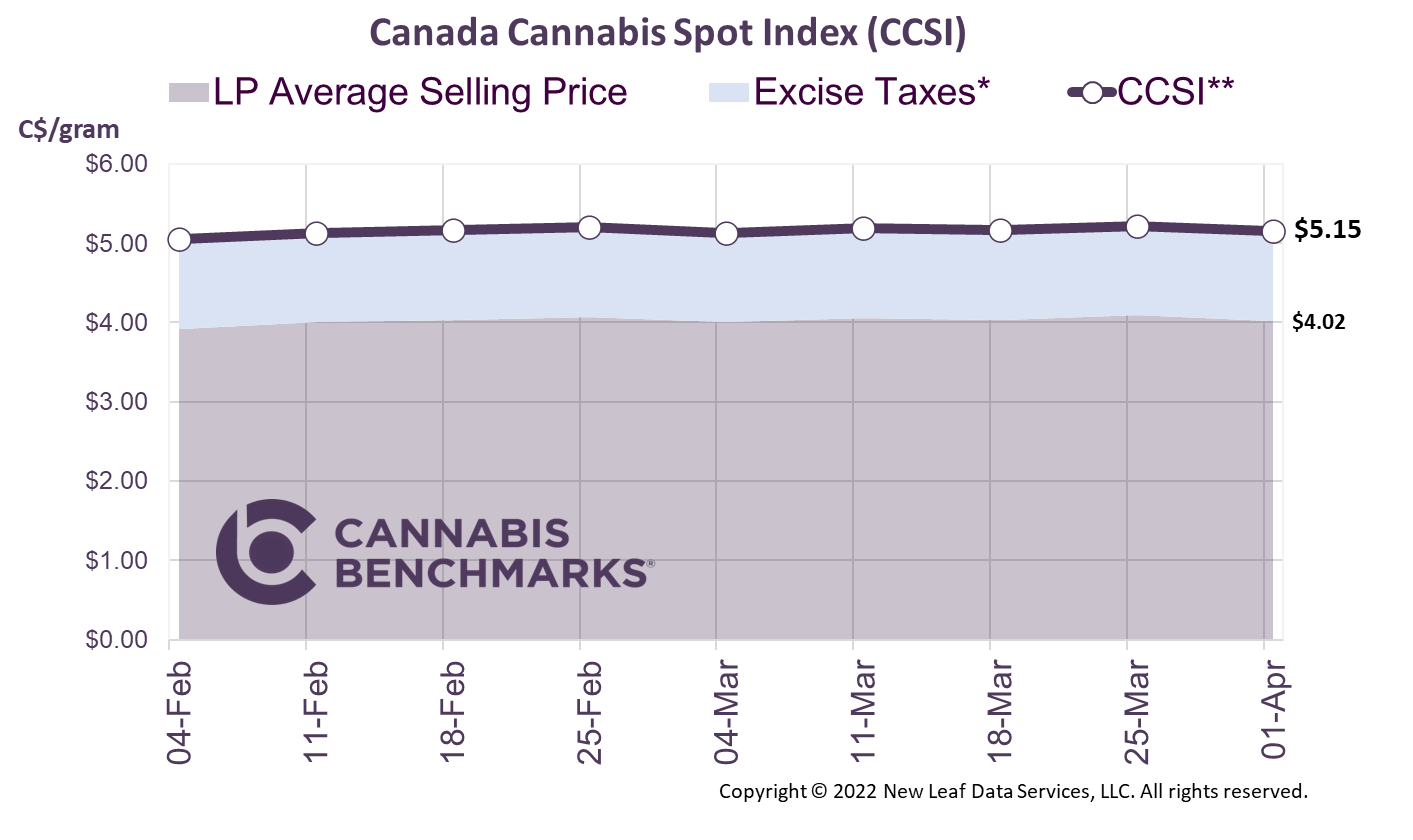

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.15 per gram this week, down -1.3% from last week’s C$5.22 per gram. This week’s price equates to US$1,870 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

