Canada Cannabis Spot Index (CCSI)

Published December 18, 2020

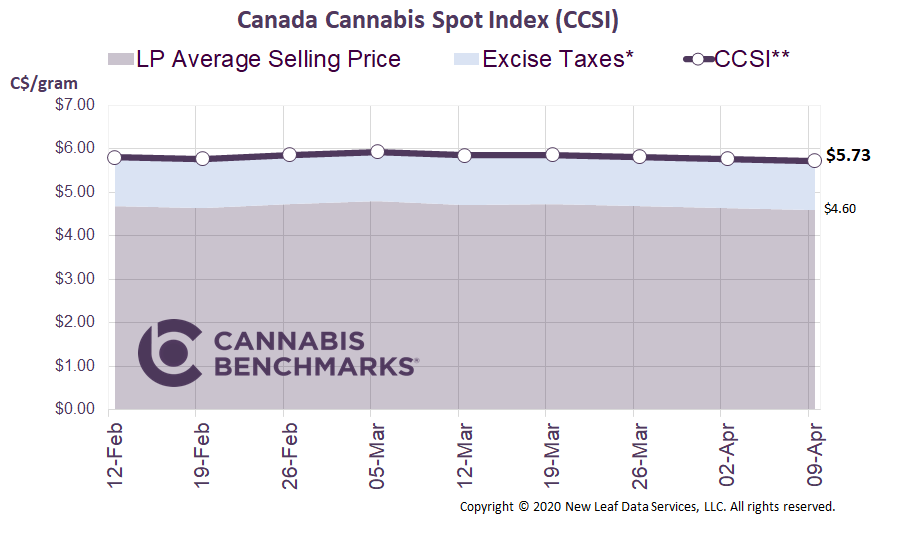

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.20 per gram this week, up 1.7% from last week’s C$6.09 per gram. This week’s price equates to US$2,207 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on the growing gap between supply and demand in Canada’s legal cannabis market. By combining our estimate on monthly demand with Statistics Canada’s production estimates, we can get a clearer understanding of the dynamics of the country’s regulated cannabis market.

Cannabis Benchmarks estimates that the total implied demand for legal cannabis in August 2020 was 25,978 kg, an 81% increase over the same month in 2019, as shown in the following table.

Source: Cannabis Benchmarks, Statistics Canada

Even though demand has continued to grow at a rapid rate, August’s demand is still less than 25% of the 112,025 kg of unpackaged production reported by Statistics Canada for the month. The mismatch is creating a huge oversupply of both packaged (finished) and unpackaged (unfinished) products across the country. Not surprisingly, Statistics Canada’s most recent data for August 2020 shows unpackaged and packaged inventory ballooning to 882,938 kg. This represents 34 months worth of supply at current demand levels, and inventory is continuing to increase. Additionally, this imbalance has persisted even after many Licensed Producers took large write-offs for excess inventory over the past year.

Source: Cannabis Benchmarks, Statistics Canada

The hope is that this inventory will ultimately be sold either as dried flower or after being converted into a cannabis derivative product, but there is a chance that the quality of the product degrades to a point where it is not sellable. As noted above, we estimate that the August inventory level represents 34 months of demand based on the August sales volume.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.