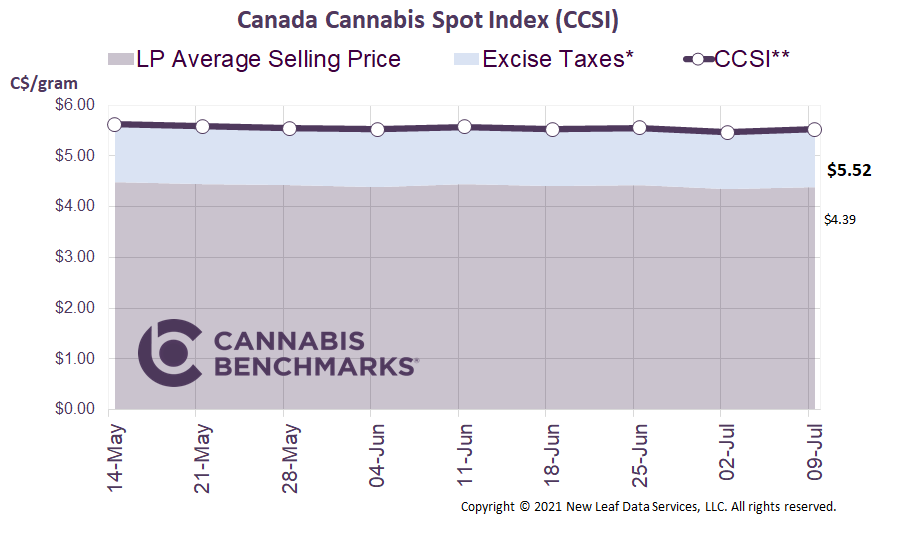

Canada Cannabis Spot Index (CCSI)

Week Ending July 9, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.52 per gram this week, up 1.0% from last week’s C$5.47 per gram. This week’s price equates to US$2,014 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

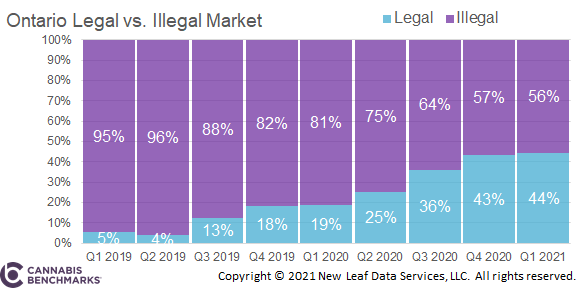

Last week the Ontario Cannabis Store (OCS), the organization that regulates the province’s cannabis market, released their annual Cannabis Insights report for the period from January through March 2021. The report contains a wide variety of useful data, detailing how Ontario’s market has developed.

In the first few years of cannabis deregulation, the legal Canadian cannabis market has faced strong competition from illicit supply chains, due in part to high product prices and few stores. That story has changed dramatically, however, especially in Ontario, Canada’s largest province by population.

The most recent report shows that not only did Ontario’s brick-and-mortar retail footprint grow substantially, but also that the price of dried flower as listed at the OCS online store dropped even further below the price of cannabis sold through illegal mail-order marijuana sites.

In today’s report, we focus specifically on the market share of the legal markets. The latest report shows the legal cannabis market in Ontario makes up 44% of total cannabis sales. Meanwhile the average price of legal dried flower, including sales taxes, dropped by 3% from the previous quarter to C$6.17 per gram.

Source: OCS

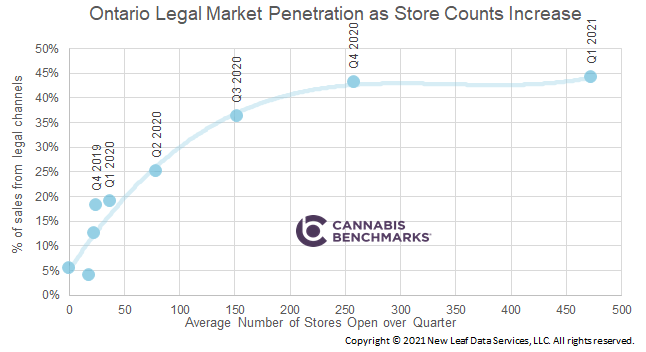

While the legal market has continued to build market share over the past two years, growth slowed significantly during the past quarter. Even though the legal cannabis industry appears to be moving in the right direction, by lowering cannabis prices and providing better access with more retail stores, illicit cannabis channels have maintained a strong presence. Up until this last OCS report, the growth of the legal cannabis sector has had a very strong correlation to the number of storefronts open for business. The chart below, which combines the average number of stores in each province in the past nine quarters as tracked by Cannabis Benchmarks, versus the share of the legal cannabis market, shows the legal cannabis market share seems to have plateaued despite an increase in store counts.

Source: OCS, Cannabis Benchmarks

The slowdown in market penetration is a cause for concern for the legal cannabis sector. For the government, this change could undermine its goal of legalizing cannabis to stamp out the illicit market altogether and to generate taxable legal sales. For the Canadian LPs and other market participants, the slowdown will impact projected revenues from domestic sales, as the export market is also facing growing competition from producers in Europe, Africa, and Colombia.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.