Canada Cannabis Spot Index (CCSI)

Published September 18, 2020

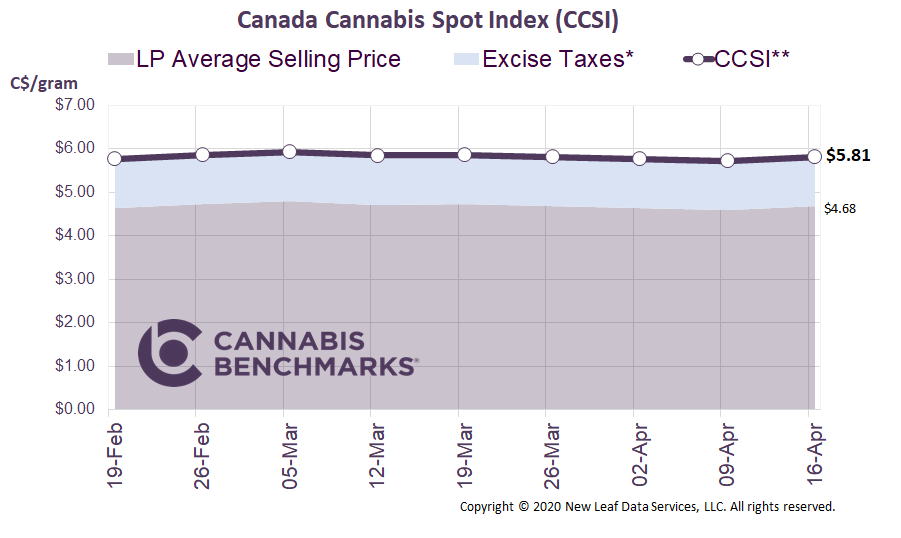

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.13 per gram this week, down 3.8% from last week’s C$6.13 per gram. This week’s price equates to US$2,112 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

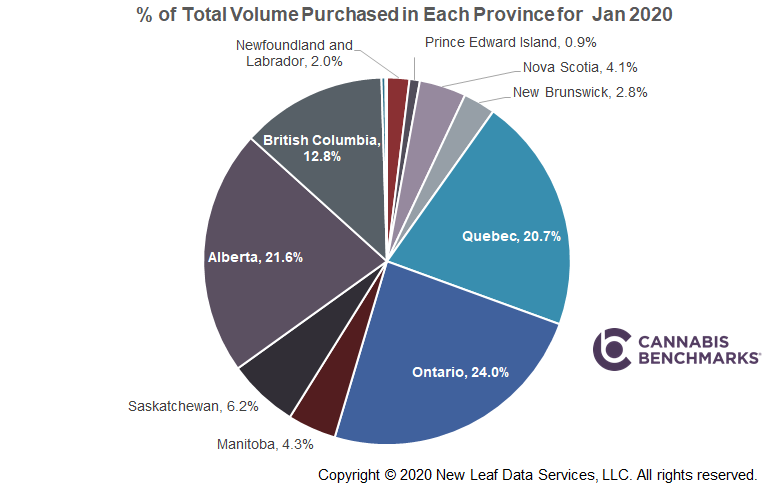

This week we share our latest sales forecast for Alberta, which has one the most robust legal cannabis markets in Canada. The Alberta Gaming and Liquor Commission (AGLC) is the provincial regulatory body responsible for regulating private retail cannabis, the distribution of cannabis, and operation of online cannabis stores. They have been the most efficient of all provinces in having retail applications translate into store openings.

At Cannabis Benchmarks, we conduct a monthly store count across each province. We have seen a significant uptick in new stores across all major provinces. Alberta is the fourth most populous province with 10% of the country’s population, but it is home to 515 cannabis stores as of August 31, or 48% of all physical retailers nationwide.

Source: Cannabis Benchmarks, Statistics Canada

The number of new stores opening in Alberta each month has slowed as major cities like Calgary and Edmonton are becoming saturated. We expect new store openings to continue to grow at a slower pace through the end of the year, resulting in a total of 600 stores by the beginning of 2021.

Source: Cannabis Benchmarks, PotGuide.com

As we have noted in the past, there is a very strong relationship between the number of open stores and monthly retail sales in each province. Each new store provides better accessibility to the legal cannabis market and helps pull consumers away from the still robust illicit market. However, after a certain threshold new store openings begin to have a diminishing effect on sales; it appears that Alberta might be reaching that saturation point. The latest sales data issued by Statistics Canada for June 2020 shows Alberta’s retail cannabis sales totaling C$46.7M for the month. Ontario, with triple the number of people but only quarter of the number of stores, had a similar level of sales.

Our latest forecast for Alberta has sales growing, but at a reduced pace due to the slowdown in new store openings and overall saturation. We project December sales to reach C$51.3M and total Alberta sales for 2020 to reach C$540M. Based on this forecast, sales in 2020 will amount to more than double those in 2019. This is a positive sign for regulators and market participants who are looking for the legal cannabis system to take a bigger chunk out of the illicit trade.

Source: Cannabis Benchmarks, PotGuide.com

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.