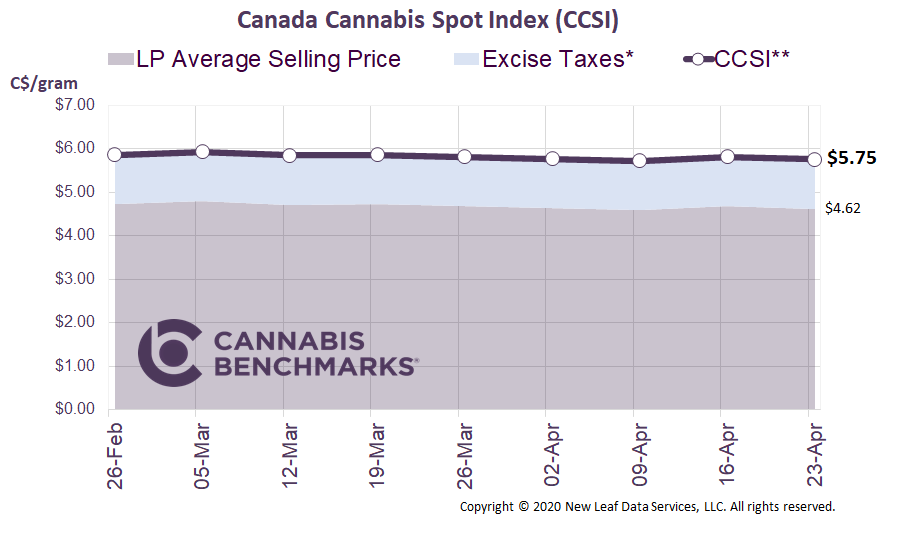

Canada Cannabis Spot Index (CCSI)

Published April 24, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.18 per gram this week, down 3.1% from last week’s C$6.38 per gram. This week’s price equates to US$1,987 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor NetworkIf you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

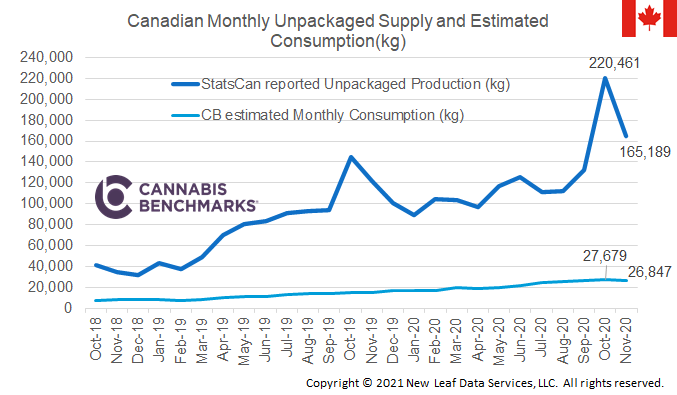

This week we review new data from Statistics Canada on retail sales. The latest data for February shows sales sliding to C$150M. With two fewer days than January, however, this lower overall number still represents growth. Average daily sales show an increase of 4% in February versus the previous month, to C$5.2M/day.

Source: Cannabis Benchmarks

All of the large Canadian provinces saw substantial daily sales gains except for Quebec. Ontario’s daily sales grew by 10%, to C$1.3M/day. This increase in sales comes with only five new stores opening in Ontario in February. March sales are expected to rise by an even larger magnitude, with seven additional stores opening, as well as a sales spike associated with the COVID-19 pandemic. Quebec had four more retail stores open in February, yet total daily sales decreased by 3% to just over C$1M/day.

In terms of volume, Cannabis Benchmarks estimates a total of 14,792 kg of recreational cannabis flower was purchased across Canada in February. Ontario, with 39% of the Canadian population, leads in sales, but only makes up 25% of the total volume sold. This implies that there should be significant sales growth in the province in coming months, as Ontario makes legal cannabis more accessible with a larger retail store footprint.

Alberta, on the other hand, generated 22% of total sales despite only 12% of the country’s population living in the province. As we have discussed previously, this is due largely to the fact that Alberta is home to a disproportionately large proportion of the licensed retailers in Canada, making the legal market more convenient and accessible to consumers in the province.

Source: Cannabis Benchmarks

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.