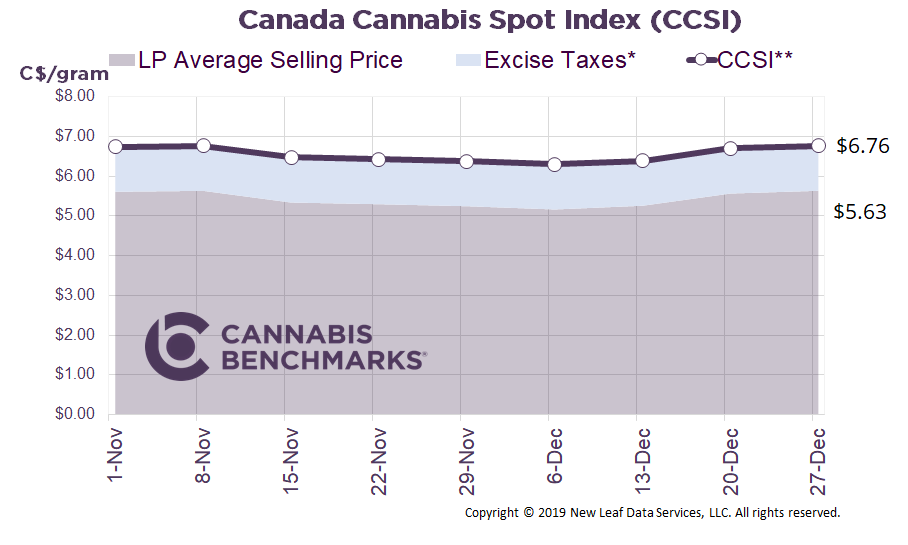

Canada Cannabis Spot Index (CCSI)

Published December 27, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.76 per gram this week, up 1.0% from last week’s C$6.69 per gram. This week’s price equates to US$2,336 per pound at the current exchange rate.

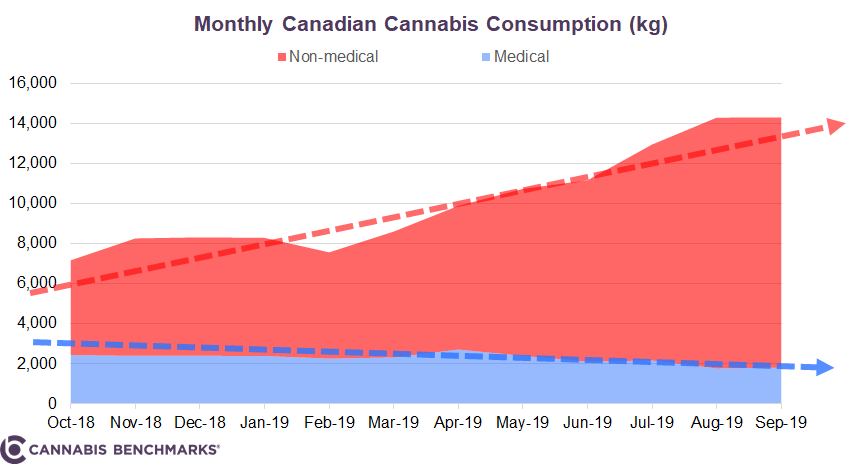

This week we examine the rising supply-demand gap in the Canadian cannabis market. With the onset of legalization over a year ago, data from Statistics Canada has shown increasing consumption in the recreational market, while that in the medical sector continues to slide. This makes simple sense, as Canadians look to self-medicate via purchasing in the adult-use market, rather than go through the formal process of getting a medical note to purchase more expensive medical products. We foresee this trend continuing as recreational cannabis becomes cheaper and more accessible.

While the total monthly consumption of legal cannabis has been increasing steadily, as shown in the chart below, the legally licensed producers (LPs) continue to face intense competition from the robust illicit market. In September, Canada consumed a total of 14,000 kg from legal sources, or 467 kg/day. In Q3 2019, 5.2 million Canadians were estimated to be cannabis users. Given those numbers, Canadian cannabis consumers, on average, purchased 2.7 grams per person per month from legal sources. Overall, not an impressive number.