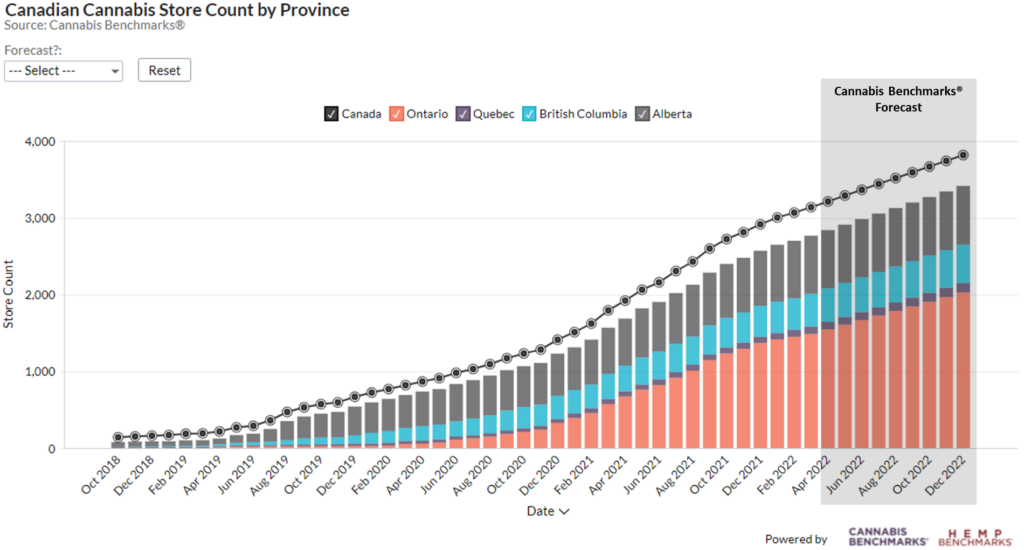

This week we review Canada’s recreational cannabis store count. We have been tracking this number very closely because there has been a very strong correlation between stores and sales. The number of stores continues to climb steadily across the country, making the legal cannabis system more accessible to consumers and, in some cases, increasing competition between retailers in more saturated local markets.

Our latest count shows the number of stores open for business reached 3,138 as of the end of March. That figure is up by 1,344 stores – or a jump of 75% – compared to March 2021. As shown in the chart below, we expect that trend to continue throughout this year but at a slightly slower rate, a change that is already playing out. During Q1 2022, an average of 74 new stores opened each month, which is much lower than the 127 stores added monthly during the same quarter in 2021.

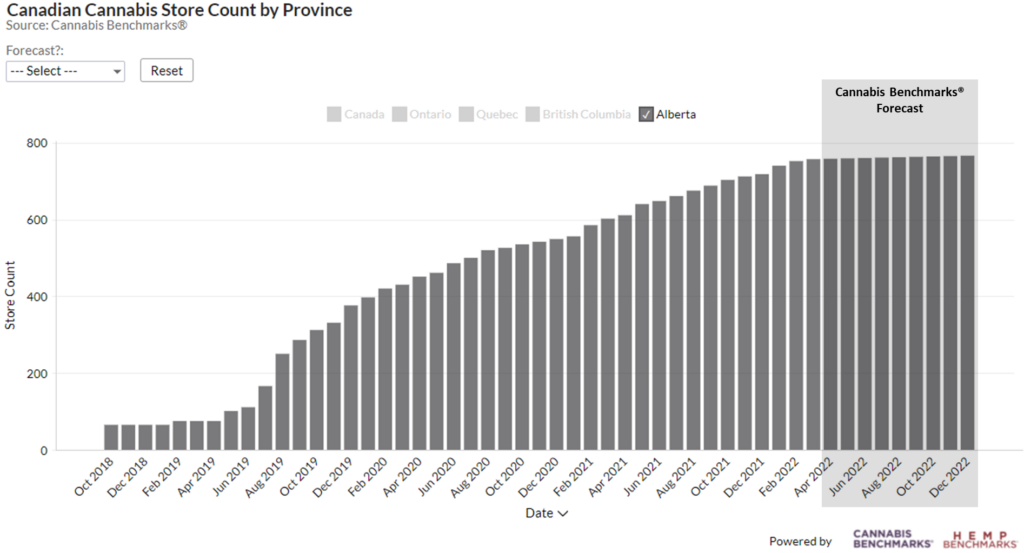

As we noted a few months back, one province that sticks out is Alberta. We have long been awaiting a slowdown in the number of stores added each month, but Alberta’s store count continues to grow at a steady rate. The current count is 757 stores, which is 155 more than last March.

The situation is already ultra-competitive amongst Alberta cannabis retailers, but it is expected to become even more so with the passing of Bill 80 in December. That measure allowed licensed retailers to set up their own e-commerce platforms starting on March 8, 2022. At the moment only the major retail chains have established an online presence, but over time almost every store should have a simple, Shopify-type site to fulfill online orders.We expect this change will lead to lower cannabis prices for customers, as the larger, more efficient retailers flex their pricing muscle. We also believe this trend will eventually lead to a flattening store count, as new store openings are offset by the closing of unprofitable ones.