The U.S. Cannabis Spot Index increased by 3.3% to $1,108 per pound.

In grams, the Spot price was $2.44.

After settling into a long-term price depression for 39 weeks, driven by a bumper outdoor crop coming to market in October 2024, the Michigan Cannabis Spot Index has reached levels not seen since prior to last fall’s harvest. Although the state indoor index lost 1.3% this week, mainly from an injection of transactions for bulk indoor flower products priced in the lower-quartile, both greenhouse and outdoor flower prices increased, by 7.7% and 6.8%, respectively.

After declining for the last six weeks, the Nevada Cannabis Spot Index increased by 3.4% per pound this week. Indoor grown flower prices achieved a 5.8% increase over last week. Transaction prices for both bulk and prepackaged indoor flower products rose, by 3.7% and 7.9%, respectively. A reduction in low-priced bulk greenhouse flower enabled the state greenhouse index to climb by 1.9% per pound.

The Ohio Cannabis Spot Index saw an 8.1% increase to end the week. After the state price assessment lost 13.9% over the previous four weeks, this week’s positive movement is a welcome sign to market participants. The September average price per pound remains 4.8% below the August average.

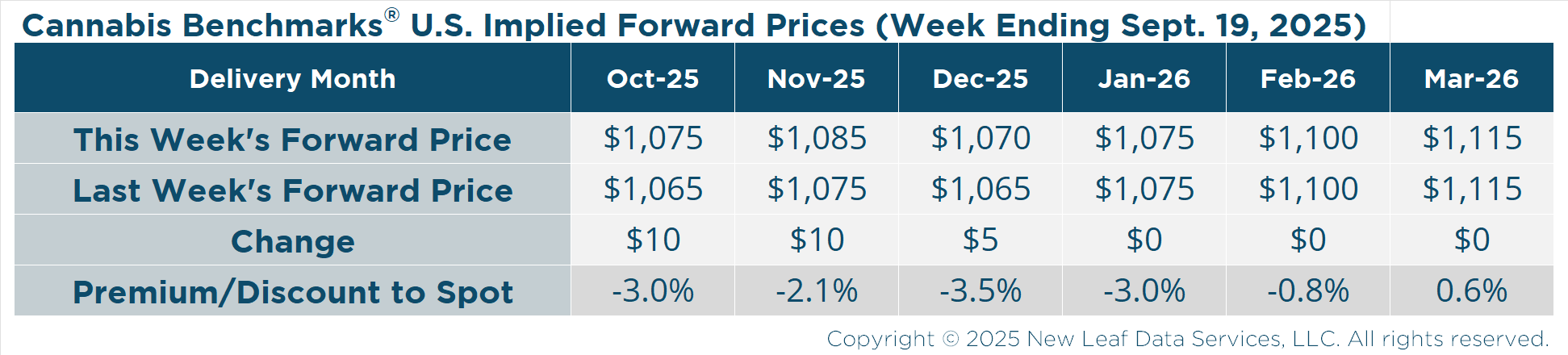

October 2025 Implied Forward assessed up $10 to $1,075 per pound.

At $1,075 per pound, the October Implied Forward represents a discount of 3.0% relative to the current U.S. Spot Price of $1,108 per pound.

Did you know that you can access state-level retail sales data and much more in our Interactive Charts?

We collect fundamental market data released by states and put it all in one convenient location for you to access it. Looking for more data? Contact Us and let us know what you’re looking for.