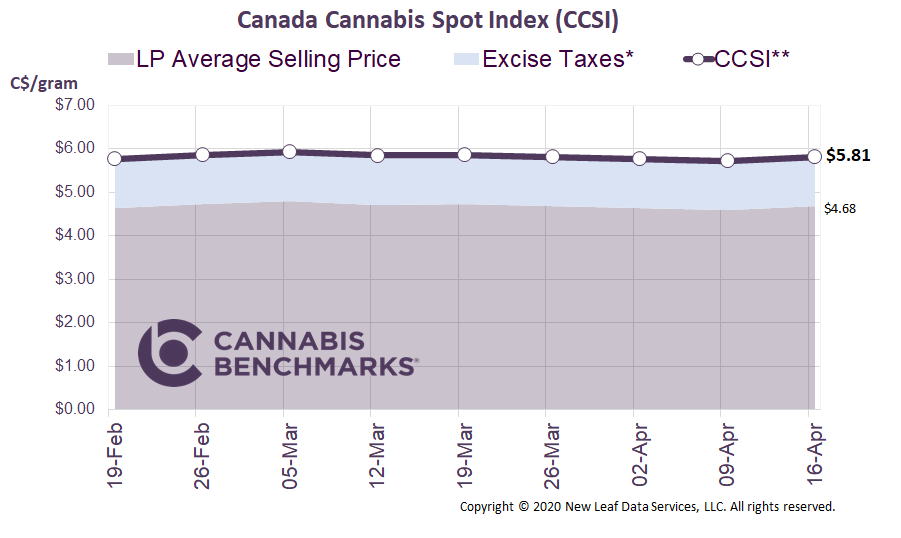

Canada Cannabis Spot Index (CCSI)

Week Ending June 25, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.55 per gram this week, up 0.4% from last week’s C$5.53 per gram. This week’s price equates to US$2,055 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

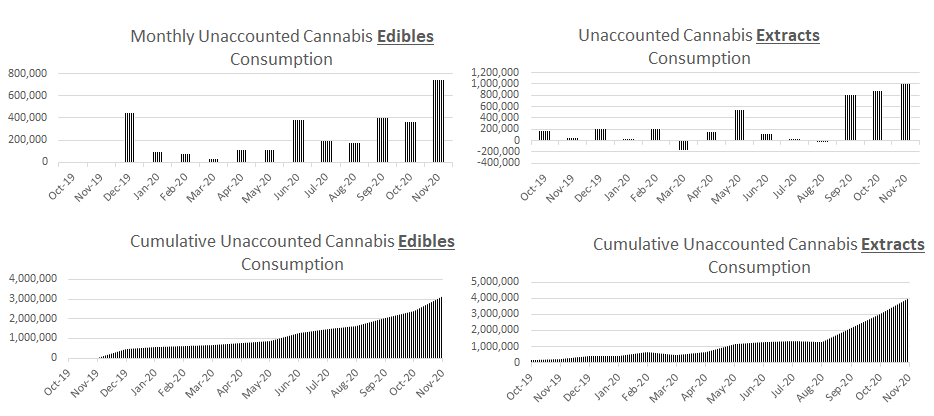

This week we once again turn our attention to supply and demand dynamics for cannabis 2.0 products in Canada’s legal cannabis market. The three main product categories that fall under the cannabis 2.0 umbrella are edibles, extracts, and topicals. See the definitions of each category in our past report covering this topic.

In today’s report, we provide an update on the supply and demand associated with edibles and extracts, which are the two larger categories. To date, Health Canada has compiled and published monthly data for production, consumption, and inventory of packaged units through March 2021.

Below are two charts showing the monthly supply and demand for edibles and extracts from the introduction of cannabis 2.0 products in October 2019 through March 2021.

Starting with edibles, we see the production of packaged units by licensed producers ramping up through the end of Q3 2020, and then declining slightly since. The production of packaged units increased at a greater rate than non-medical and medical sales, leading to excess production going into inventory at the federal, provincial, or retail level. The current inventory of edible packaged units sits at 16M, which is approximately 7.1 months’ worth of supply at March’s consumption rate.

Source: Cannabis Benchmarks, Statistics Canada

The story for extracts is somewhat similar. Both production, as well as medical and non-medical sales, increased at relatively steady rates throughout 2020, but eased in Q1 2021. Still, production outpaced domestic consumption, leading to growing inventories. The current inventory of packaged units of extracts has not grown as quickly as edibles, but still sits at 12.6M, which is approximately 6.6 months’ worth of supply at March’s consumption rate.

Source: Cannabis Benchmarks, Statistics Canada

Typically, inventory level is a barometer for the health of a commodity. Inventories are closely tracked for major agricultural commodities, metals, and energy. A growing level of inventory signals a continuous mismatch between supply and demand, and ultimately leads to lower wholesale prices. The lower wholesale price diminishes the economics to produce at the same strong rate, and also increases demand for the commodity by providing consumers an incentive to purchase more. Ultimately the change in price helps bring the market back into equilibrium.

Source: Cannabis Benchmarks

The yellow lines in the charts above denote the typical timing of the autumn harvest of outdoor-grown cannabis, which provides a good deal of feedstock from which extracts and edibles are manufactured. Increased supply of raw materials for these products from expanding outdoor cultivation is likely helping to push down prices. Since 2020’s fall harvest, the total packaged inventory of edibles and extracts looks to be on a corrective path, as increased inventory and lower prices signal to producers of these derivative products to pull back on manufacturing.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.