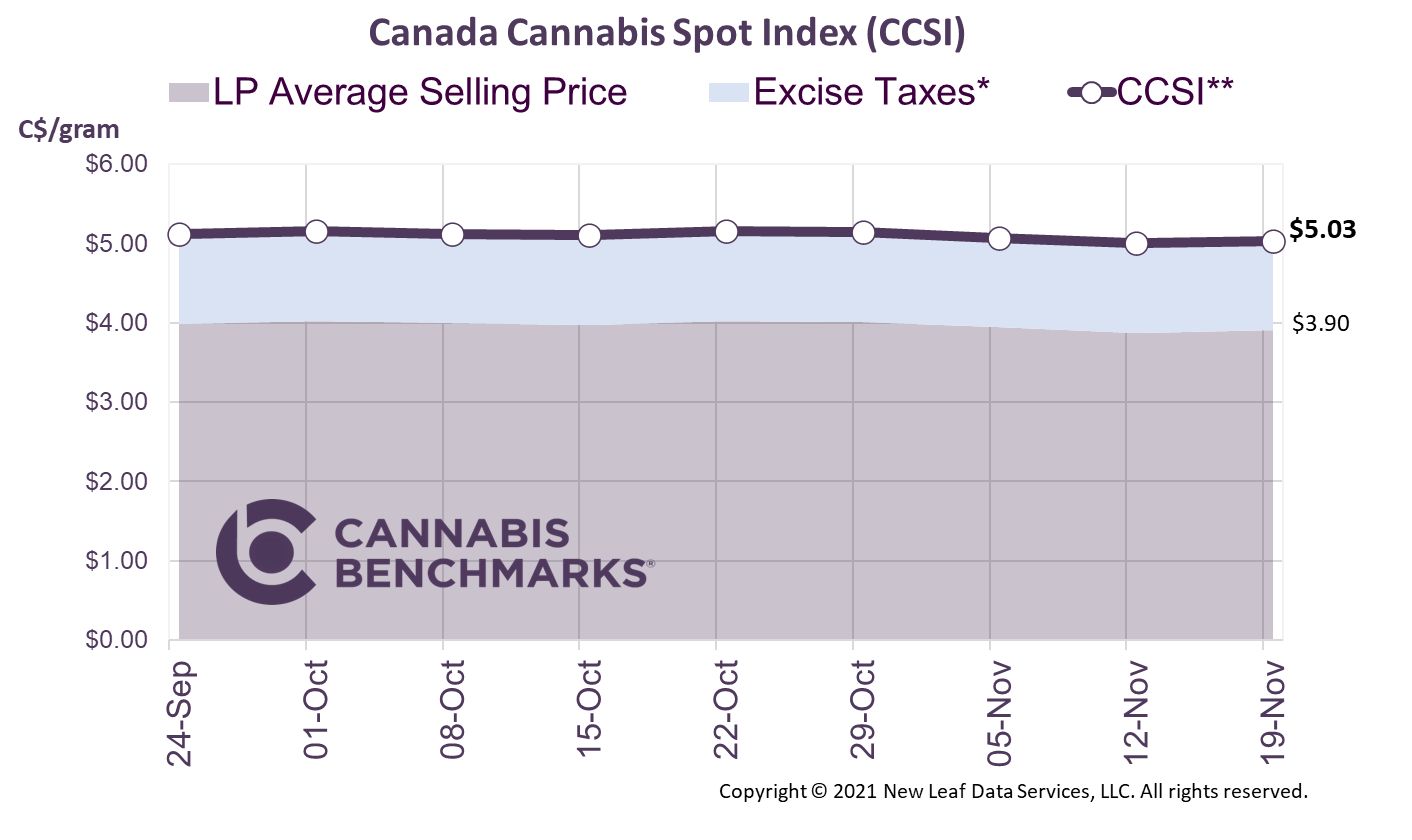

Canada Cannabis Spot Index (CCSI)

Week Ending November 19, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.03 per gram this week, up 0.6% from last week’s C$5.00 per gram. This week’s price equates to US$1,815 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

