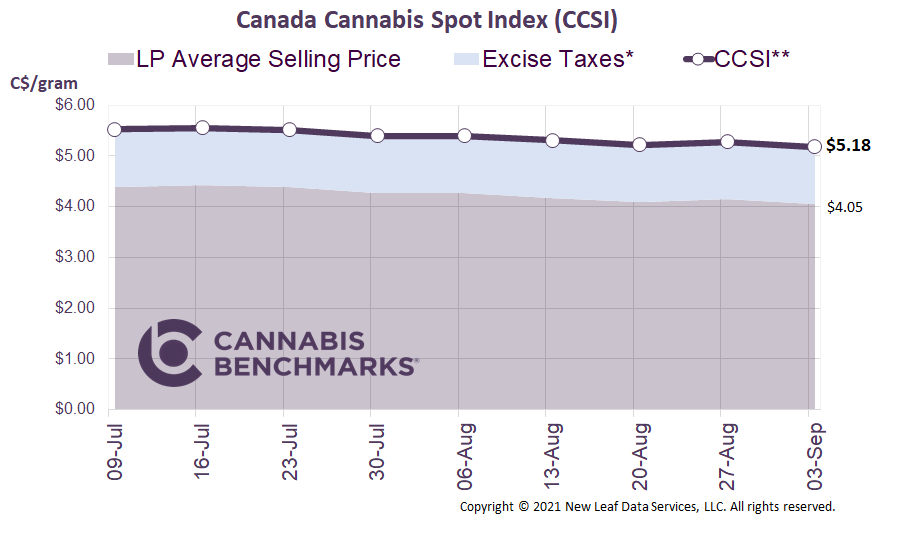

Canada Cannabis Spot Index (CCSI)

Week Ending September 3, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.18 per gram this week, down 1.9% from last week’s C$5.28 per gram. This week’s price equates to US$1,863 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

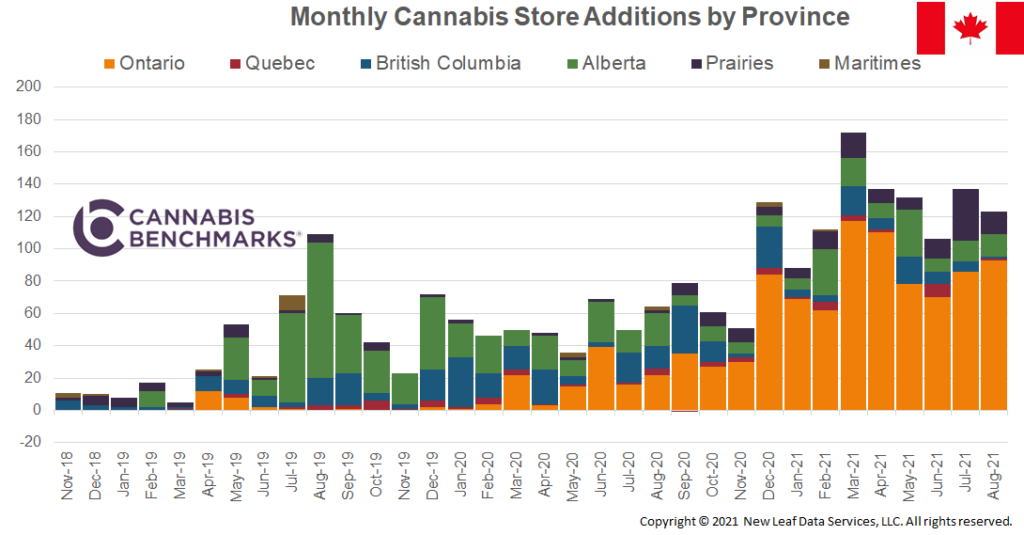

This week we provide an update on the increase in retail storefronts across Canada. As of August 31 we are tracking 2,412 licensed retailers, with an average monthly growth rate of 7% in 2021. Ontario continues to lead the national growth trend, with the province hitting its 1,000 store goal ahead of schedule. The province had originally targeted September to reach that goal, but on August 20 the Ontario Cannabis Store (OCS) tweeted that the goal had been reached.

As seen in the chart below, the growth in Canada’s retail stores has been driven primarily by Ontario’s quest to make legal cannabis more accessible. In 2021 Ontario opened an average of 85 stores per month, a trend we expect to continue through the end of the year, as part of an ongoing government effort to marginalize the illicit market. One example of that growth: Canopy Growth is looking to open its Tokyo Smoke cannabis stores in four malls.

Ontario is still far behind Alberta in terms of number of stores per capita, but there are areas in Toronto that have been overbuilt. This recent rapid growth will likely result in increased local competition, which could result in some closures. That being said, there are still many regions that are underserved, which is keeping the illicit market very active. We anticipate another 200+ stores to open in Ontario by the end of the year.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.