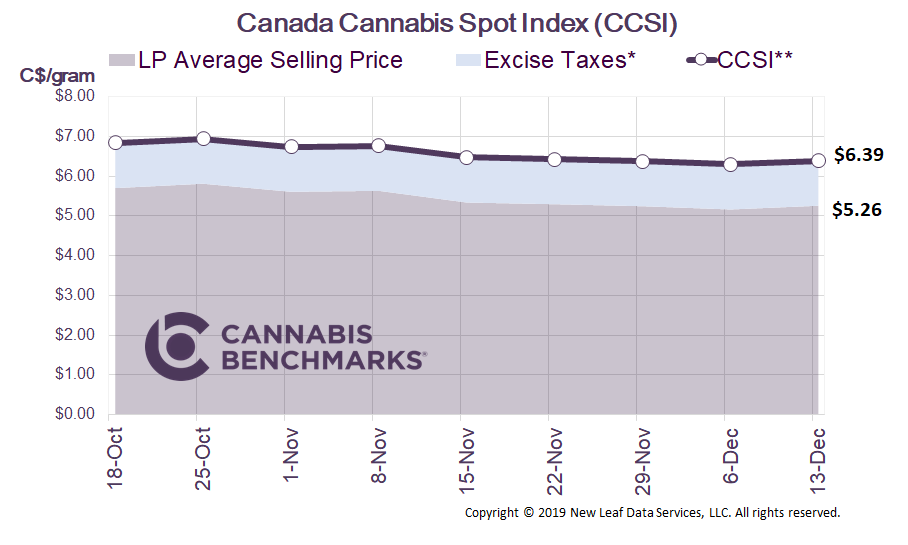

Canada Cannabis Spot Index (CCSI)

Published March 13, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.58 per gram this week, up 2.8% from last week’s C$6.40 per gram. This week’s price equates to US$2,179 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor NetworkIf you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

All Eyes on Ontario

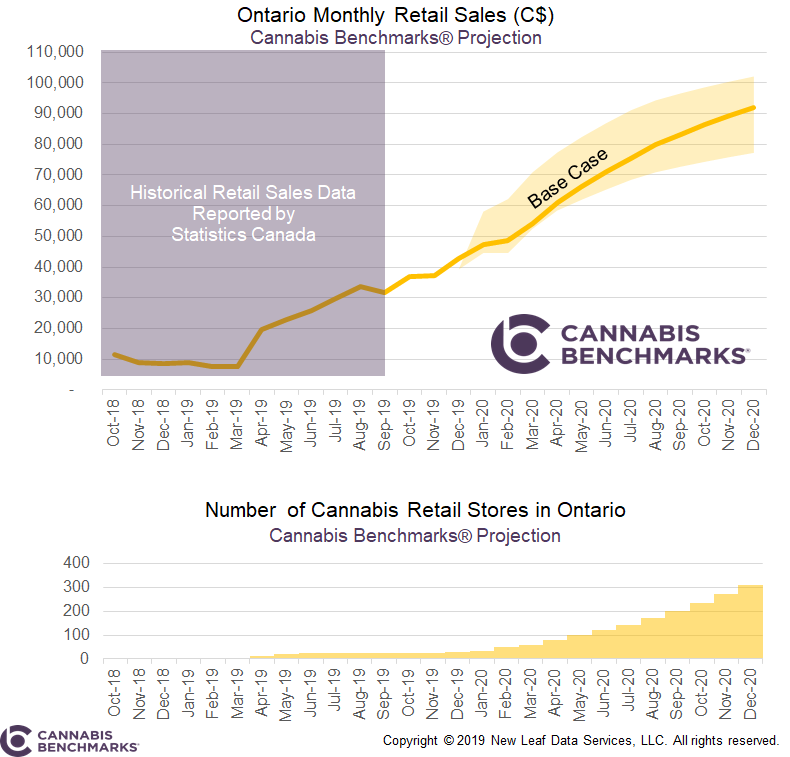

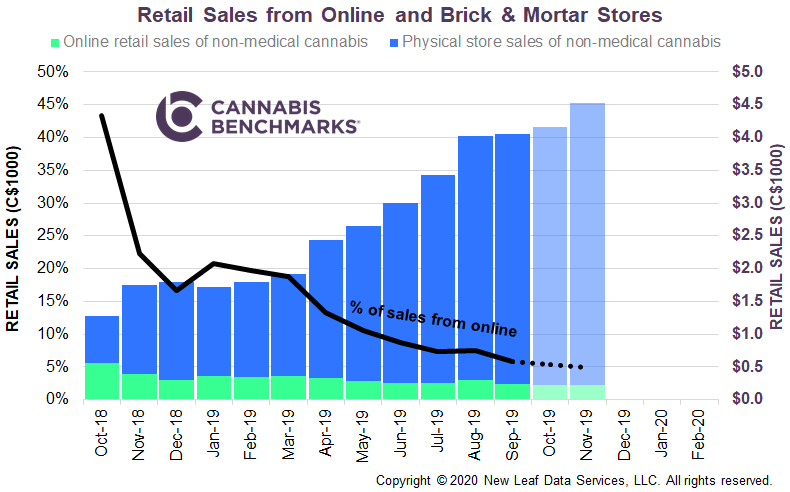

We continue to keep a close eye on the expansion of cannabis retail stores in Ontario. Today we are reporting 40 active stores in Canada’s most populous province. This is a 29% increase from last month, but still only accounts for 5% of the 807 stores open across Canada.

