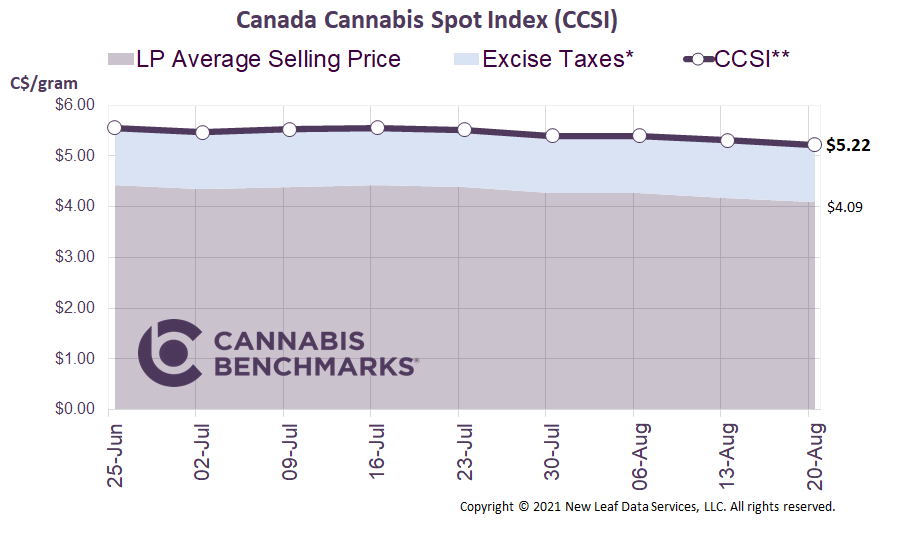

Canada Cannabis Spot Index (CCSI)

Week Ending August 20, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.22 per gram this week, down 1.7% from last week’s C$5.31 per gram. This week’s price equates to US$1,871 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

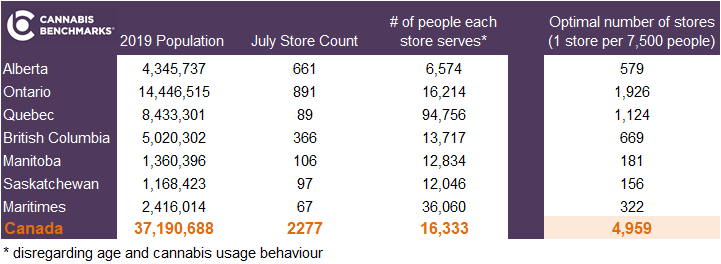

This week we provide some further analysis on the optimal number of recreational cannabis stores in Canada. The Canadian cannabis industry continues to open new retail outlets across the country at a steady pace. As of the end of July we counted 2,277 licensed retailers, with an average monthly growth rate of 7.2% in 2021. This growth rate has been very consistent throughout the year, which gives us confidence that the cannabis industry will continue to grow for the remainder of 2021.

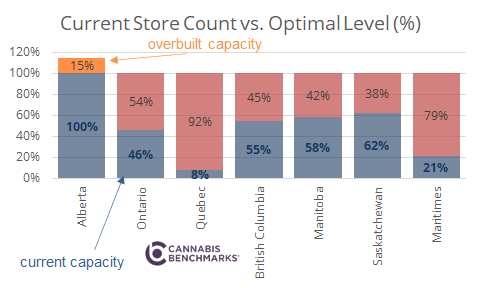

All of Canada’s provinces are seeing store counts grow, but at different rates. Alberta remains an outlier, with stores continuing to open despite it having the smallest population of the four major provinces. In our opinion, Alberta is the only province where retail locations may have been overbuilt. British Columbia’s store count is growing at a steady rate, while Ontario’s has been growing exponentially. Ontario, however, is playing a bit of catch-up to the rest of the provinces on this front. While Ontario is close to achieving its goal of opening 1,000 stores by September, the second most populous province, Quebec, lags quite a bit in that store tally.

The table below shows the average number of people each store serves in all the major provinces. As we alluded to above, Alberta looks to have opened more stores than expected by our analysis, which ultimately ends up with consumer cannabis spending in the province spread out across too many locations. On the opposite extreme is Quebec, with 89 stores that serve, on average, 95,000 people each.

To better understand the number of stores required, we looked to Colorado and Oregon – two mature legal cannabis markets in the U.S. In Colorado there is one recreational retailer for about every 9,600 residents while in Oregon there is one legal store for about every 6,150 people. Using that example, we assume one store should ideally serve 7,500 people. Based on this analysis, Canada as a whole would require a total of 4,959 stores, or 2.2 times the current number of retailers.

In the chart below we show how each province is performing relative to the optimal store count. Other than Alberta, every province is still far behind its optimal level.

This level of accessibility would almost certainly minimize illicit market activity and shift a significant portion of the overall cannabis sales volume to legal channels – something the regulated industry is very much looking forward to.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.