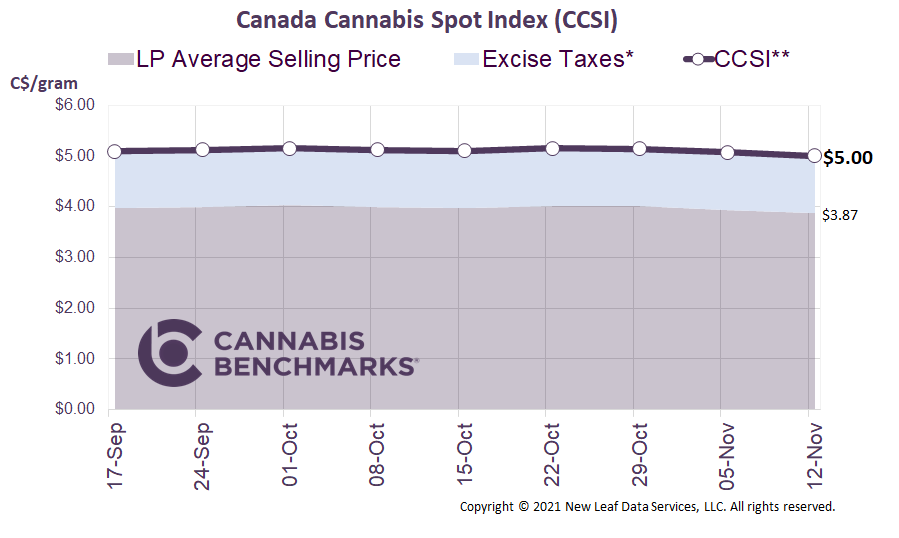

Canada Cannabis Spot Index (CCSI)

Week Ending November 12, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.00 per gram this week, down 1.5% from last week’s C$5.07 per gram. This week’s price equates to US$1,817 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

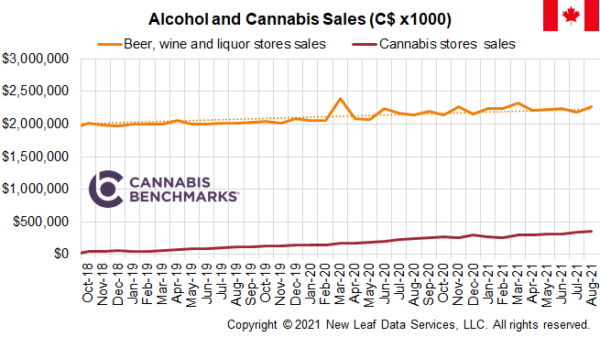

This week we examine whether legal cannabis sales in Canada have impacted alcohol sales. With the legalization of recreational cannabis in October 2018, alcohol companies feared they would see a reduction in sales, as consumers of legal age might opt to substitute cannabis for alcohol. (In Canada, one must be 18 or older to purchase cannabis; for alcohol, the legal age varies between 18 and 19, depending on the province.) The Canadian government releases monthly retail sales data, on a lagged basis, for both cannabis and alcohol (beer, wine, and liquor), which provides insight into whether cannabis has actually had an impact on alcohol sales.

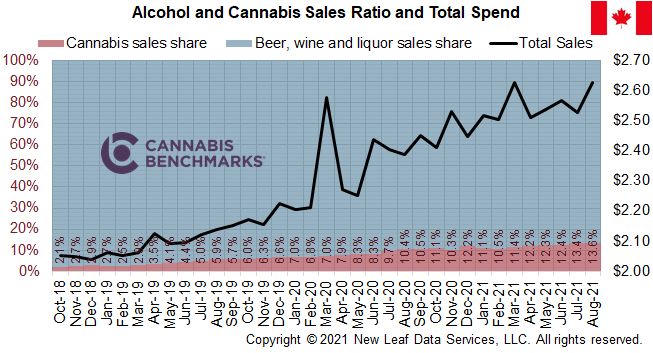

Below is monthly data from the start of October 2018 through the end of this summer, showing sales of both categories. The chart illustrates that alcohol sales have been growing steadily despite the introduction of legal recreational cannabis sales. Since August 2020, monthly alcohol sales have grown by C$132M to C$2.27B. Meanwhile, monthly legal cannabis sales have grown by C$109M to reach C$357M.

So far it appears that legal cannabis sales have not eaten into alcohol sales, but we do believe that, at some point, they will. Because consumers have a finite amount of money to spend in this recreational category, increasing accessibility to and education around cannabis may lead to larger proportional expenditures for the newly-legal intoxicant. Cannabis sales are starting to represent a larger portion of the total dollars spent towards alcohol and cannabis. Currently, cannabis’ share stands at 13.6% of the total spend of the combined categories and we expect that trend to continue.