Source: Cannabis Benchmarks

Ontario has had the slowest roll out of stores among all provinces, especially considering the vast market it could be serving. All Canadian licensed producers (LPs) have blamed the sluggish roll out of retail stores in Ontario as the major reason for their lagging financial performance. With immense pressure from the public and the major LPs, the provincial government finally acted late last year by abandoning the lottery system for awarding new retail licenses. This was a positive move for the industry as Ontario’s slow roll out of retail shops had depressed legal cannabis sales and kept customers going back to illegal sources.

The new stores that have opened year-to-date are part of Ontario’s second lottery that was conducted in August 2019. With today’s count, there are now 15 new stores of the 42 licenses issued opened in Canada’s largest province; as indicated, there are more to come from that licensing round.

Additionally, the next wave of licensing retail stores looks to be in the pipeline and could start as early as Q2 2020. From data received from the Alcohol and Gaming Commission of Ontario (AGCO), we were able to get a glimpse of the number of stores that will be coming soon. The online status report takes all the applications and distributes them in one of the following categories:

-

In Progress – this status indicates that the AGCO has received the application and the process is underway.

-

Public Notice – this indicates an application has been successful, and the provincial government is now accepting written submissions for 15 days for a specific location from residents of that municipality.

-

Authorized to Open – this indicates that the store has met the regulatory requirements and has passed its pre-opening inspection from the AGCO.

Based on the data, it appears that Ontario could have a total of at least 177 cannabis stores. The timing of authorized store openings is set by the individual store operators; therefore we estimate that this number is not achievable until late summer.

Source: Cannabis Benchmarks

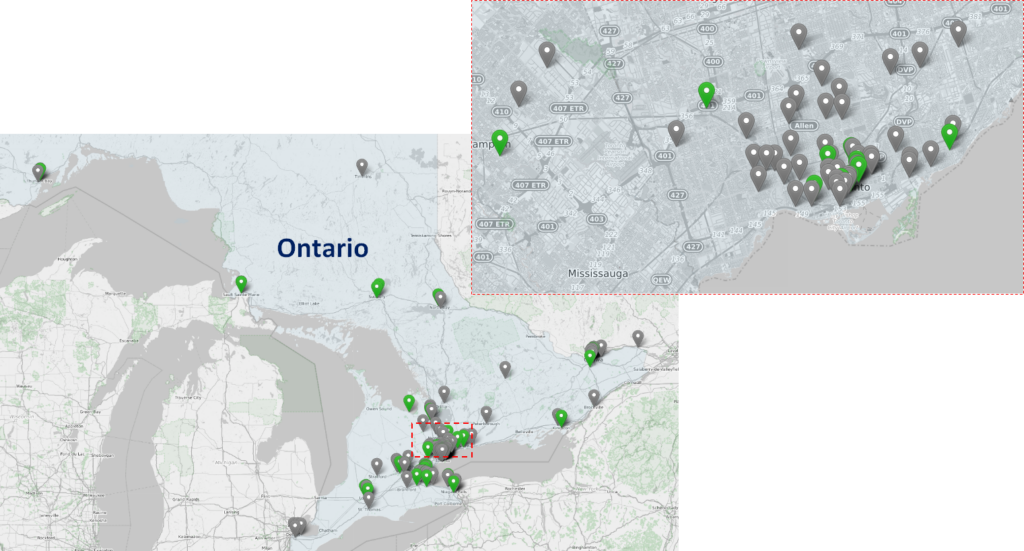

The map below from the AGCO website shows the locations of currently open and authorized to open shops. The green pins represent the former, while the gray ones designate the latter. As can be seen, the vast majority of stores are concentrated in the Greater Toronto area.

Source: AGCO

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.

If you missed our announcement last week:

We are pleased to share that Cannabis Benchmarks® has begun disseminating its Canada cannabis index data through Nasdaq’s GIDS service. These unbiased indexes provide a variety of benefits for this emerging commodity, including:

– making it easier to reference the market value of product in buy/sell negotiations,

– writing spot and forward contracts on a published index,

– third-party validation for asset valuation (e.g., biological assets), and

– paving the way for more sophisticated financial instruments for hedging, trading, and risk management (e.g., swaps, futures, and other derivative contracts).

Click to read the full press release: Cannabis Benchmarks® Distributes its Canada Cannabis Pricing Indexes on Nasdaq Global Index Data Service