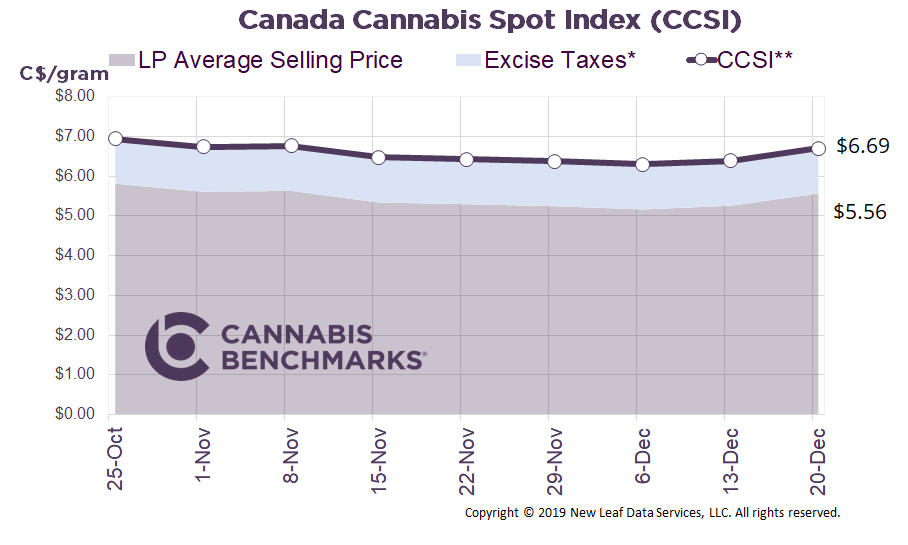

Canada Cannabis Spot Index (CCSI)

Published December 20, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.69 per gram this week, up 4.8% from last week’s C$6.39 per gram. This week’s price equates to US$2,310 per pound at the current exchange rate.

This week we examine the potential cannabis market landscape in British Columbia (BC) in 2020. Yesterday, December 19, BC initiated Cannabis 2.0. The province’s Liquor Distribution Branch (LDB), the wholesale distributor of non-medical cannabis, received its first batch of products other than dry flower, pre-rolls, and oils – such as edibles, vaporizers, beverages, extracts, and topicals – and began to distribute them via both public and private channels. Consumers can expect to see products on legal retail store shelves in time for the holiday season. The LDB has registered more than 260 products, but only a fraction of them will be available initially.

We believe the addition and diversification of available products will drive more consumers to the growing number of stores across BC and away from the illegal market. The variety will also attract new customers willing to experiment with cannabis, but averse to smokeable products. Overall, we see sales expanding with the the introduction of these new products and the continuous opening of new stores each month, of which there are currently 88 in the pipeline that have been licensed and are expected to open in 2020.

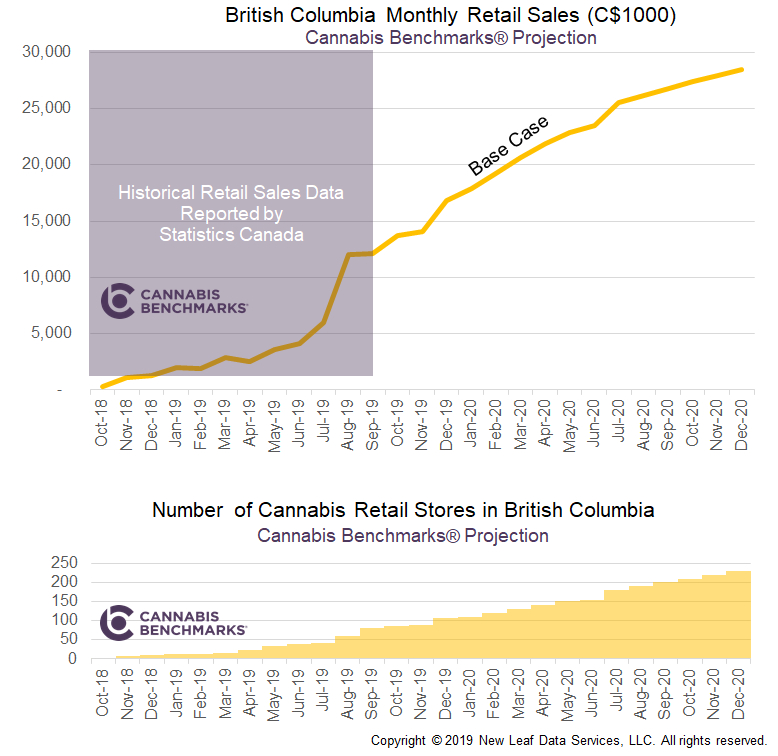

Cannabis Benchmarks projections for retail cannabis sales in BC and the number of licensed storefronts projected to open each month through the end of 2020 are illustrated in the chart below.

Source: Statistics Canada, Cannabis Benchmarks

As of the last retail report from the Government of Canada, BC’s monthly sales for August and September averaged C$12M. This is likely a relatively small portion of all cannabis commerce taking place in the province compared to that captured by the illicit market, giving legal sales significant room to expand. We are now forecasting legal retail cannabis sales in BC to average C$24M per month in 2020, with 230 retail locations open by December 2020, generating C$28.5M in sales that month. This puts total 2020 BC cannabis sales at C$288M, of which the Cannabis 2.0 products are expected to make up 15% or C$43M.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.