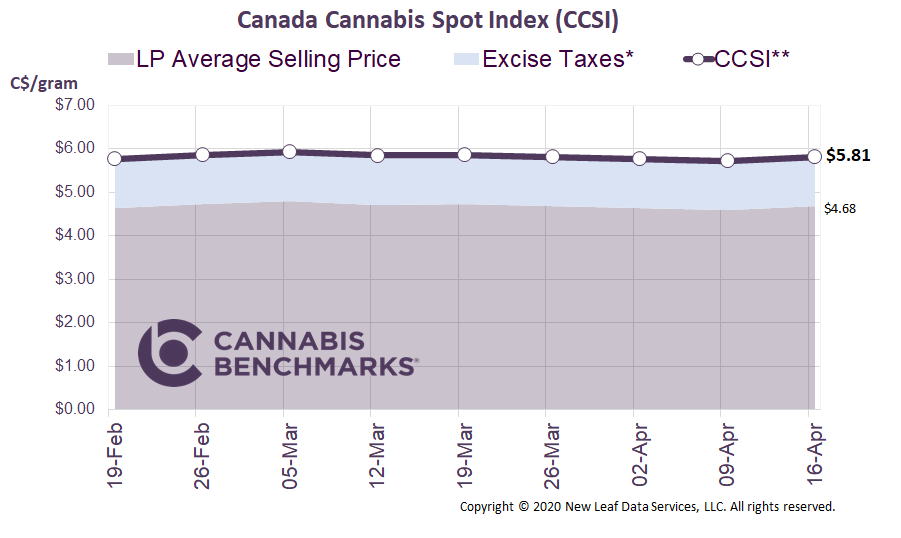

Canada Cannabis Spot Index (CCSI)

Published June 19, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.15 per gram this week, down 2.3% from last week’s C$6.30 per gram. This week’s price equates to US$2,053 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week, we continue our review of data released recently by the Ontario Cannabis Store (OCS). The report, entitled “A Year in Review,” details the development of Ontario’s cannabis market from April 1, 2019 through March 31, 2020. As a reminder, this is the first report of its kind that shows a full year of history in Canada’s most populous province. You can read the full report here.

The following examination focuses on online sales. As we have reported in the past, online sales exploded in March as Canadians prepared for stay-at-home orders in response to COVID-19. Along with other essentials, Ontario residents stocked up on cannabis. With a limited physical retail presence in the province, Ontarians turned to the province’s online outlet, the OCS, to load up on products. Prior to March 2020, the number of OCS purchases remained steady at around 62,000 transactions per month, but in March that jumped to 114,000, an 82% spike.

Source: Cannabis Benchmarks, OCS

We contend that the shift to purchasing from the OCS is not an anomalous response to the unique conditions created by the coronavirus pandemic, but rather the beginning of a fundamental change in buying habits. We are not speaking specifically of buying online, but rather purchasing cannabis from a legal channel where the product is subject to regulation and oversight. If this is the case, then legal Canadian cultivators will be better positioned to win the war against illicitly-produced product.

Another factor underpinning this shift is the shrinking price discrepancy between the province’s online store and illegal sources. During the period covered by the report, online cannabis was only C$0.33/gram or 4% more expensive than product coming from illegal channels, according to the OCS.

Source: Cannabis Benchmarks, OCS

This data validates a strategy undertaken by licensed cultivators: releasing lower-priced options to be more competitive with the illegal market. From Q1 2019 to Q4 2019, the average price of dried flower on the OCS sank by C$2.00/gram, or 21%. The price drop at physical retail outlets was not as dramatic, but that channel also saw prices decline by an average of 10%.

Source: Cannabis Benchmarks, OCS

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.