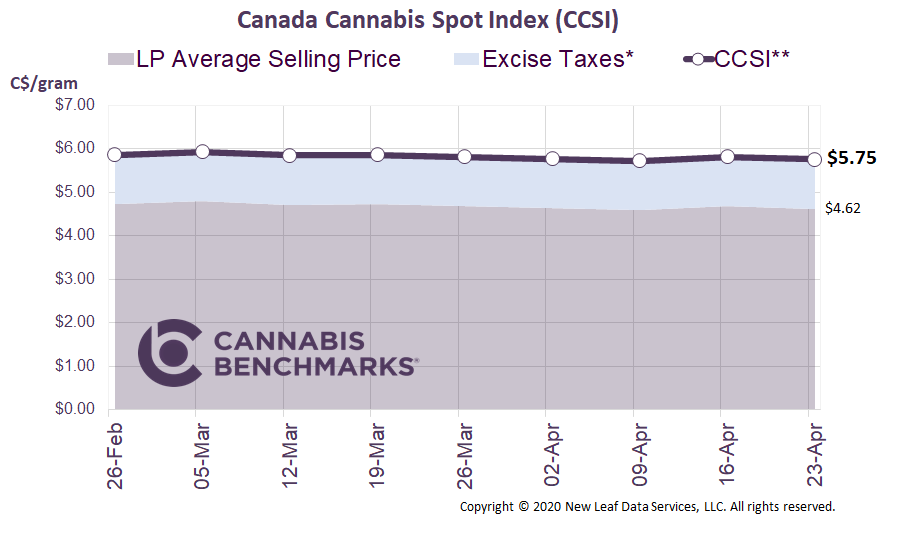

Canada Cannabis Spot Index (CCSI)

Published July 24, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.31 per gram this week, down 1.5% from last week’s C$6.40 per gram. This week’s price equates to US$2,121 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on the ever-growing stockpiles of cannabis held in federal and provincial storage facilities. Earlier this month, Statistics Canada released data showing both unpackaged and packaged inventory ballooning to levels that point to potential inventory write-downs and financial distress for cultivators.

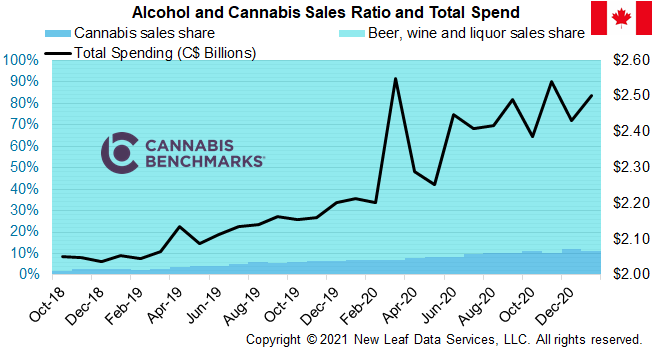

As of the end of April, total unpackaged inventory stood at 620,144 kg. This is product sitting with both cultivators and processors that is not yet ready for sale. Adding to that is 85,014 kilograms of ready-to-sell packaged inventory that is held by cultivators, provincial wholesalers, and retailers. These are outrageous numbers when we consider total Canadian consumption levels, which we detail just below. In no other major commodity market do we see such a large disconnect between supply and demand.

