Canada Cannabis Spot Index (CCSI)

Week Ending June 18, 2021

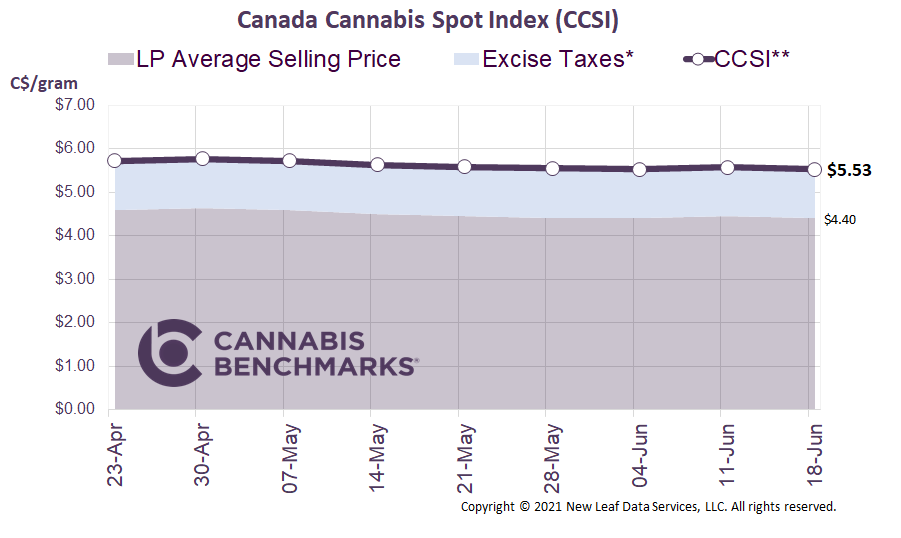

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.53 per gram this week, down 0.8% from last week’s C$5.57 per gram. This week’s price equates to US$2,073 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we dive further into household expenditure data from Statistics Canada, issued quarterly. The data shows some very interesting and positive trends for the legal cannabis sector. As we have noted in the past, major alcohol and tobacco companies have made significant investments in cannabis operations over the last few years. They have made these investments as a hedge, to ensure their current business operations do not lose market share to the growing cannabis usage that is being captured gradually by legal businesses.

Some of the notable cannabis partnerships include:

·Constellation Brands + Canopy

·Molson/Coors + Hexo

·Anheuser-Busch InBev + Tilray

·Altria + Cronos

·Imperial Brands + Auxly

Soda, energy drinks, and sports drink markets are also studying the growth of this emerging industry. Several mainstream consumer packaged goods (CPG) heavyweights, including Coca-Cola and PepsiCo, are reportedly considering the launch of THC and / or CBD infused products, but nothing has materialized yet from major CPG firms.

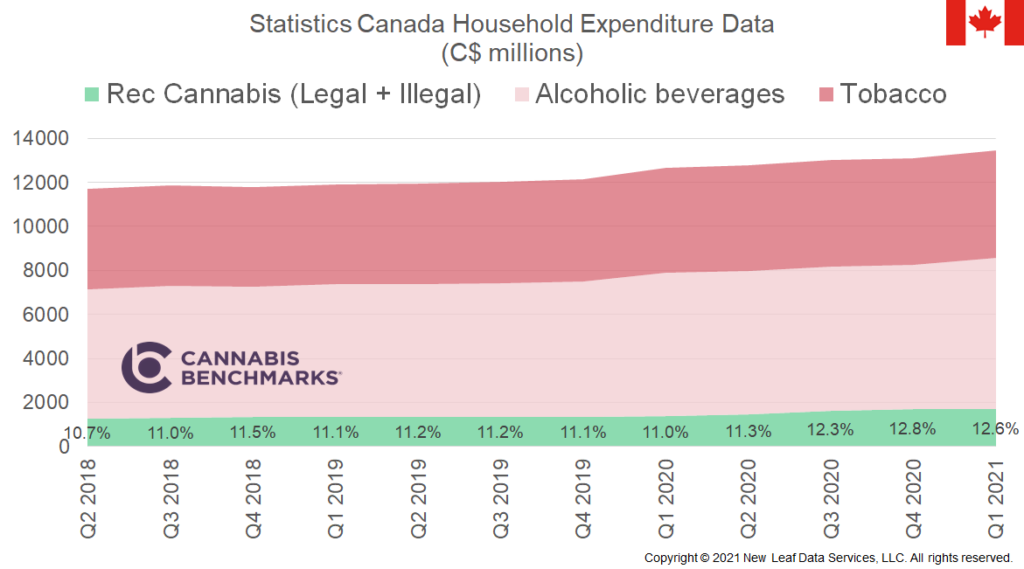

So, should traditional players be threatened by the cannabis movement? Data released by Statistics Canada to date shows that alcohol and tobacco sales remain much stronger than cannabis sales, and that increased cannabis sales have only slightly impacted those categories negatively. As seen in the chart below, the overall category of spending related to tobacco, alcohol, and cannabis has grown over the past three years by 15% to C$13.4B. Over 25% of that growth comes from cannabis.

Source: Cannabis Benchmarks, Health Canada

In the chart above, we also show the percentage of spending devoted to cannabis. Although cannabis’ share is not significant yet at only 12.6% of total spending, it is an emerging category that continues to expand with new product offerings and a growing consumer base. We estimate cannabis will grow to 14-15% of total spending by the end of 2021, with accelerated adoption amongst the younger generation and growing accessibility in major provinces such as Ontario.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.