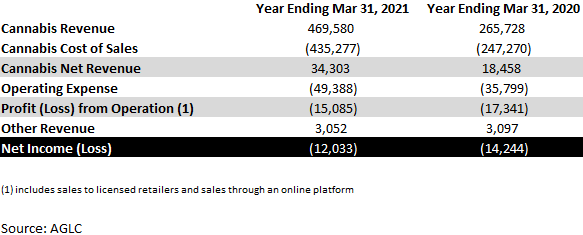

Today we focus our attention on Alberta, one of the stronger performing cannabis provinces when it comes to retail licensing and sales. That trend may be reinforced with the introduction this month of Bill 80, the Red Tape Reduction Implementation Act, 2021. This bill only received its first reading on November 4, but it proposes nine legislative items, including one that allows licensed cannabis retailers in Alberta to develop an online presence. Currently, Alberta has a private model for physical recreational cannabis retail sales and a government-regulated model for online sales. All cannabis retailers must be licensed by Alberta Gaming Liquor and Cannabis (AGLC), an agency of the provincial government that regulates alcoholic beverages, recreational cannabis, and gaming-related activities. The AGLC also plays another critical role in the cannabis sector by purchasing cannabis products wholesale from 17 licensed producers. AGLC is then responsible for warehousing and reselling to licensed retailers and consumers through its online platform. In this model, the government is both the wholesaler and competitor to privately-run retailers. With Bill 80, any existing physical stores will also have the ability to sell cannabis direct-to-consumer via e-commerce. To date, the government-run online stores have a clear advantage as they can cut out many of the overhead costs that retail stores currently face, such as employees, rent, and utilities. This enables the Alberta online store to routinely sell the same products at a lower price point than private brick-and-mortar retailers. That being said, the AGLC’s cannabis operation has been running at a net loss for the past two years. For the year ending March 31, 2021, the Alberta government lost C$12M.

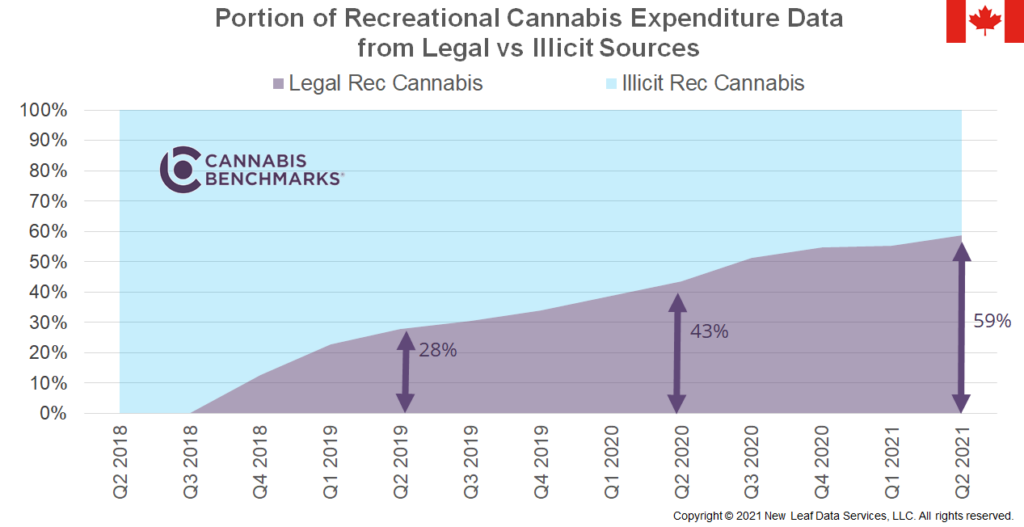

One of the positives that might occur if the bill is passed is a bigger push against the illicit cannabis sector, which currently makes up an estimated 41% of recreational cannabis sales at the national level. We do not have any specific data on Alberta, but we believe that Alberta’s illicit market share is smaller due to its robust retail footprint.