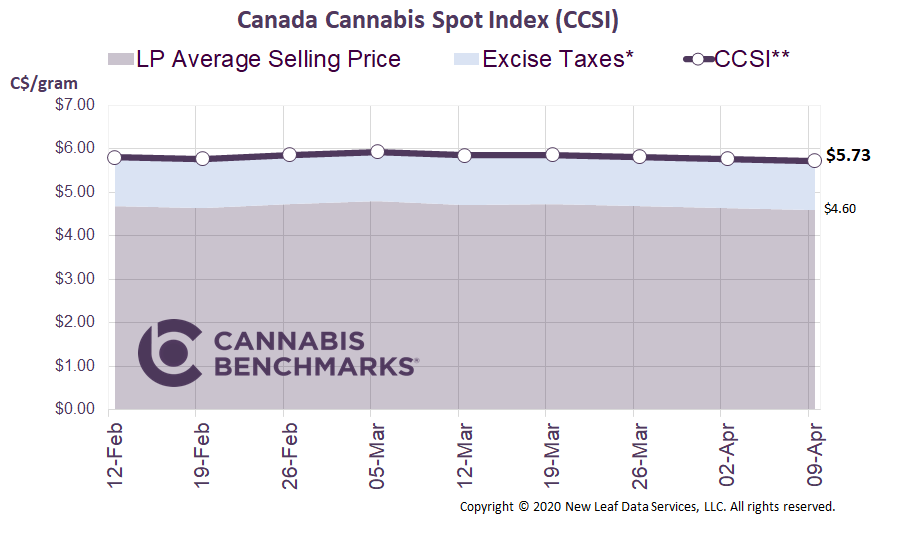

Canada Cannabis Spot Index (CCSI)

Published October 9, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.96 per gram this week, down 0.4% from last week’s C$5.99 per gram. This week’s price equates to US$2,042 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on store counts nationwide, with an emphasis on the development of Ontario’s legal market. Overall, the Canadian cannabis industry has increased the pace at which it is opening new retail outlets across the country. At the end of July, we crossed the milestone of 1,000 stores and expansion has not slowed since then. As of September, we counted 1,159 licensed retailers, with an average monthly growth rate of 6.3% in 2020. This solid growth rate comes despite many store applications and openings being delayed due to COVID-19 shutdowns.

Source: Cannabis Benchmarks

The 75-store increase in September was dominated by Ontario. Ontario’s Alcohol and Gaming Commission (AGCO) issued a statement on September 1 regarding Cannabis Retail Store Authorizations. AGCO stated that they were going to “double the pace of store authorizations this fall.” This suggested that, on average, up to 40 new stores would be opened each month through the end of the year.

With the most recent Ontario store count, we can confirm that 40 new stores were in fact opened in the province in September, bringing the total in Ontario to 178. This is still far below the 526 retailers active in Alberta, but growth there has slowed and Ontario should lead all provinces in store count by late 2021 if this pace continues.

As we have reported in the past, expansion of the legal market’s physical presence in the form of licensed storefronts correlates strongly with increased sales, up to a point. However, given Ontario’s large population and still relatively low store count, saturation of retail outlets in the province is a long ways off.

The latest sales data for June 2020 issued by Statistics Canada shows cannabis retail sales in Ontario totaling C$48.8M with 116 stores open. Our most recent forecast shows sales growing dramatically with the increase in active retailers, bringing September sales to C$63.9M and total Ontario sales for 2020 to C$655M. If the provincial store count continues to grow by 40 stores per month, our initial estimates show total Ontario sales eclipsing C$1B in 2021.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.