![]()

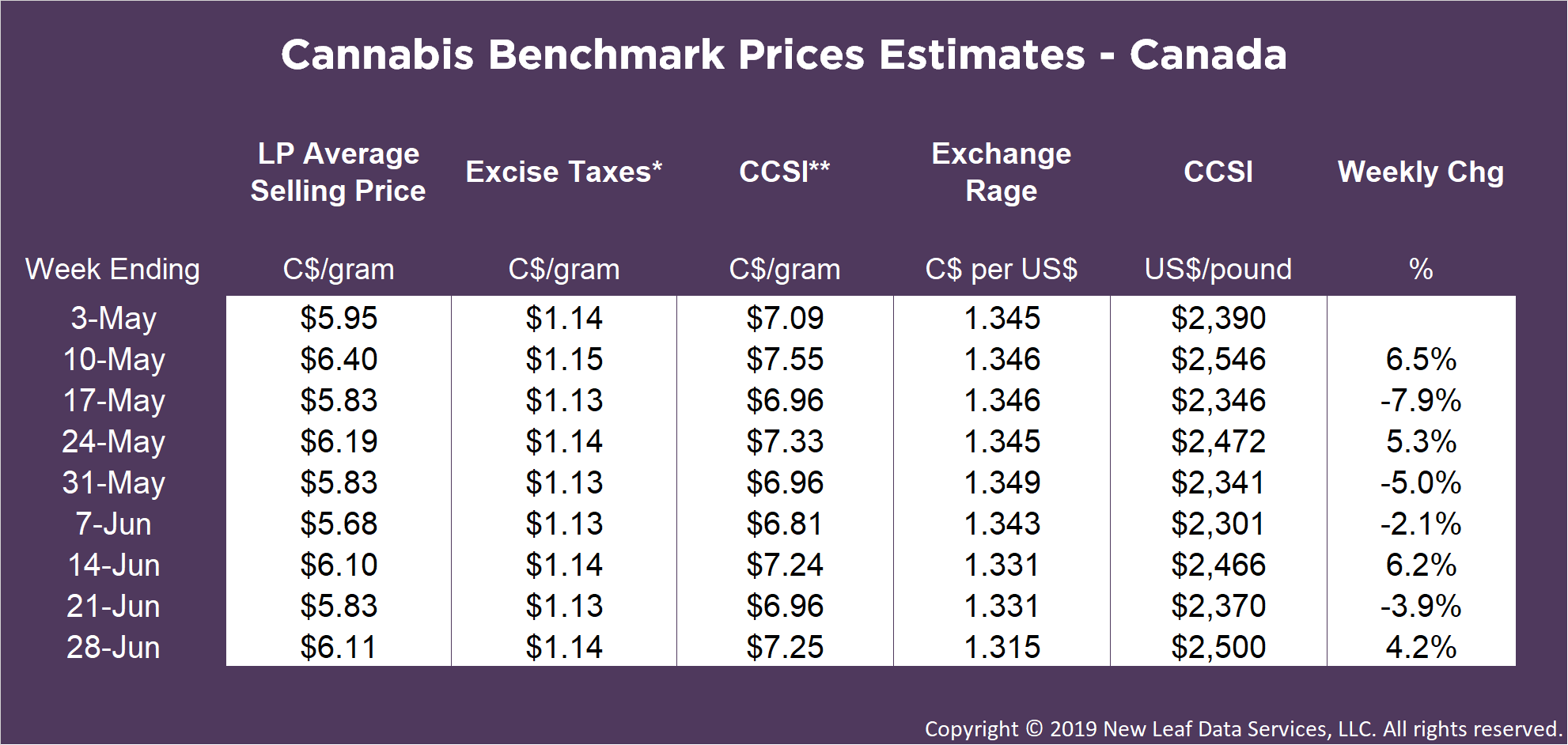

Canada Cannabis Spot Index (CCSI)

Published June 28, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$7.25 per gram this week, up 4.2% from last week’s C$6.81 per gram. This week’s price equates to US$2,500 per pound at current exchange rates.

This week we focus on the estimated wholesale to retail pricing for one of Canada’s largest licensed producers to the country’s four most populous provinces: British Columbia (BC), Quebec, Ontario, and Alberta.

We started our analysis by identifying the same five product names from a single licensed producer on each of the four online provincial sales portals (accessed June 27, 2019). Prices for each product varied quite a bit across the provincial sales sites. Additionally, there was no consistency to the variation, as no single province had either the lowest or the highest prices across any of the five products. To simplify the analysis, we calculated the average retail price per gram of the five products in each province.

The average retail price per gram for the five products, before sales tax, is shown in the chart below. As can be seen, Alberta has the highest retail prices, on average, for the products in question. Mean prices in Alberta were C$2/gram, or 22%, higher than the retail prices in BC. Ontario and Quebec fell in the middle.

Source:Cannabis Benchmarks, sqdc.ca, bccannabisstores.com, ocs.ca, albertacannabis.org

To calculate the average wholesale prices at which each of the provinces sells to public and private retailers, we reviewed order data and surveyed retailers on expected margins, revealing a typical retail markup in the range of 40-50%. By stripping out a 45% margin from the above retail prices, we determined the wholesale transaction prices of the five products and compared them to the aggregated wholesale transaction prices reflected in the weekly CCSI.

The average estimated provincial selling (wholesale) price per gram for our group of products is shown in the chart below.

Source:Cannabis Benchmarks

The average across the four provinces was C$6.97, slightly below this week’s assessed price of C$7.25, but comparable to the CCSI’s trailing 4-week average, which is C$7.07.

The last piece of our analysis revolved around better understanding the average net selling price for this specific producer. To calculate the average net selling price, we deducted the Canadian federal and provincial excise duty using the framework provided by the government. Based on these calculations, a flat rate of C$1.00/gram was charged to the producer when selling into BC and Quebec. For dried cannabis sold to Alberta and Ontario, there was an additional cannabis duty, resulting in a total estimated excise taxes of C$1.71/gram for Alberta and C$1.18/gram for Ontario.

After removing the excise taxes, we finally arrived at the average net selling price for the group of five products under examination.

Source:Cannabis Benchmarks

The average selling price across the four provinces was C$5.74. Coincidentally, this falls very much in line with their reported average net selling price from their most recent quarterly earnings statements. Our analysis shows that our spotlight producer gets a very similar price when selling into three of the four provinces, but receives up to 11% less when selling to the province of British Columbia.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..