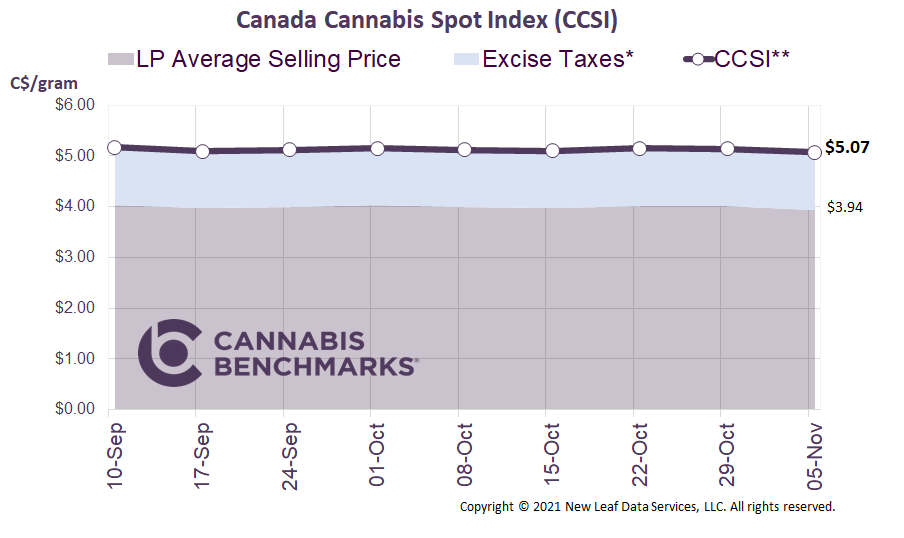

Canada Cannabis Spot Index (CCSI)

Week Ending November 5, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.07 per gram this week, down 1.3% from last week’s C$5.14 per gram. This week’s price equates to US$1,856 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

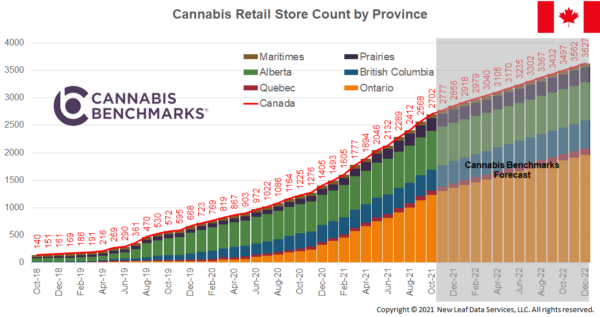

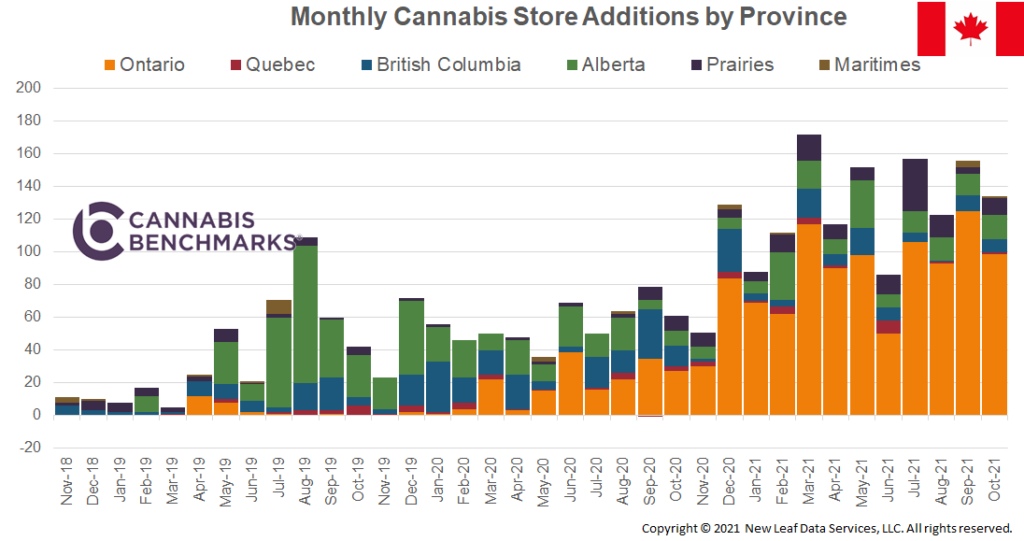

This week we provide an update on the increase in retail storefronts across Canada. As of October 31, we are tracking 2,702 licensed retailers, with an average monthly growth rate of 7% in 2021.

As seen in the chart, the growth in Canada’s retail stores has been driven primarily by Ontario’s quest to make legal cannabis more accessible. In 2021 Ontario opened an average of 90 stores per month, a trend we expect to slow down slightly next year as certain pockets of the Greater Toronto Area become saturated with stores.

According to an article in The Toronto Star, a new bill is being introduced to specify the minimum distance between cannabis retailers in an effort to prevent over-saturation. Bill 29 is unlikely to pass, but it addresses a growing issue in some Toronto neighborhoods. With Ontario modifying its process of issuing retail licenses, the province quickly started handing out licenses without any rules to enforce business spacing. Due to the quick roll-out of licenses, business owners signed leases in busy areas, often unaware that another store might be opening on the same block. This has been frustrating for retailers, since such local competition can cut into each other’s profits. At the moment, the Ontario government apparently believes that the best approach is to allow competition and the consumer to determine winners and losers.

In Alberta, the provincial government has set certain minimum distance requirements between cannabis retailers and other enterprises such as schools, but it has not provided guidelines on the distance between cannabis retailers. Distance requirements between cannabis retailers are set by the municipal government, and those requirements differ in Alberta’s two major cities. The City of Edmonton requires a 200-meter minimum distance requirement, while the City of Calgary requires a 300-meter separation. With Alberta having the most stores per capita, this regulation has protected cannabis business owners from having another retailer opening up next door.