Canada Cannabis Spot Index (CCSI)

Published July 17, 2020

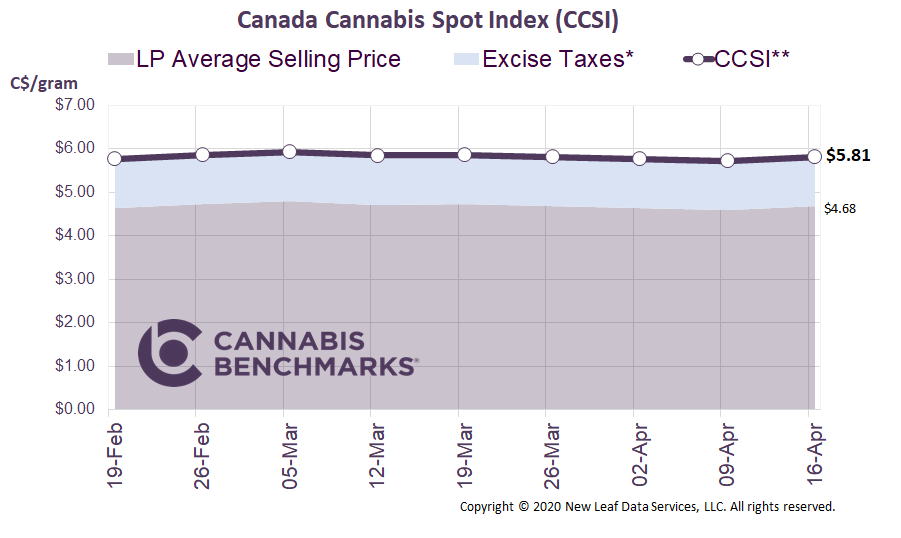

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.40 per gram this week, up 2.8% from last week’s C$6.23 per gram. This week’s price equates to US$2,137 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on the growth in licensed cannabis stores across Canada. We also highlight a new pilot program that one licensed retailer hopes will expand into a widespread strategy to drive increased traffic and sales.

Nationwide, the licensing of new stores has slowed due to COVID-19 and accompanying lockdowns. After slumping in April and May, we are seeing new stores begin to proliferate more quickly once again. At the end of June, there were 962 stores across Canada, with 59 stores added since May, and an increase of 672 stores from the same time last year. During the first half of 2020, the average number of new stores that opened monthly was 49. This took place under the specter of COVID-19. With COVID-related restrictions loosening, we expect the number of new stores to increase at an even faster pace in the second half of the year.

Source: Cannabis Benchmarks

We could also soon see an explosion of new cannabis retailers if a plan to pair them with convenience stores proceeds fruitfully. In August 2019, the publicly traded convenience store operator Alimentation Couche-Tard invested in the cannabis retail chain Fire & Flower. Couche-Tard acquired a 9.9% stake in the retailer in July 2019 with options to increase its stake to 50.1%. At the time, there was much speculation that cannabis could one day be sold through convenience stores.

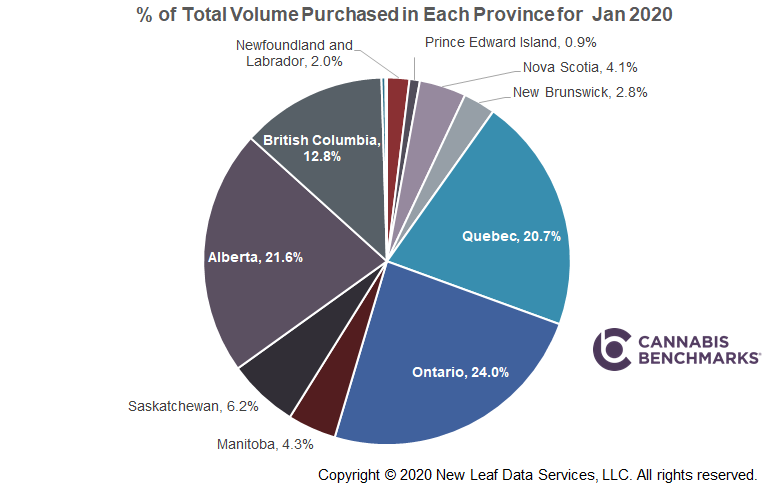

Last week, we moved one step closer to this happening. The two companies are running a pilot project in Alberta that will see Fire & Flower cannabis stores co-located with Circle K convenience stores. The cannabis and convenience stores will be on the same property, but separated in order to follow strict provincial regulations, with different entrances and points-of-sale for each. The stores are fully owned and operated by Fire & Flower and the company’s hope is that they will benefit from the foot traffic drawn by the convenience store side.

Source: Fire & Flower

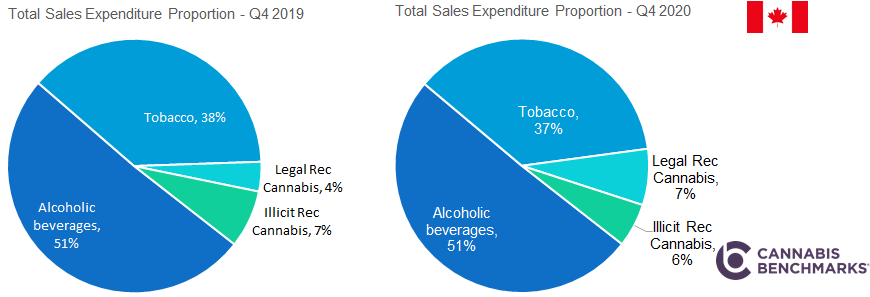

If successful, the two companies have already identified more locations where they could expand the pilot project, as seen in the graphic below. There are 2,131 convenience stores across Canada operated by Couche-Tard, and the model could potentially be expanded to the U.S., and perhaps globally in the future. Strategies such as this could be what legal Canadian cannabis businesses need to stamp out the illicit market.

Source: Couche-Tard 2020 Annual Report

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.