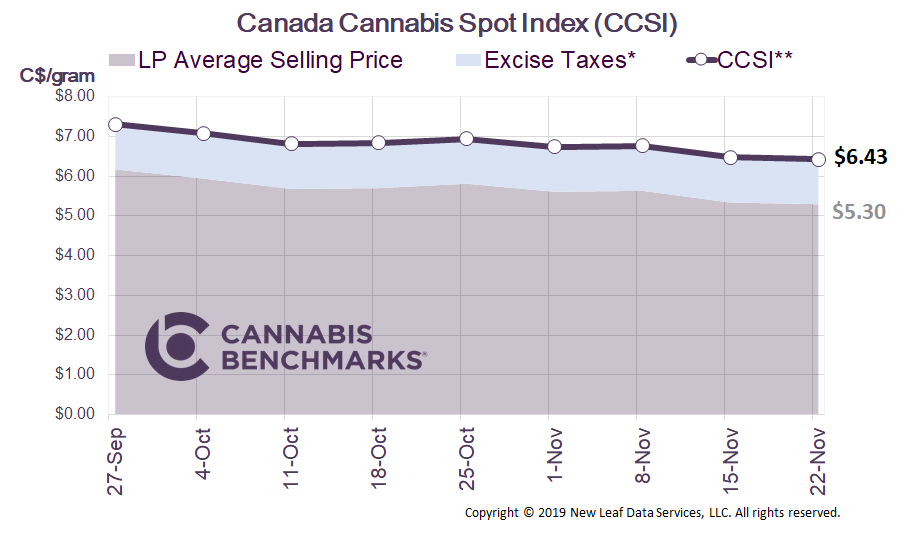

Canada Cannabis Spot Index (CCSI)

Published November 22, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.43 per gram this week, down 0.6% from last week’s C$6.47 per gram. This week’s price equates to US$2,198 per pound at the current exchange rate.

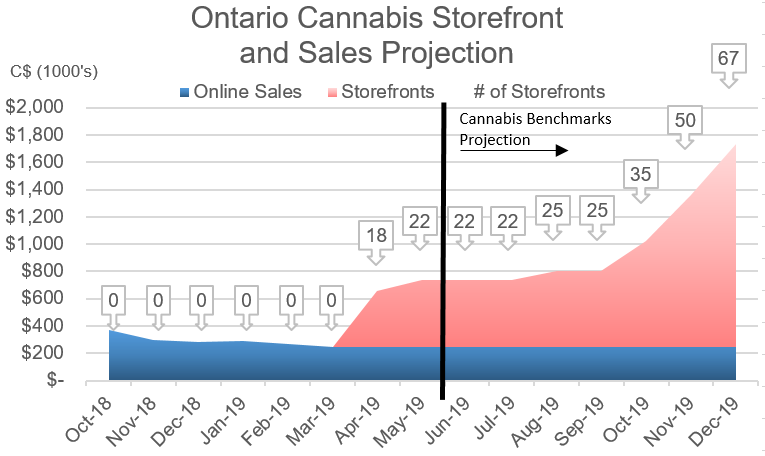

This week we analyse the sweeping changes about to occur in Ontario’s cannabis market. These changes are expected to be well received, both by consumers and the four major licensed producers (LPs) – Tilray, Aurora Cannabis, Canopy Growth, and Cronos – that reported big misses in their quarterly earnings last week. In their quarterly earnings calls last week, each company’s management team concluded that the lack of retail infrastructure in Ontario is constraining their sales. With Ontario home to 38% of the Canadian population, or 14.5 million people, increased and more convenient access is very important to the growth of this sector.

A number of recent announcements will fundamentally alter the trajectory of Ontario’s cannabis market. Below, we summarize the key changes and, taking those into account, introduce our new retail sales projections for Ontario through the end of 2020.

-

Next month we are expecting the introduction of cannabis 2.0 products, or cannabis-derived products such as vapes, beverages, edibles, and more. As we reported in our October 25 report, sales of these new products should expand the current cannabis user base by bringing in novelty buyers, as well as attracting buyers away from the illicit markets. Additionally, a portion of consumer spending will likely shift from dry flower to more premium priced alternative products, resulting in higher sales revenues. (Cannabis 2.0 will take place nationwide and is not limited only to Ontario.)

-

On November 6 the Ontario Cannabis Store announced the click-and-collect system, which will allow existing private cannabis retailers to take orders online or by phone for in-store pickup. This service aims to reduce wait times for buyers and mimic the sales process of the illicit markets. Leafly, a well-known cannabis discovery site, already provides this service in Alberta.

-

The Ontario Cannabis Store (OCS) announced on November 19 the move to a privately-operated centralized distribution network. This will further remove the OCS from the cannabis sector by privatizing the storage and distribution centers and direct store deliveries. The goal is to have less government intervention to promote cost efficiencies and increase the legal consumer base by ultimately driving down prices closer to those observed in the black markets.

-

Finally, the biggest announcement was made yesterday, November 21, in regard to the potential for an open allocation process for issuing retail store licences next year. The current lottery system has been fraught and slow-moving, resulting in only 24 cannabis stores currently open across Ontario. The new process is intended to be more streamlined, with an online application and thorough background check.

If all these changes transpire, we expect the number of stores to increase dramatically starting Q2 2020, eventually reaching 400 by the end of next year. As a result, we have updated our base case cannabis sales projections through the end of 2020.

Our analysis includes both a low and high case. The low case assumes the process for issuing retail store licenses stays on its current path, resulting in only 150 physical locations by the end of 2020. The high case assumes store growth to be rapid (or required), as outlined by the Canopy management team on their earnings call last week. They suggested 40 new stores each month to suck up current production levels and inventory to balance the market by late summer. In this scenario, we reach 505 operational stores by the end of 2020.

In our base case, we see Ontario sales expanding quickly and reaching C$97 million in total monthly retail sales for December 2020. This is almost triple the sales reported by Statistics Canada for August 2019.

Source: Cannabis Benchmarks

The linear relationship between number of stores and total sales does break down with the opening of new locations. As more stores are opened, consumers will have more access points and sales get distributed. Additionally, we factor in the sales growth from cannabis 2.0 by scaling in the additional spending that we anticipate will be generated by the new products. Ultimately, we forecast the boost in sales from cannabis 2.0 will account for 25% of the total spend in this market.

Source: Cannabis Benchmarks

These announced changes, if implemented effectively, efficiently, and in a timely manner, will likely put the Ontario cannabis market on the growth path envisioned originally by market participants.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.