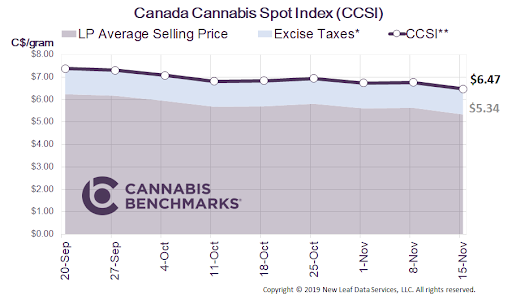

Canada Cannabis Spot Index (CCSI)

Published November 15, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.47 per gram this week, down 4.3% from last week’s C$6.76 per gram. This week’s price equates to US$2,219 per pound at the current exchange rate.

This week four major licensed producers (LPs) – Tilray, Aurora Cannabis, Canopy Growth, and Cronos – reported quarterly earnings that sent their stock prices diving while giving the market more insight into their operations, financials, and future plans. In a nutshell, the fundamentals are catching up to the inflated stock prices.

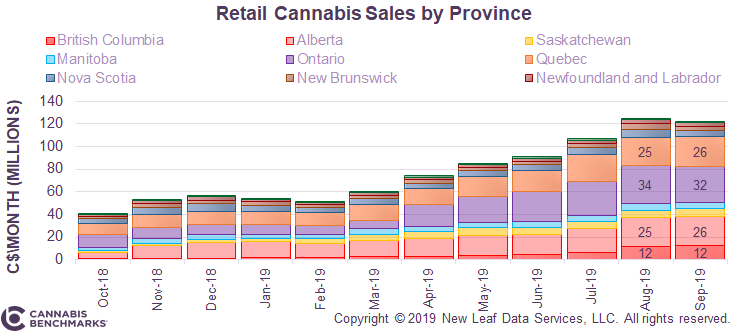

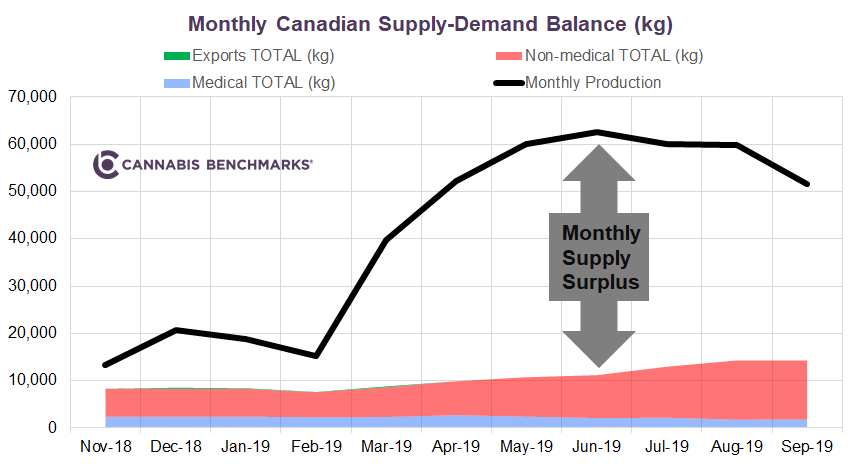

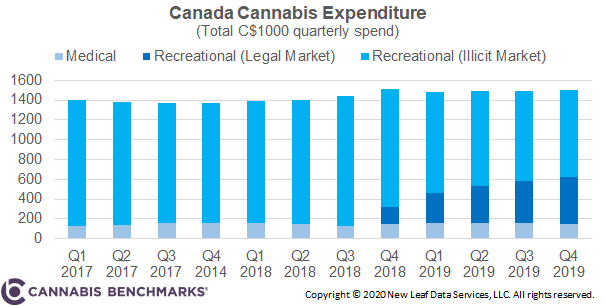

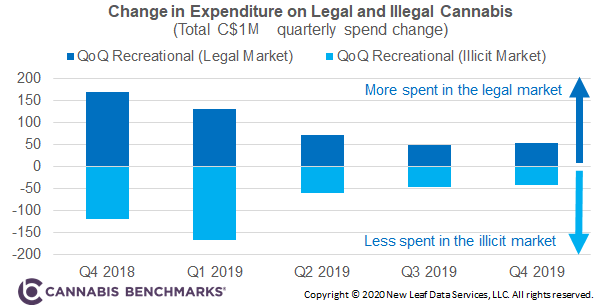

The consumption of cannabis is not keeping pace with the accelerated growth in kilograms being harvested. The main culprit that the management of all the companies reported was the substantial size of the illicit market due to the lack of a sufficient network of legal retail operations. Ontario was the market that most of these LPs were counting on due to the size of its population, but with only 24 operating stores sales have been disappointing. Canopy management reported that Ontario will be announcing revised plans in the very near future to grow the number of stores in 2020. Canopy’s CEO said that Ontario would likely need 40 stores per month starting in 2020 to help rebalance the market by late summer of 2020. Aurora also acknowledged the oversupply amd announced their future Aurora Sun facility in Alberta would now only be constructed to 238,000 square feet of production space, compared to an original target of 1.6 million square feet, to rationalize production and slash capital expenditures to conserve cash.

A major theme of the quarterly reports was the need to expand the network of retail sales and cut the wholesale cost of cannabis in order to expand the legal market, which currently represents less than 20% of the total projected market. The four LPs continue to show an increase in total cannabis produced each quarter as new facilities come online and efficiencies in production are gained. Both Aurora and Canopy reported producing over 40,000 kg over the three-month period. Each company currently produces enough each month to fulfill all of Canada’s current legal recreational cannabis demand – a staggering fact when Health Canada has licensed over 120 producers nationwide.

Source: Cannabis Benchmarks, Company MD&A reports

With production hitting new records, total cannabis sales from LPs have not kept pace. Both Aurora and Canopy sold approximately 30% of their harvests, meaning that the rest went into inventory. As inventory levels build and age, the inventory degrades and leads to LPs writing off bad inventory. Canopy Growth reported a C$15.9 million inventory write-down this past quarter.

Source: Cannabis Benchmarks, Company MD&A reports

In order to compete with the lower priced illicit market, the large LPs have begun cutting their wholesale prices. This quarter we saw average selling prices from all the LPs continuing to decrease, with Cronos and Tilray showing the largest quarter-on-quarter drop. All the LPs referenced a changing product mix this quarter, which simply translates to introducing new budget brands selling at lower price points.

Source: Cannabis Benchmarks, Company MD&A reports

One of the bright spots in the cannabis sector has been the drop in production costs. For the current quarter, we see that three of the LPs reported decreasing costs. Aurora reported that it had cut the cash cost per gram to just above C$1. The lower wholesale prices will be partially mitigated by these cost efficiencies, but margins will still be under pressure.

Source: Cannabis Benchmarks, Company MD&A reports

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.