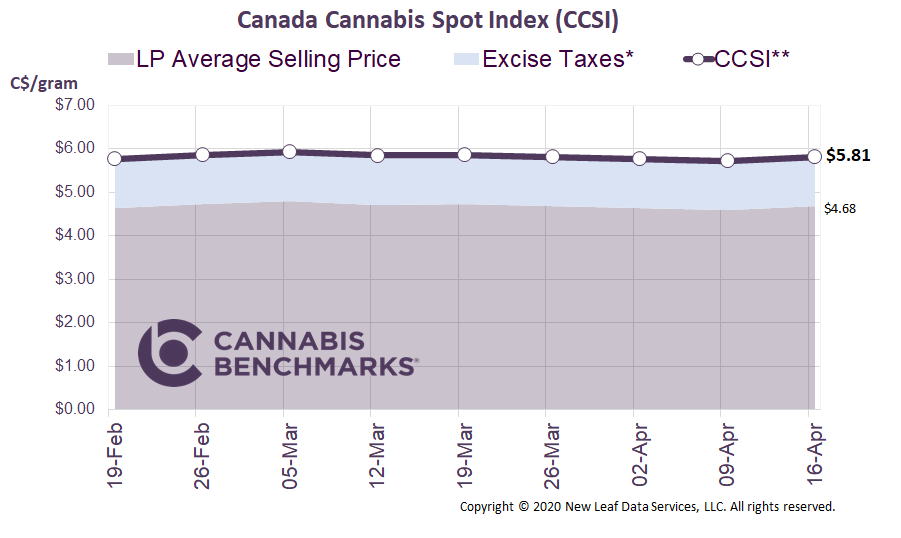

Canada Cannabis Spot Index (CCSI)

Week Ending April 16, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.81 per gram this week, up 1.4% from last week’s C$5.73 per gram. This week’s price equates to US$2,101 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

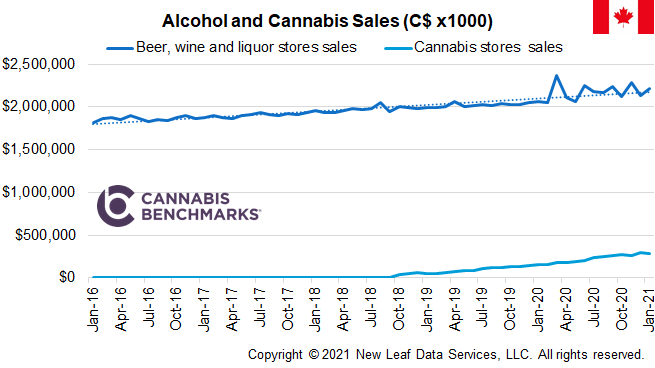

This week we examine whether legal cannabis sales in Canada have impacted alcohol sales. With the legalization of recreational cannabis in October 2018, alcohol companies feared they would see a reduction in sales, as consumers of legal age may opt to substitute cannabis for alcohol. (In Canada, one must be 18 or older to purchase cannabis; for alcohol, the legal age varies between 18 and 19, depending on the province.) The Canadian government releases monthly retail sales data for both cannabis and alcohol (beer, wine, and liquor), which provides us with a better understanding of whether cannabis has actually had an impact on alcohol sales.

Below is monthly data from the start of 2016 through early this year showing sales of both categories. The chart illustrates that alcohol sales have been growing steadily despite the introduction of legal recreational cannabis sales in late 2018. Since January 2019, monthly alcohol sales have grown by C$219M to C$2.22B. Meanwhile, monthly legal cannabis sales have grown by almost the same amount – C$227M – to reach C$282M.

Source: Cannabis Benchmarks

A review of Canadian census data for the 19+ demographic shows that the growth in alcohol sales is consistent with the growth in this population segment. Overall to this point, it appears that legal cannabis sales growth has not yet impacted alcohol sales negatively. Still, it should be noted that the COVID-19 pandemic – and associated lockdowns, including restrictions on and / or closures of bars and restaurants – provided anomalous conditions that almost certainly boosted alcohol sales higher than they might have been had the pandemic not occurred. This can be seen in the spike in alcohol sales that occurred in March 2020, as lockdowns were put in place across Canada. We have in previous reports detailed our reasoning regarding how the pandemic also resulted in a boost to legal cannabis sales.

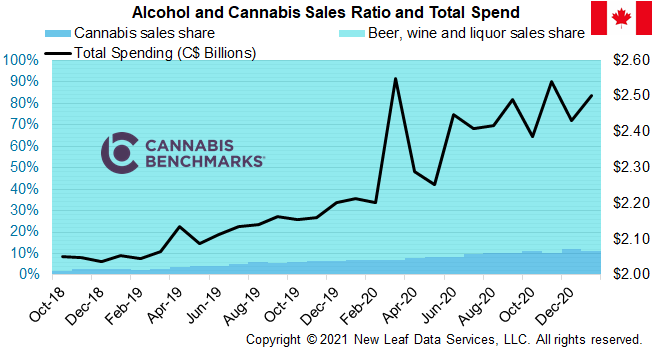

Going forward, we do believe that at some point cannabis sales will impact alcohol sales. Consumers have a finite amount of money to spend in this category, and increased accessibility and education around cannabis may lead to larger proportional expenditures for the newly-legal intoxicant. Indeed, this is occurring already. As shown in the chart below, cannabis sales are starting to represent a larger portion of the total dollars spent towards alcohol and cannabis. Currently, cannabis’ share stands at 11.3% of the total spend of the combined categories.

Source: Cannabis Benchmarks

Our current forecast for cannabis sales projects monthly spending to reach C$433M by the end of 2021. If we assume an average annual alcohol sales growth of 1.5% each year, then we can expect monthly alcohol sales to reach C$2.33B by end of the year. At those levels, cannabis sales would grow to represent 16% of the total spend on the two categories.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.