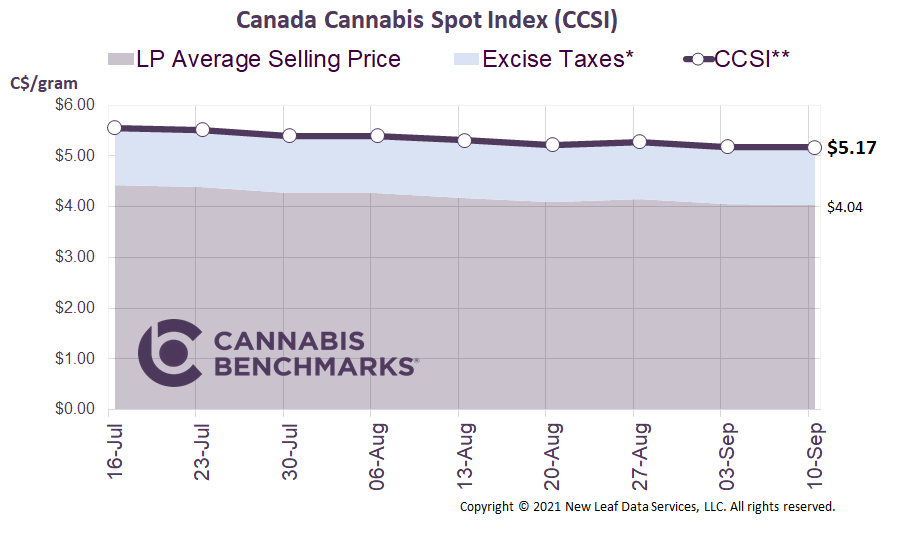

Canada Cannabis Spot Index (CCSI)

Week Ending September 10, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.17 per gram this week, down 0.2% from last week’s C$5.18 per gram. This week’s price equates to US$1,860 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

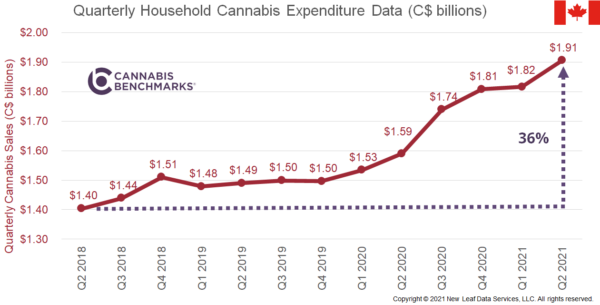

This week we look into the latest household expenditure data from Statistics Canada, issued quarterly. The data continues to show a positive trend for the legal cannabis sector, which is encouraging news for the three-year-old industry. The first thing to note from the data is that the total dollars spent on cannabis has been on a steady rise since legalization. Statistics Canada estimates a total of C$1.91B was spent on cannabis in Q2 2021 from both the legal medical and recreational markets, as well as the illicit market. This figure is 36% higher than the amount spent in the same quarter in 2018, which shows the increase in mainstream adoption of cannabis use since the onset of legalization.

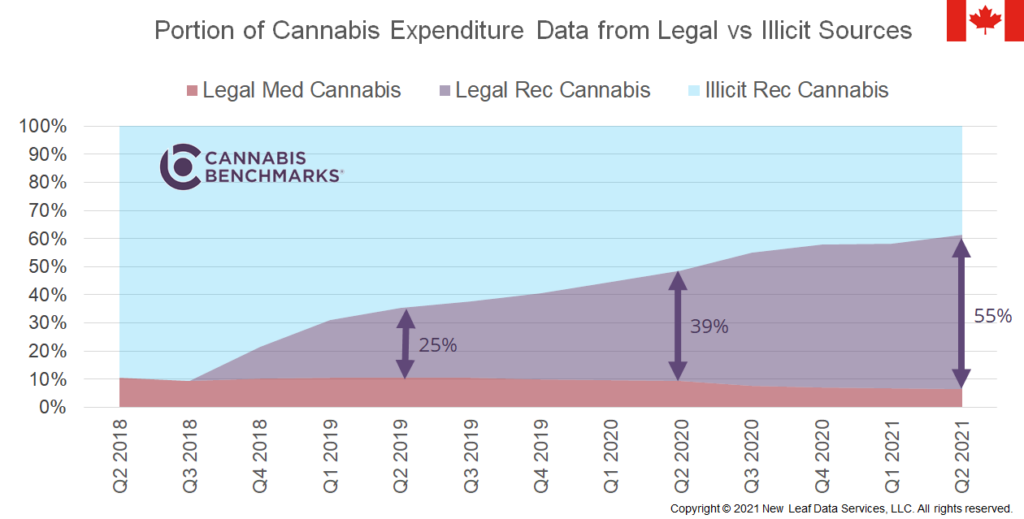

In the chart below, we take the same dataset and split out the source and use of the cannabis sale. The chart shows that the legal recreational cannabis sector has been growing substantially over the past few years. The legal recreational market is not only taking market share from the illicit market but also growing overall cannabis expenditures. Statistics Canada estimates illicit recreational sales have fallen 9.7% to C$0.74B from Q2 2020 to Q2 2021.

As legal recreational sales have grown to 55% of total cannabis purchases, legal medical sales have declined. Some previously medical consumers have shifted their purchases to the legal recreational markets; this can be confirmed by the drop in active medical client registrations with federally licensed cannabis cultivators. Total registrations stood at 345,520 right before recreational cannabis legalization in October 2018 and dropped to 292,399 by March 2021.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.