Canada Cannabis Spot Index (CCSI)

Published August 7, 2020

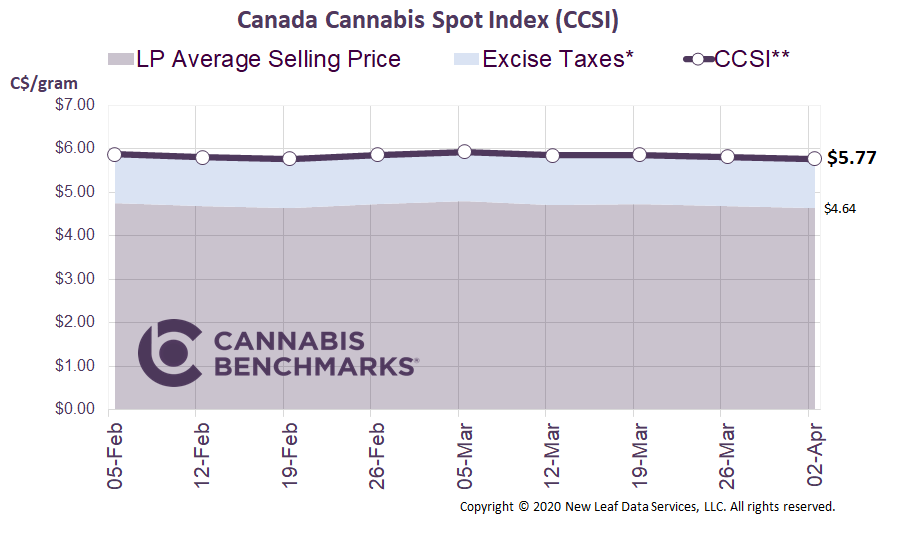

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.33 per gram this week, up 0.7% from last week’s C$6.28 per gram. This week’s price equates to US$2,149 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on store counts and sales. The Canadian cannabis industry is growing up with more than one thousand retail outlets now open across the country. This is an immense milestone, as there were only 361 stores open at the end of July 2019. With the increased physical retail presence, cannabis is becoming more visible and, presumably, more normalized in Canadian society.

To be exact, we count 1,012 licensed retailers, with an average monthly growth rate of 6% in 2020. This solid growth rate comes despite many store applications and openings being delayed due to COVID-19 shutdowns. The 50 store increase in July was distributed almost equally across Alberta, British Columbia, and Ontario. However, Alberta store counts seem to be hitting a saturation point, while Ontario store openings are taking off after a slow start.

Source: StatsCan, Cannabis Benchmarks

However, simply looking at licensed growing areas does not provide a good estimate of monthly production. The yields of indoor and outdoor operations can vary quite widely depending on the grower, plant genetics, climate conditions, and other factors. And, to add to that, not all of the licensed production capacity is currently online and operational. Some of it is newly licensed with no production occurring yet, while other licensed facilities that were in operation have been taken offline due to bad economics.

Outdoor growing is somewhat new in Canada, where the market to this point has been supplied primarily by indoor and greenhouse production. There are obvious benefits to both grow methods. Outdoor cultivation offers cheaper cannabis with the use of natural light and low-cost land, while growing in controlled indoor or greenhouse environments can produce a more consistent year-round product, but at significantly higher cost. Estimates from cultivators suggest cannabis grown outdoors could be produced for less than C$0.20/gram, while production costs for indoor and greenhouse growing range between C$0.80/gram and C$2.00/gram.

The expansion of outdoor production seems positive for the consumer, but raises both potential drawbacks and benefits for the supply side of the market. Most outdoor-grown cannabis is harvested in October, with some variability due to weather and different maturation periods for various varieties. With the Canadian cannabis market already facing a major supply glut, the seasonal surge of supply that comes with outdoor harvests could exacerbate that issue.

The seasonality and variability of outdoor production may also result in increased price volatility, particularly in the initial seasons of outdoor growing when operations are honing their approaches and consumer demand for legal cannabis is still expanding. In legal cannabis markets in the western U.S., such as Oregon, bumper crops of outdoor cannabis in the autumns of 2017 and 2018 – the first two full years after the state’s legal adult-use market opened – caused dramatic wholesale price erosion. However, rates have recovered and stabilized beginning in the second half of 2019, partially due to growing consumer demand.

Potential inconsistency in product quality and variabilities in production volume year-to-year due to weather, pests, and other factors may also make it difficult to fulfill fixed-volume provincial sales contracts. Again, though, as licensed producers dial in cultivation methods over the course of several seasons, some of that variability can be minimized.

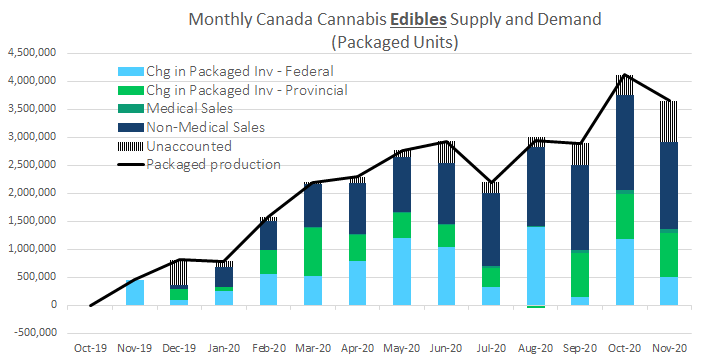

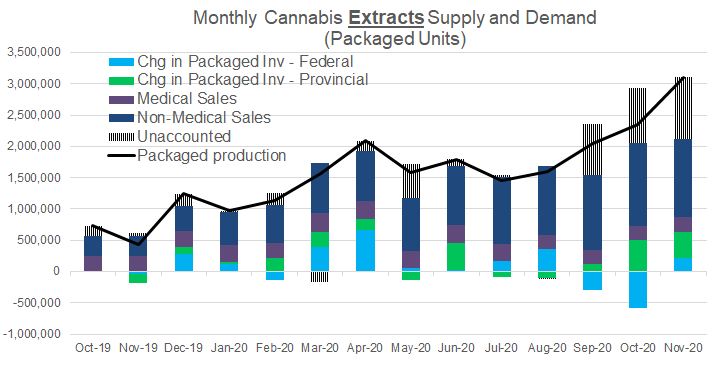

Finally, it should be noted that significant amounts of outdoor-grown cannabis will likely be devoted to extraction and infused product manufacturing, as it is in legal U.S. markets. This should lessen the impact of Canada’s expanding outdoor production on the country’s oversupply of trimmed, smokable flower. It should also provide lower-cost raw material from which cannabis 2.0 products can be manufactured, presumably resulting in lower prices for consumers. While the current supply-demand imbalance is still worrisome and will likely continue to grow with expanded outdoor production, increased supply of more reasonably priced cannabis 2.0 products could also help grow demand by bringing more consumers into the legal market.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.