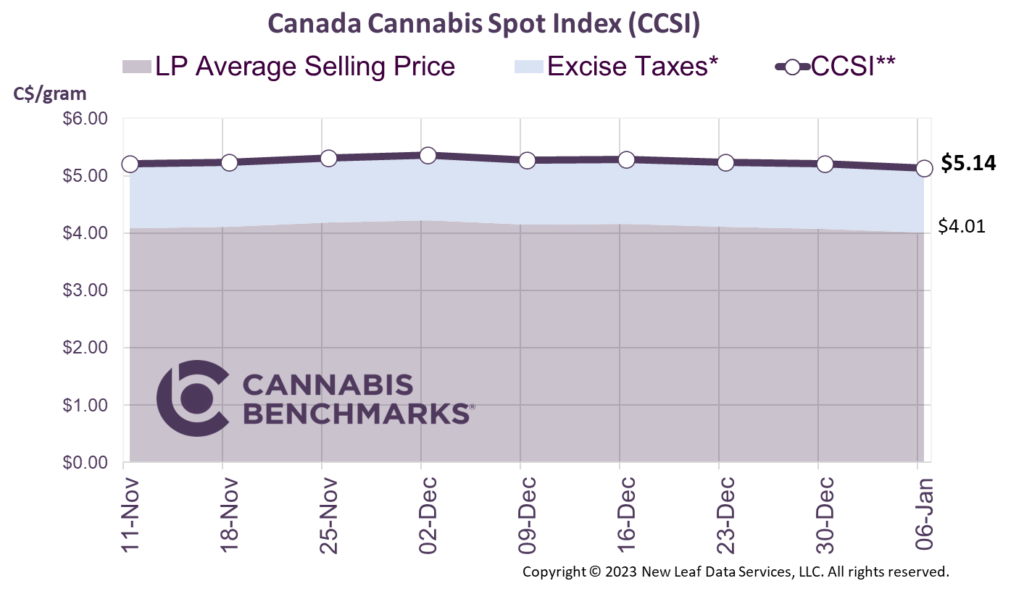

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes.

The CCSI was assessed at C$5.14 per gram this week, down 1.3% from last week’s C$5.21 per gram. This week’s price equates to US$1,720 per pound at the current exchange rate.

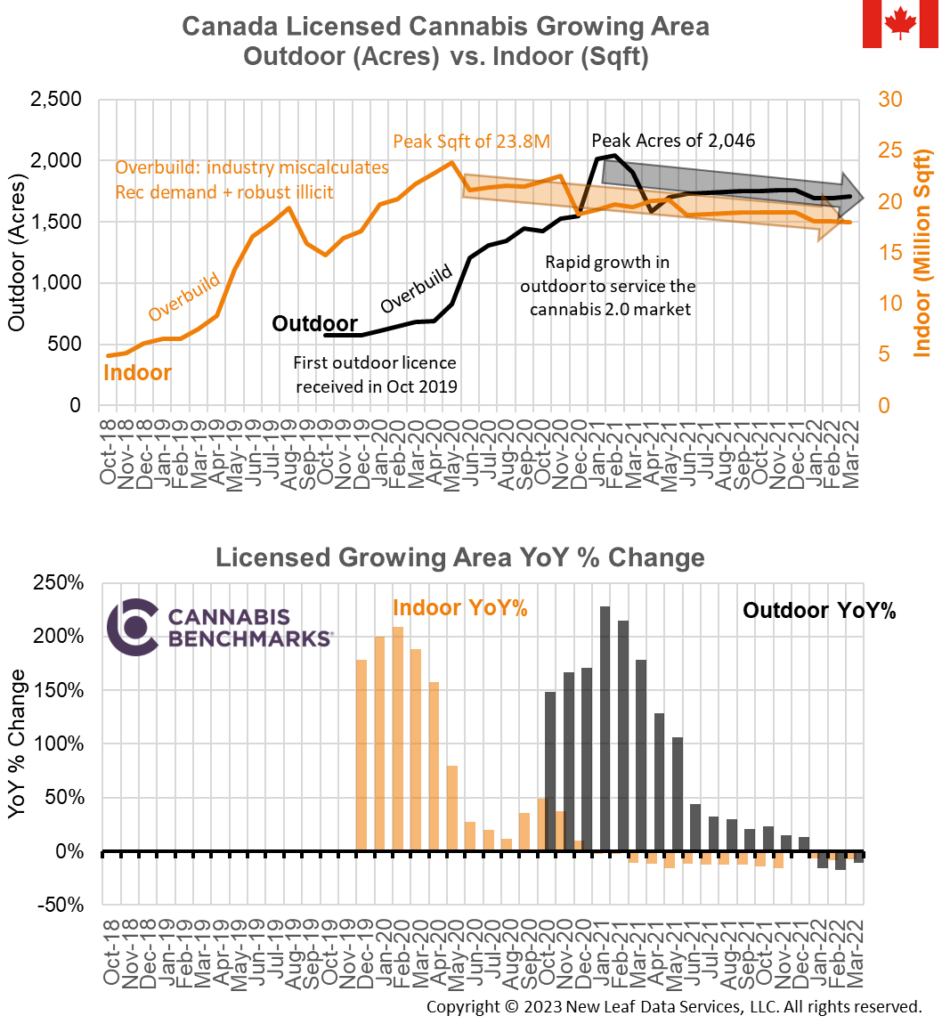

- Statistics Canada recently released six additional months of data on licensed indoor and outdoor cannabis growing areas, providing information on legal cultivation capacity up to March 2022. The data shows clearly that the decline in production capacity continued in the opening quarter of 2022 with the industry recognizing massive overbuild.

- At the onset of cannabis legalization in Canada only indoor grow facilities were authorized, with some facilities built specifically to serve the recreational sector while others converted from the medical cannabis market. One year after legalization, the first outdoor cannabis cultivation site was licensed. The advent of outdoor production coincided with the legalization of so-called “cannabis 2.0” products. Such products include edibles, vapes, and topicals that were not available during the first year of legal sales. Outdoor cannabis has a significantly lower cost of production, but is often considered to be of lower quality and can be difficult to market as smokable flower. That said, outdoor flower is often employed as the raw material for extraction, with the extracted cannabinoids further refined into inhalable products such as vapes or incorporated into manufactured products like edibles.

- As seen in the charts above, the industry drastically miscalculated the volume of cannabis required to meet demand and very quickly overbuilt indoor and outdoor cultivation capacity. With much of that production unsold, sitting in federal or provincial inventories, or destroyed and written off after becoming unmarketable, all the major licensed producers began to close cultivation space at indoor and greenhouse operations.

- The latest data continues to show a decrease in indoor cultivation capacity, and now a similar fate for outdoor cultivation capacity. As of March 2022, the available indoor cultivation capacity is 24% below the peak reached in May 2020 and the available outdoor growing capacity is 16% below the peak set in Feb 2021. While painful currently, this is an overall positive for the cannabis industry long-term as the reduction in growing capacity will eventually lead to a better balance between supply and demand, resulting in a more sustainable market..

Content is provided “as is.” New Leaf Data Services, LLC., makes no guarantees or warranties as to the accuracy, completeness, timeliness or results to be obtained from accessing and using Cannabis Benchmarks® data.

This publication may not be duplicated, distributed, or stored in a retrieval system, in whole or in part, in any form or by any means, without prior written permission and consent of New Leaf Data Services, LLC.

1-888-502-7298 | www.CannabisBenchmarks.com | support@CannabisBenchmarks.com