Canada Cannabis Spot Index (CCSI)

Week Ending August 27, 2021

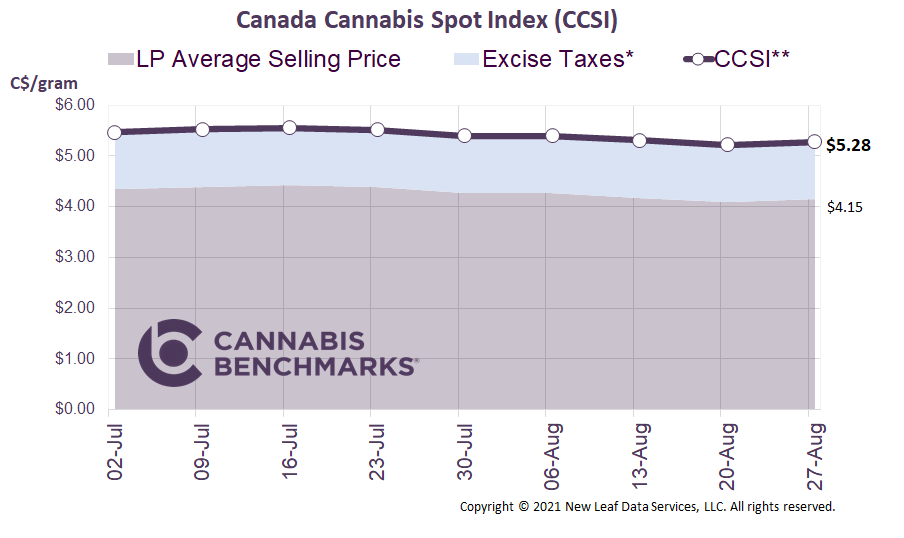

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.28 per gram this week, up 1.1% from last week’s C$5.22 per gram. This week’s price equates to US$1,886 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

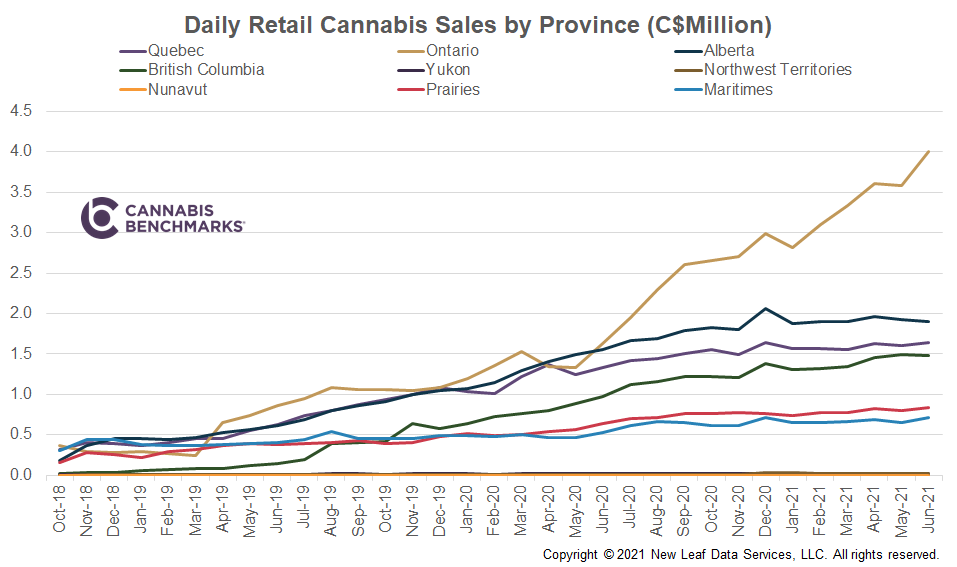

Last week Statistics Canada released retail sales data for June 2021, with nationwide legal cannabis sales reaching a new monthly high of C$318.7M. June was also the third month where sales have exceeded the C$300M threshold, marking a new baseline for the industry. The growing retail footprint is helping the sector’s growth by expanding the consumer base to new cannabis users, while also drawing in more consumers who would otherwise have purchased cannabis from the illicit marketplace.

The latest data point shows sales in the first half of 2021 totaling C$1.78B, which is 68% of total 2020 sales. Average daily sales in June 2021 reached C$10.6M.

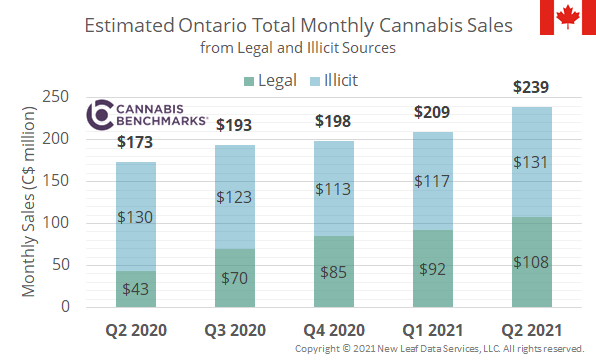

Ontario’s share of total sales continues to grow, as the province gets closer to its target of 1,000 retail stores by September. In June 2021 Ontario’s sales exceeded C$120M, accounting for 38% of Canada’s total sales. The Ontario Cannabis Store (OCS) puts out a report every quarter detailing activity in the province’s cannabis market. In the last report, which covers Q2 2021, the OCS reported that the legal market accounted for 44% of total cannabis sales, while the rest came from illicit markets.If we slightly increase that figure to 45% and apply that to the June 2021 sales figure, the total Ontario cannabis sales for the month are estimated to be C$239M. From the historical data we can go back and calculate the historical figures and market trends, as seen in the chart below. The most striking statistic is that from Q2 2020 to Q2 2021, total cannabis sales increased by C$66M, or 38%. This shows that not only is more cannabis being bought in the legal market, but that cannabis is becoming more mainstream. In other words, overall growth of that magnitude suggests more people are using cannabis, and potentially using more of it.

Taking this Ontario data and interpolating it to assess the full Canadian market, we estimate that total cannabis sales from legal and illicit sources would have been C$557M during June 2021. At an annual run rate that would equate to C$6.6B in cannabis sales.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.