Source: Cannabis Benchmarks

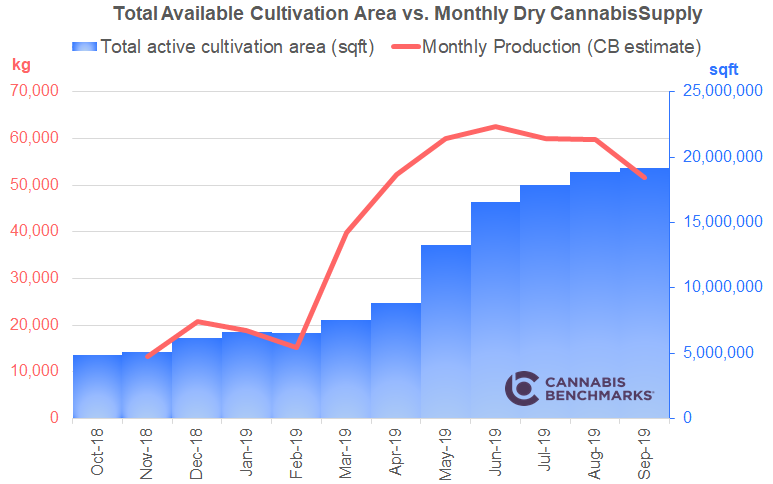

Meanwhile, cannabis supply has been growing rapidly as every minor and major LP looked to build capacity to supply the market. According to data from Statistics Canada, total active cultivation area grew by nearly 400% over the first year of legalization to 19 million square feet. Cannabis Benchmarks estimates that total production peaked at 62,600 kg in July 2019.

At full utilization, Canada’s LPs could grow over 100,000 kg/month. Since July, we estimate supply has slowed slightly as LPs began to manage production, stopped funding additional capacity, and wrote down inventory, thereby reducing the overall supply of product.

Source: Cannabis Benchmarks

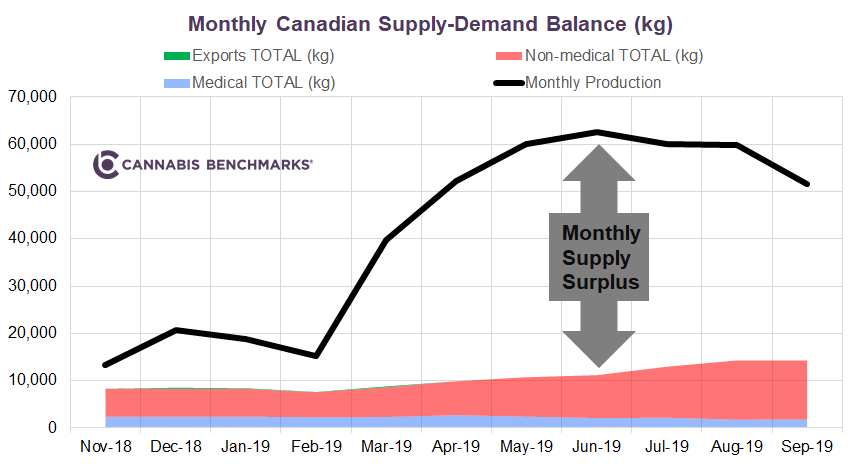

This significant gap between current supply and demand is leading to major inventory issues at the licensed producer site, with provincial distributors, and on the retailer’s shelf. After the first year of legal sales, finished and unfinished product inventory has ballooned to 28 months worth of current demand. This is a problem that will take some time to resolve.

Source: Cannabis Benchmarks

There may be some light at the end of the tunnel for the market; the oversupply has begun to moderate somewhat, which could lead to a more stable market towards the end of 2020. On the demand side, new regulations in Ontario could see a rapid build out in the physical retail locations across the country’s largest province by population, increasing accessibility. We project Ontario sales tripling from current levels by the end of 2020. Additionally, the new product categories such as vapes, edibles, beverages, and topicals available across Canada will lead to growing usage and an expanding consumer base.

On the supply side, where there is a clear overbuild of cultivation capacity, many major producers signalled in recent quarterly reports that they intend to scale back utilization of existing capacity and halt or delay further expansion to help balance the market. Adding to that, a handful of major LPs have also announced new discounted product lines to encourage customers to move away from the cheaper illegal market and obtain product from licensed sources.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.