Source: Statistics Canada, Cannabis Benchmarks

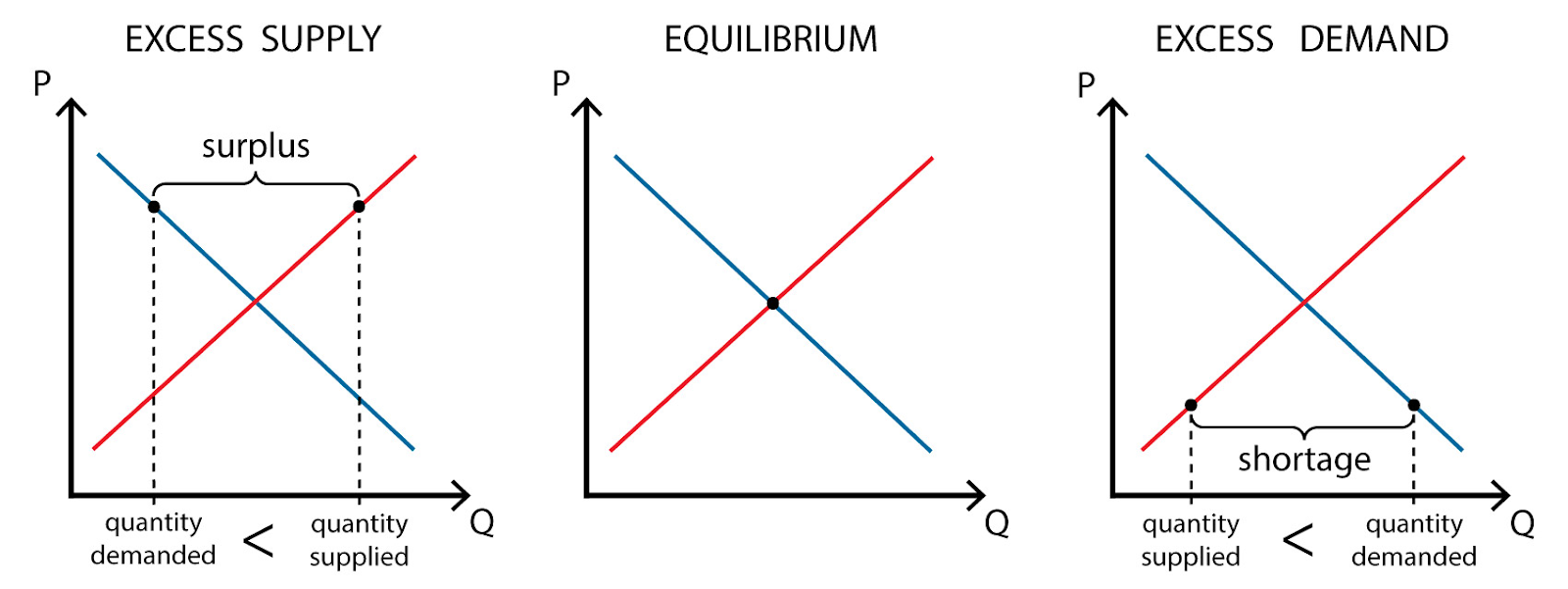

So, let’s examine how we got here. The excess inventory is a result of massive mismatch between supply and demand. As Canada prepared to legalize recreational marijuana sales in Oct 2018, all the major Canadian cultivators planned to bring online an immense amount of growing capacity. This capacity slowly trickled into the market in 2019, which we can see in the unpackaged production figures reported by Statistics Canada. Monthly unpackaged production peaked in October 2019 at 144,955 kg, but has since stabilized to around 100,000 kg per month. Once the supply-demand imbalance became undeniable, cultivators began scaling back production and even went as far as closing growing facilities in some cases.

Reality struck the market early with demand being only a fraction of the initial expectations. The illicit market continued to be robust and captured nearly 75% of total national cannabis consumption. That being said, with lower pricing and a growing retail footprint, we see demand expanding, but not at a pace sufficient to reach market equilibrium. Our estimates do show demand growing by 36% from September 2019 to April 2020, to 19,430 kg. At best this is about 20% of corresponding supply levels; hence the mismatch continues to grow each month.

Source: StatsCan, Cannabis Benchmarks

So the question remains: how will all this unsold cannabis be utilized? If all cannabis cultivation were to stop today, existing inventory could support 36 months of consumption, assuming demand holds at current rates. It is of course unlikely that cultivation will cease; the next major step is cannabis growers recognizing that most of this product will be unsaleable, which should lead to the destruction of product and write-downs.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.