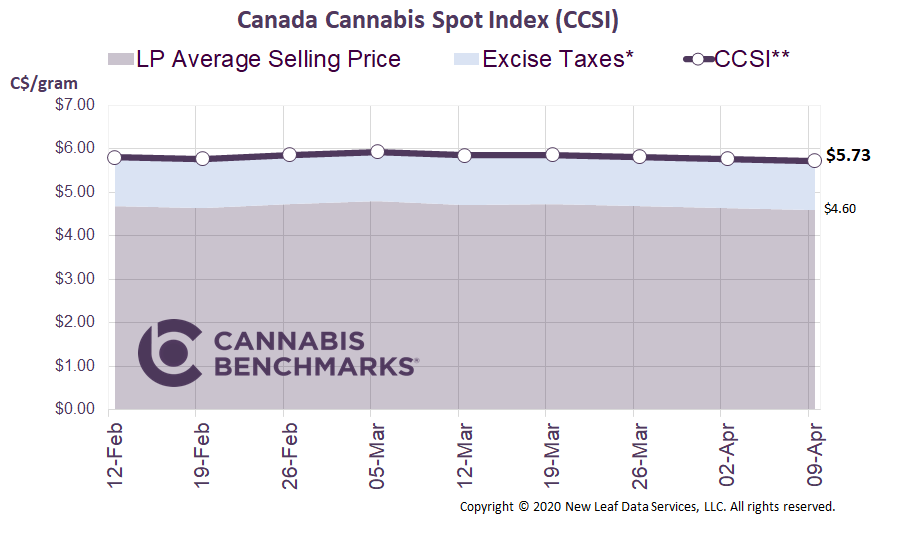

Canada Cannabis Spot Index (CCSI)

Week Ending April 9, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.73 per gram this week, down 0.7% from last week’s C$5.77 per gram. This week’s price equates to US$2,067 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

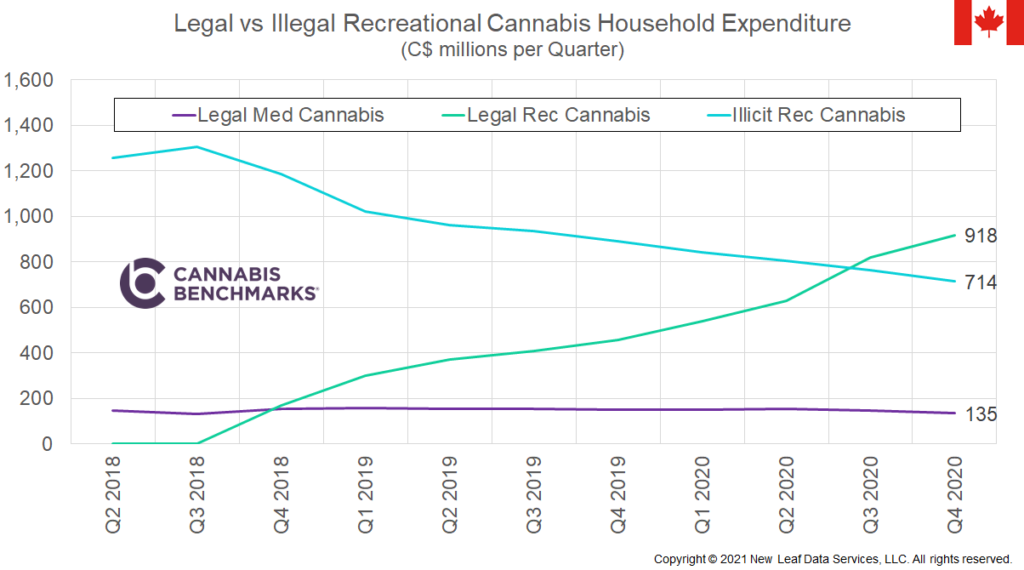

This week we examine household expenditure data issued by Statistics Canada on a quarterly basis. The data show some very interesting and positive trends for the legal cannabis sector. As seen in the chart below, Q3 2020 was the first quarter in which the estimated household expenditure for legal recreational cannabis exceeded that spent in the illicit market. That trend continued into Q4 2020.

With increased access through physical retail stores – particularly in Ontario – and online channels during the pandemic, more Canadians chose to purchase cannabis from regulated, legal sources. Also fueling that trend was a drop in prices for legal product as new supply from indoor and outdoor cultivation operations became available.

In Q4 2020, recreational cannabis expenditures grew 101% to C$918M, while illicit cannabis expenditures dropped by 20% to C$714M as compared to the same time frame in 2019. We also note that expenditures for medical-use cannabis dropped 6% to C$135M. Medical cannabis now makes up only 7.6% of total cannabis spending in Canada. Total expenditures on cannabis reached C$1.77B for the quarter, or C$19.2M per day.

Source: Cannabis Benchmarks, Health Canada

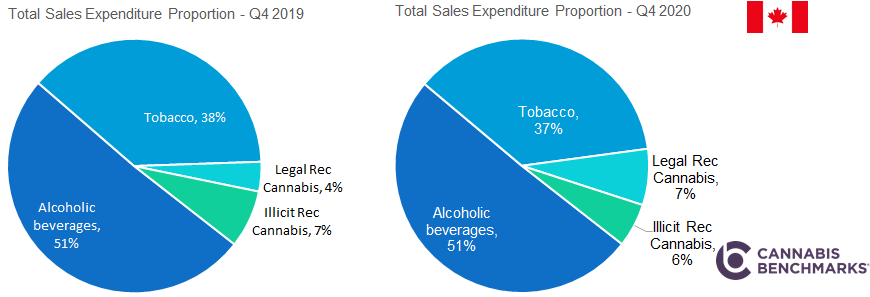

Next we examine cannabis purchasing in comparison to that for alcohol and tobacco. Major alcohol and tobacco companies have made significant investments in cannabis operations over the last few years, in part as a hedge to ensure they do not lose out on the latent demand for cannabis that is being captured gradually by legal businesses. The data released by Statistics Canada to date shows that alcohol and tobacco sales remain much stronger than cannabis sales, and that increased cannabis sales have not impacted those categories negatively. As seen in the chart below, both alcohol and tobacco’s shares of sales remained consistent between Q4 2019 and Q4 2020, at 51% and 37-38% respectively.

Source: Cannabis Benchmarks, Health Canada

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.